Royal Caribbean Cruise Lines 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

F-15 Royal Caribbean Cruises Ltd.

Hedge of Net Investment in a Foreign Operation

In 2006, in conjunction with our acquisition of Pullmantur, we obtained

a bridge loan with a notional amount of `750.0 million, or approxi-

mately $960.5 million, of which we drew `701.0 million, or approximately

$925.1 million, to finance the acquisition. We designated a portion

of this bridge loan, approximately `478.8 million, or approximately

$631.8 million, as a nonderivative hedge of our net investment in

Pullmantur and, accordingly, included approximately $18.7 million of

foreign-currency transaction losses in the foreign currency translation

adjustment component of accumulated other comprehensive loss at

December 31, 2006.

In 2007, prior to repaying the bridge loan, we included approximately

$12.7 million of foreign-currency transaction gains in the foreign

currency translation adjustment component of accumulated other

comprehensive (loss) income.

Prior to the repayment of the bridge loan, we issued `1.0 billion

unsecured senior notes to refinance the acquisition of Pullmantur and

to repay amounts under our $1.2 billion revolving credit facility. During

2008 and 2007, we designated a portion of the `1.0 billion unsecured

senior notes as a nonderivative hedge of our net investment in Pull-

mantur. The designated portion was approximately `393.0 million and

`466.0 million, or approximately $549.1 million and $679.9 million at

December 31, 2008 and 2007, respectively. During 2008 and 2007,

we included approximately $23.2 million and $76.7 million of foreign-

currency transaction losses, respectively, related to the `1.0 billion

unsecured senior notes in the foreign currency translation adjust-

ment component of accumulated other comprehensive loss.

NOTE 15.

FAIR VALUE MEASUREMENTS

The Company uses quoted prices in active markets when available to

determine the fair value of its financial instruments and does not hold

them for trading or other speculative purposes. The estimated fair value

of our financial instruments that are not measured at fair value on a

recurring basis are as follows (in thousands):

2008 2007

Long-term debt (including current portion

of long-term debt) $5,132,547 $5,558,984

In addition as discussed in Note 2, Summary of Significant Accounting

Policies, we adopted the provisions of SFAS 157, “Fair Value Measure-

ments” effective January 1, 2008. SFAS 157 defines fair value, establishes

a formal framework for measuring fair value and expands disclosures

about fair value measurements.

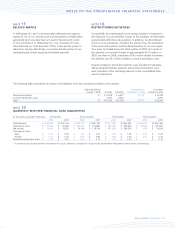

The following table presents information about the Company’s financial instruments recorded at fair value on a recurring basis as of December 31, 2008,

segregated among the appropriate levels within the fair value hierarchy:

Fair Value Measurements

at December 31, 2008 Using

Description Total Level 1 Level 2 Level 3

Assets:

Derivative financial instruments

1

$284,175 $ – $284,175 $ –

Investments

2

14,238 14,238 – –

Total Assets $298,413 $14,238 $284,175 $ –

Liabilities:

Derivative financial instruments

3

$360,941 $ – $360,941 $ –

Total Liabilities $360,941 $ – $360,941 $ –

1 Consists of foreign currency forward contracts and interest rate, cross currency and fuel swaps.

2 Consists of exchange-traded equity securities and mutual funds.

3 Consists of fuel swaps and foreign currency forward contracts.

The reported fair values are based on a variety of factors and assump-

tions. Accordingly, the fair values may not represent actual values of the

financial instruments that could have been realized as of December 31,

2008 or 2007, or that will be realized in the future and do not include

expenses that could be incurred in an actual sale or settlement.

Our exposure under foreign currency contracts, interest rate and fuel

swap agreements is limited to the cost of replacing the contracts in the

event of non-performance by the counterparties to the contracts, all

of which are currently our lending banks. To minimize this risk, we select

counterparties with credit risks acceptable to us and we limit our

exposure to an individual counterparty. Furthermore, all foreign cur-

rency forward contracts are denominated in relatively stable currencies.

Long-Term Debt

The fair values of our senior notes and senior debentures were estimated

by obtaining quoted market prices. The fair values of all other debt were

estimated using the present value of expected future cash flows.

Other Financial Instruments

The carrying amounts of all other financial instruments approximate fair

value at December 31, 2008 and 2007.