Royal Caribbean Cruise Lines 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 Royal Caribbean Cruises Ltd.

PART I

Celebrity Cruises’ products and service have broad appeal for a global

audience. Celebrity Cruises delivers an intimate experience onboard

upscale ships that offer a high staff-to-passenger ratio, extensive spa

facilities, fine dining, personalized service, and on Celebrity Solstice,

unique onboard attractions such as the “Lawn Club,” a half acre venue

featuring live grass and the “Hot Glass Show,” a fully functional glass

blowing studio.

Pullmantur

Pullmantur serves the contemporary segment of the Spanish and Latin

American cruise markets. Pullmantur operates six ships with approxi-

mately 8,650 berths, offering various seven-night cruise itineraries. In

addition, Pullmantur has tour operations, and owns a 49% interest in

a small air business that operates three Boeing 747 aircraft in support

of its cruise and tour operations.

Pullmantur’s strategy is to attract cruise guests by providing a variety

of cruising options and land-based travel packages. Pullmantur offers

a range of cruise itineraries to the Caribbean, the Mediterranean, Brazil

and the Baltic. Pullmantur offers a wide array of onboard activities and

services to guests, including exercise facilities, swimming pools, beauty

salons, gaming facilities, shopping, and dining and entertainment venues.

Pullmantur’s tour operations sell land-based travel packages to Spanish

guests including hotels and flights primarily to Caribbean resorts, and

sell land-based tour packages to Europe aimed at Latin American guests.

Empress of the Seas and Sovereign of the Seas were redeployed

from Royal Caribbean International to Pullmantur in March 2008 and

November 2008, respectively. The ships currently sail under the names

of Empress and Sovereign, respectively. Before redeployment to Pull-

mantur, each ship underwent renovations including the expansion of

public areas and restaurants, the redesign of the Atrium and incorpora-

tion of Pullmantur’s signature elements.

Azamara Cruises

Azamara Cruises is designed to serve the emerging deluxe cruise

segment between the premium and luxury segments of the North

American cruise markets, along with the U.K. and German markets.

Azamara Cruises operates two ships with a total of approximately

1,400 berths, offering various cruise itineraries that range from seven

to 24 nights and appeal to the more experienced guest who is usually

more affluent.

Azamara Cruises’ strategy is to attract experienced travelers who enjoy

cruising and who seek a more intimate onboard experience, a high

level of service and itineraries to a variety of unique destinations.

Azamara Cruises completed its first full year of operation offering

global itineraries to many ports not accessible by larger ships. Europe,

South America, the Caribbean, Asia, and the Panama Canal were all

visited by either Azamara Journey or Azamara Quest in 2008.

Azamara Cruises offers a wide array of onboard services, amenities

and activities, including gaming facilities, fine dining and interactive

entertainment venues.

CDF Croisières de France

CDF Croisières de France is designed to serve the contemporary seg-

ment of the French cruise market and increases our global presence

by providing us with a brand custom-tailored for French cruise guests.

In April 2008, Holiday Dream, a 750-berth ship, was redeployed from

Pullmantur to CDF Croisières de France and is currently sailing under

the name Bleu de France as the brand’s only ship. Before redeployment

to CDF Croisières de France, Bleu de France underwent renovations to

customize the ship for French guests.

CDF Croisières de France offers seasonal seven to ten night itineraries

to the Mediterranean and the Caribbean. CDF Croisières de France

offers a variety of onboard services, amenities and activities, including

entertainment venues, exercise and spa facilities, fine dining, and

gaming facilities.

TUI Cruises

In April 2008, we closed on our joint venture agreement with TUI AG,

a European tourism and shipping company which owns 51% of TUI

Travel. The joint venture operates TUI Cruises, designed to serve the

contemporary and premium segments of the German cruise market by

offering a custom-tailored product for German guests. Celebrity Galaxy,

a 1,850-berth ship currently part of Celebrity Cruises, will be sold to

TUI Cruises to serve as its first ship and will sail under a new name

beginning in May 2009.

Other

In November 2008, we sold our 50% investment in a joint venture

with TUI Travel PLC (“TUI Travel”), formerly First Choice Holidays PLC,

which operates the brand Island Cruises. As part of this transaction,

we agreed to an early termination of the charter of Island Star to Island

Cruises. We anticipate the return of Island Star in April 2009 and intend

to redeploy the ship to Pullmantur. The ship will sail under the name

Pacific Dream. Before redeployment to Pullmantur, the ship will undergo

renovations to incorporate Pullmantur’s signature elements. This ship

will be dedicated to the Latin American market in support of Pullman-

tur’s Latin American expansion.

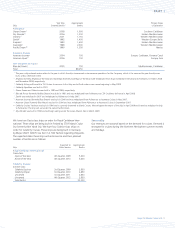

INDUSTRY

Over the past several years, cruising has represented a small but

growing sector of the overall vacation market. Industry data indicates

that a significant portion of cruise guests carried are first-time cruisers.

We believe this could present an opportunity for long-term growth

and a potential for increased market share through the expansion of

our fleet.

We estimate that the global cruise industry carried 17.2 million cruise

passengers in 2008 compared to 16.6 million cruise passengers carried

in 2007. We estimate that the global cruise fleet was served by approxi-

mately 354,000 berths on approximately 240 ships by the end of 2008.

There are approximately 34 ships with an estimated 86,000 berths that

are expected to be placed in service in the global cruise market between

2009 and 2012.

North America represents the primary source of our cruise passengers

and has experienced a compound annual growth rate of approximately

8.7% since 1970. From 2004 to 2008 North America has experienced

a compound annual growth rate in cruise passengers of approximately

4.4%. We estimate that North America was served by 132 ships with

approximately 194,000 berths at the beginning of 2004 and by 150

ships with approximately 257,000 berths by the end of 2008. There

are approximately 27 ships with an estimated 68,000 berths that are

expected to be placed in service in the North American cruise market

between 2009 and 2012.