Royal Caribbean Cruise Lines 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 Royal Caribbean Cruises Ltd.

s We sold our interest in Island Cruises to TUI Travel PLC, the other 50%

owner in the joint venture. We received proceeds of $51.4 million

and recognized a gain of approximately $1.0 million on the trans-

action. As part of the transaction, we agreed to an early termination

of the charter of Island Star to Island Cruises. We anticipate the

return of Island Star in April 2009 and intend to redeploy the ship to

Pullmantur at that time.

s We discontinued the Company’s dividend beginning in the fourth

quarter of 2008.

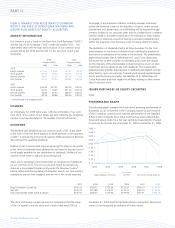

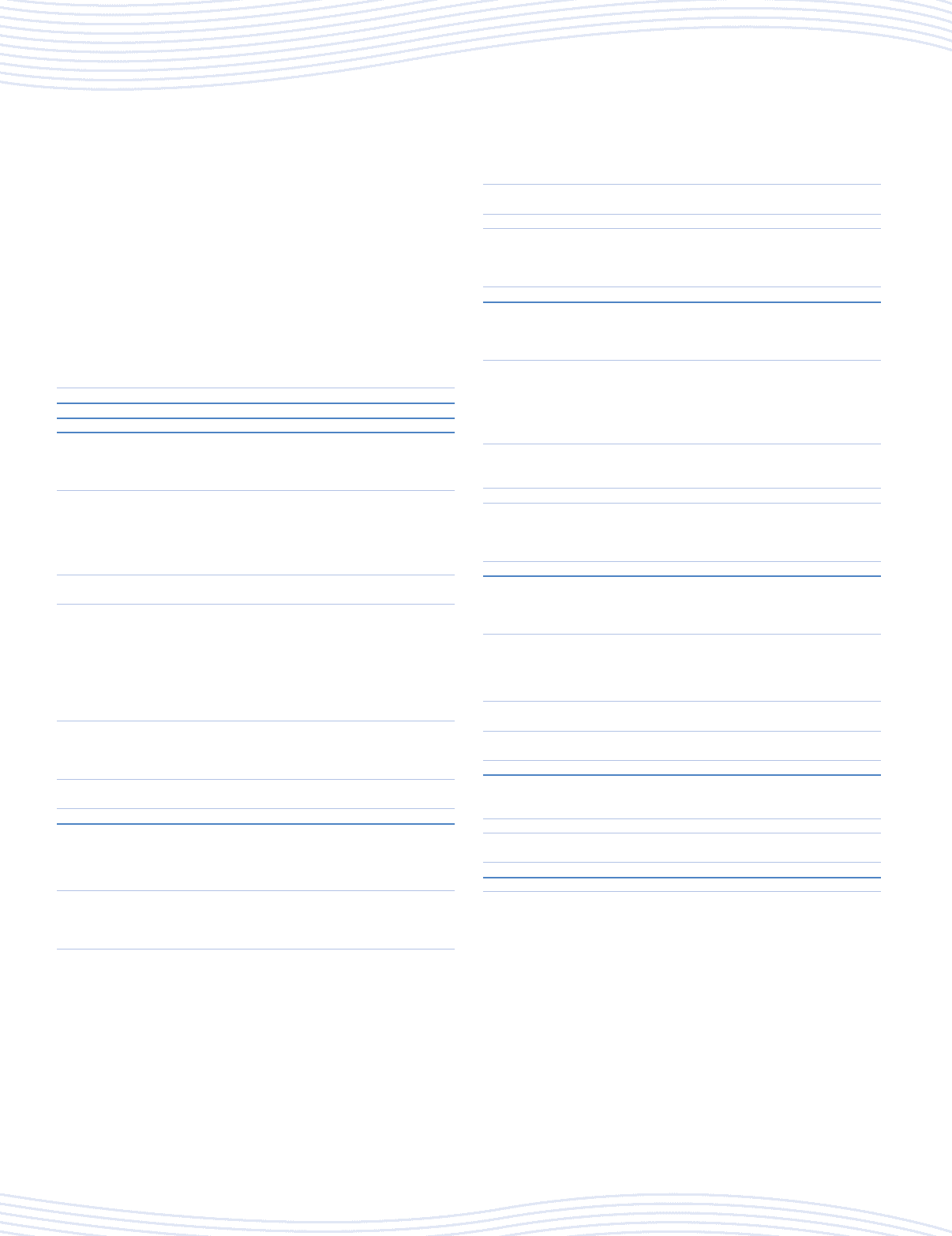

We reported historical total revenues, operating income, net income

and earnings per share as shown in the following table (in thousands,

except per share data):

Year Ended December 31, 2008 2007 2006

Total revenues $6,532,525 $6,149,139 $5,229,584

Operating income $ 831,984 $ 901,335 $ 858,446

Net income $ 573,722 $ 603,405 $ 633,922

Basic earnings per share:

Net income $ 2.69 $ 2.84 $ 3.01

Diluted earnings per share:

Net income $ 2.68 $ 2.82 $ 2.94

The following table presents historical operating data as a percentage

of total revenues for the last three years:

Year Ended December 31, 2008 2007 2006

Passenger ticket revenues 72.4 72.0 73.4

Onboard and other revenues 27.6 28.0 26.6

Total revenues 100.0% 100.0% 100.0%

Cruise operating expenses

Commissions, transportation and other 18.3 18.3 17.6

Onboard and other 7.0 6.6 6.3

Payroll and related 10.1 9.5 9.6

Food

5.2 5.3 5.3

Fuel 11.1 8.9 9.2

Other

operating 15.8 16.2 14.1

Total cruise operating expenses 67.5 64.8 62.1

Marketing, selling and

administrative

expenses 11.9 12.7 13.4

Depreciation and amortization expenses 7.9 7.8 8.1

Operating income 12.7 14.7 16.4

Other expense (3.9) (4.9) (4.3)

Net income 8.8% 9.8% 12.1%

Selected historical statistical information is shown in the following table:

Year Ended December 31, 2008 2007 2006

Passengers Carried 4,017,554 3,905,384 3,600,807

Passenger Cruise Days 27,657,578 26,594,515 23,849,606

APCD 26,463,637 25,155,768 22,392,478

Occupancy 104.5% 105.7% 106.5%

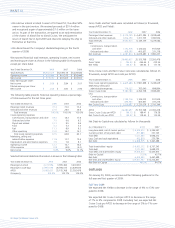

Gross Yields and Net Yields were calculated as follows (in thousands,

except APCD and Yields):

Year Ended December 31, 2008 2007 2006

Passenger ticket revenues $ 4,730,289 $ 4,427,384 $ 3,838,648

Onboard and other revenues 1,802,236 1,721,755 1,390,936

Total revenues 6,532,525 6,149,139 5,229,584

Less:

Commissions,

transportation

and other 1,192,316 1,124,022 917,929

Onboard and other 458,385 405,637 331,218

Net revenues $ 4,881,824 $ 4,619,480 $ 3,980,437

APCD 26,463,637 25,155,768 22,392,478

Gross Yields $ 246.85 $ 244.44 $ 233.54

Net Yields $ 184.47 $ 183.64 $ 177.76

Gross Cruise Costs and Net Cruise Costs were calculated as follows (in

thousands, except APCD and costs per APCD):

Year Ended December 31, 2008 2007 2006

Total cruise operating expenses $ 4,403,666 $ 3,981,698 $ 3,249,629

Marketing, selling and

administrative

expenses 776,522 783,040 699,864

Gross Cruise Costs 5,180,188 4,764,738 3,949,493

Less:

Commissions,

transportation

and other 1,192,316 1,124,022 917,929

Onboard and other 458,385 405,637 331,218

Net Cruise Costs $ 3,529,487 $ 3,235,079 $ 2,700,346

APCD 26,463,637 25,155,768 22,392,478

Gross Cruise Costs per APCD $ 195.75 $ 189.41 $ 176.38

Net Cruise Costs per APCD $ 133.37 $ 128.60 $ 120.59

Net Debt-to-Capital was calculated as follows (in thousands):

As of December 31, 2008 2007

Long-term debt, net of current portion $ 6,539,510 $ 5,346,547

Current portion of long-term debt 471,893 351,725

Total debt 7,011,403 5,698,272

Less: Cash and cash equivalents 402,878 230,784

Net Debt $ 6,608,525 $ 5,467,488

Total shareholders’ equity $ 6,803,012 $ 6,757,343

Total debt 7,011,403 5,698,272

Total debt and shareholders’ equity 13,814,415 12,455,615

Debt-to-Capital

50.8% 45.7%

Net Debt 6,608,525 5,467,488

Net Debt and shareholders’ equity $13,411,537 $12,224,831

Net Debt-to-Capital 49.3% 44.7%

OUTLOOK

On January 29, 2009, we announced the following guidance for the

full year and first quarter of 2009:

Full Year 2009

We expected Net Yields to decrease in the range of 9% to 13% com-

pared to 2008.

We expected Net Cruise Costs per APCD to decrease in the range

of 7% to 9% compared to 2008. Excluding fuel, we expected Net

Cruise Costs per APCD to decrease in the range of 5% to 7% com-

pared to 2008.

PART II