Salesforce.com 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

Recent Accounting Pronouncement

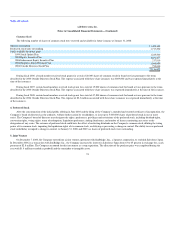

In September 2006, the FASB issued SFAS No. 157, "Fair Value Measurements" (SFAS No. 157). SFAS No. 157 defines fair value, establishes a

framework for measuring fair value, and enhances fair value measurement disclosure. In February 2008, the FASB issued FASB Staff Position (FSP) 157-1,

"Application of FASB Statement No. 157 to FASB Statement No. 13 and Other Accounting Pronouncements That Address Fair Value Measurements for

Purposes of Lease Classification or Measurement under Statement 13" (FSP 157-1) and FSP 157-2, "Effective Date of FASB Statement No. 157" (FSP

157-2). FSP 157-1 amends SFAS No. 157 to remove certain leasing transactions from its scope. FSP 157-2 delays the effective date of SFAS No. 157 for all

non-financial assets and non-financial liabilities, except for items that are recognized or disclosed at fair value in the financial statements on a recurring basis

(at least annually), until the beginning of the first quarter of fiscal 2010. The measurement and disclosure requirements related to financial assets and financial

liabilities are effective for the Company beginning in the first quarter of fiscal 2009. The adoption of SFAS No. 157 for financial assets and financial

liabilities will not have a significant impact on the Company's consolidated financial statements. However, the resulting fair values calculated under SFAS

No. 157 after adoption may be different from the fair values that would have been calculated under previous guidance. The Company is currently evaluating

the impact that SFAS No. 157 will have on the Company's consolidated financial statements when it is applied to non-financial assets and non-financial

liabilities beginning in the first quarter of 2010.

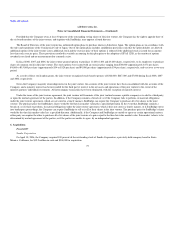

In December 2007, the FASB issued SFAS No. 160, "Noncontrolling Interests in Consolidated Financial Statements—an amendment of Accounting

Research Bulletin No. 51" ("SFAS 160"). SFAS 160 establishes accounting and reporting standards for ownership interests in subsidiaries held by parties

other than the parent, the amount of consolidated net income attributable to the parent and to the noncontrolling interest, changes in a parent's ownership

interest and the valuation of retained noncontrolling equity investments when a subsidiary is deconsolidated. SFAS 160 also establishes disclosure

requirements that clearly identify and distinguish between the interests of the parent and the interests of the noncontrolling owners. SFAS 160 is effective as

of the beginning of an entity's fiscal year that begins after December 15, 2008, and will be adopted by the Company in the first quarter of fiscal 2010. The

Company is currently evaluating the potential impact, if any, of the adoption of SFAS 160 on its consolidated results of operations and financial condition.

Reclassifications

Certain reclassifications to the fiscal 2007 and 2006 balances were made to conform to the current period presentation.

67