Salesforce.com 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

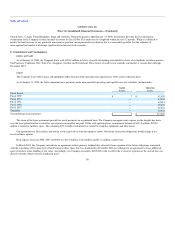

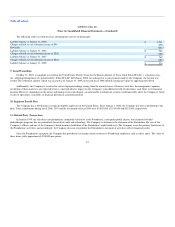

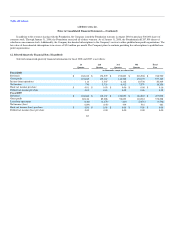

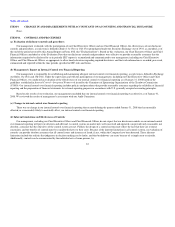

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

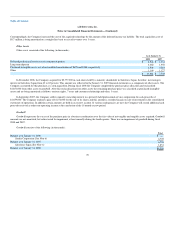

Provided that the Company owns at least 30 percent of the outstanding voting shares of the joint venture, the Company has the right to appoint three of

the six board members of the joint venture, and together with SunBridge, may appoint a fourth director.

The Board of Directors of the joint venture has authorized option plans to purchase shares in Salesforce Japan. The option plans are in accordance with

the rules and regulations of the Commercial Code of Japan. One of the option plans includes antidilution provisions such that the option holders are allowed

additional options if the joint venture issues additional stock and the exercise price of their options is reduced if the additional stock is issued for an amount

less than such exercise price. These provisions resulted in variable accounting for this plan prior to the adoption of SFAS 123R, as the number of options

awarded is not fixed and no measurement date currently exists.

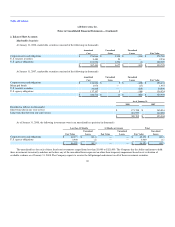

In fiscal 2008, 2007 and 2006, the joint venture granted options to purchase 11,600, 8,400 and 23,600 shares, respectively, to its employees to purchase

shares of common stock in the joint venture. The stock options were issued with an exercise price ranging from ¥20,000 (approximately $171 per share),

¥4,000 to ¥15,000 per share (approximately $34 to $129 per share) and ¥4,000 per share (approximately $34 per share), respectively, and vest over a two-year

period.

As a result of these stock option grants, the joint venture recognized stock-based expenses of $366,000, $247,000 and $7,000 during fiscal 2008, 2007

and 2006, respectively.

Given the Company's majority ownership interest in the joint venture, the accounts of the joint venture have been consolidated with the accounts of the

Company, and a minority interest has been recorded for the third party's interest in the net assets and operations of the joint venture to the extent of the

minority partners' individual investments. All intercompany transactions have been eliminated, with the exception of minority interest.

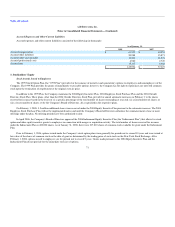

Under the terms of the joint venture agreement, the joint venture will terminate if the joint venture becomes a public company or is sold to a third party,

or upon the mutual agreement of the parties. In addition, if the Company commits a breach of, or if the Company fails to perform, its material obligations

under the joint venture agreement, which are not cured in a timely manner, SunBridge can require the Company to purchase all of its shares in the joint

venture. The purchase price for SunBridge's shares would be the then fair market value plus a specified premium. In the event that SunBridge commits a

breach of, or if it fails to perform, its material obligations under the joint venture agreement, which it does not cure in a timely manner, or if SunBridge enters

into bankruptcy proceedings, the Company can require SunBridge to sell to it all of their shares in the joint venture. The purchase price for SunBridge's shares

would be the then fair market value less a specified discount. Additionally, if the Company and SunBridge are unable to agree on certain operational matters,

either party can require the other to purchase all of its shares of the joint venture at a price equal to the then fair value market value. Fair market value is to be

determined by mutual agreement of the parties, or if the parties are unable to agree, by an independent appraiser.

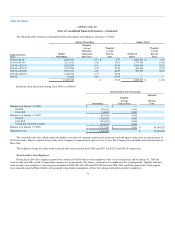

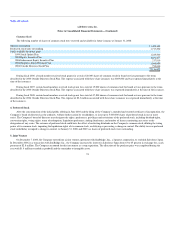

6. Acquisitions

Fiscal 2007

Sendia Corporation

On April 10, 2006, the Company acquired 100 percent of the outstanding stock of Sendia Corporation, a privately-held company based in Santa

Monica, California, for $15.2 million in cash and $304,000 in acquisition

75