Salesforce.com 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

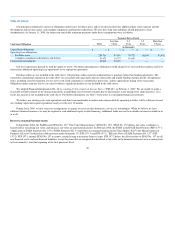

Table of Contents

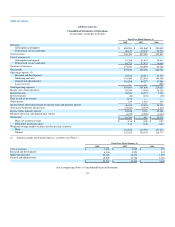

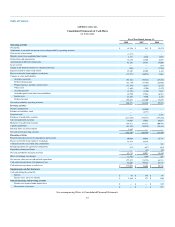

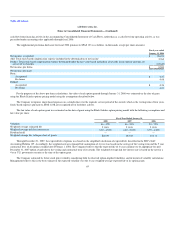

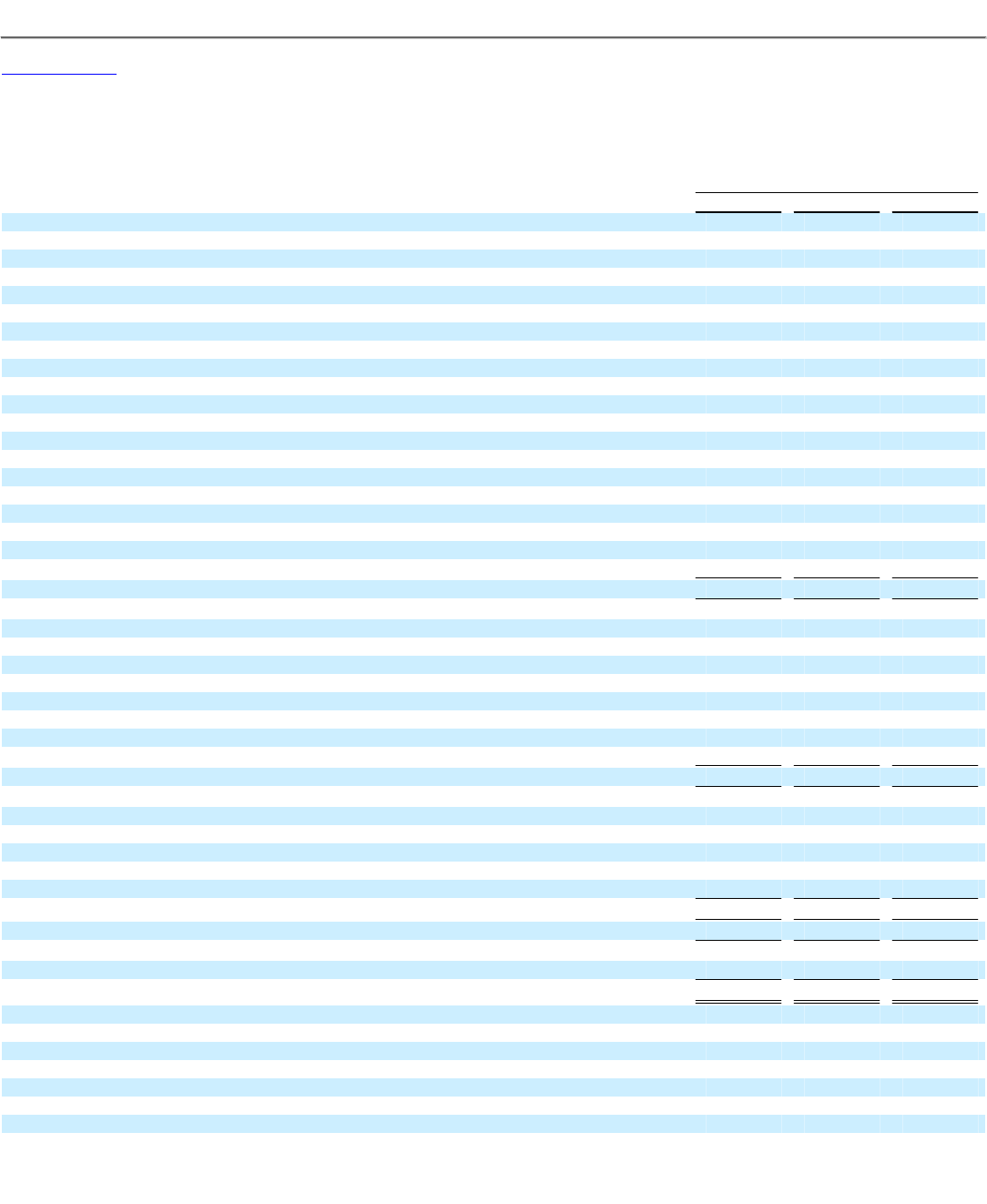

salesforce.com, inc.

Consolidated Statements of Cash Flows

(in thousands)

Fiscal Year Ended January 31,

2008 2007 2006

Operating activities

Net income $ 18,356 $ 481 $ 28,474

Adjustments to reconcile net income to net cash provided by operating activities:

Gain on sale of investment (1,272) — —

Minority interest in consolidated joint venture 4,472 2,220 1,034

Depreciation and amortization 24,219 12,504 6,027

Amortization of deferred commissions 42,195 23,381 14,606

Lease recovery — — (285)

Change in the deferred income tax valuation allowance (970) — (7,225)

Expense related to stock-based awards 55,207 39,205 3,448

Excess tax benefits from employee stock plans (31,978) (16,574) 3,662

Changes in assets and liabilities:

Accounts receivable (91,368) (52,523) (27,254)

Deferred commissions (62,759) (37,856) (22,068)

Prepaid expenses and other current assets (11,376) (8,157) (2,871)

Other assets (7,669) (1,709) (1,572)

Accounts payable (1,392) (1,764) 7,687

Accrued expenses and other current liabilities 48,950 27,926 16,521

Income taxes 22,829 9,590 2,434

Deferred revenue 196,831 114,500 73,275

Net cash provided by operating activities 204,275 111,224 95,893

Investing activities

Business combination — (15,502) —

Purchase of subsidiary stock — (2,777) —

Restricted cash — — 3,191

Purchases of marketable securities (447,296) (336,878) (193,165)

Sales of marketable securities 19,608 13,012 64,614

Maturities of marketable securities 366,872 195,672 100,989

Capital expenditures (43,552) (22,123) (23,434)

Proceeds from sale of investment 1,659 — —

Net cash used in investing activities (102,709) (168,596) (47,805)

Financing activities

Proceeds from the exercise of stock options and warrants 60,910 29,082 15,735

Excess tax benefits from employee stock plans 31,978 16,574 —

Collection of notes receivable from stockholders — — 727

Principal payments on capital lease obligations (175) (617) (614)

Repurchase of unvested shares — (12) (28)

Net cash provided by financing activities 92,713 45,027 15,820

Effect of exchange rate changes (1,792) (889) 203

Net increase (decrease) in cash and cash equivalents 192,487 (13,234) 64,111

Cash and cash equivalents at beginning of year 86,608 99,842 35,731

Cash and cash equivalents at end of year $ 279,095 $ 86,608 $ 99,842

Supplemental cash flow disclosure:

Cash paid during the period for:

Interest $ 46 $ 193 $ 69

Income taxes, net of tax refunds $ 1,564 $ 273 $ (169)

Noncash financing and investing activities

Fixed assets acquired under capital lease $ — $ — $ 129

Net exercise of warrants $ — $ — $ 287

See accompanying Notes to Consolidated Financial Statements.

57