Royal Caribbean Cruise Lines 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Royal Caribbean Cruises Ltd. F-10

acquirer to disclose all information needed to evaluate and understand

the nature and financial effect of the business combination. SFAS 141R

applies to all transactions or other events in which an entity obtains con-

trol of one or more businesses, including combinations achieved without

transfer of consideration, for example, by contract alone or through the

lapse of minority veto rights. SFAS 141R applies prospectively to business

combinations for which the acquisition date is on or after the beginning

of the first fiscal year beginning after December 15, 2008. Currently, the

adoption of SFAS 141R is not expected to have a significant impact on

our financial position, results of operations or cash flows. The impact

on future acquisitions by the Company will depend largely on the

nature and terms of such future acquisitions, if any.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling

Interests in Consolidated Financial Statements – An Amendment of

ARB No. 51,” (“SFAS 160”). SFAS 160 requires reporting entities to

present noncontrolling (minority) interests as equity instead of as a

liability or mezzanine equity and provides guidance on the account-

ing for transactions between an entity and noncontrolling interests.

SFAS 160 is effective the first fiscal year beginning after December 15,

2008, and interim periods within that fiscal year. SFAS 160 applies pro-

spectively as of the beginning of the fiscal year SFAS 160 is initially

applied, except for the presentation and disclosure requirements which

are applied retrospectively for all periods presented subsequent to

adoption. The adoption of SFAS 160 will not have a material impact

on our consolidated financial statements.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about

Derivative Instruments and Hedging Activities – An Amendment of

FASB Statement No. 133 (SFAS 133),” (“SFAS 161”). SFAS 161 requires

enhanced disclosures about an entity’s derivative and hedging activities

and thereby improves the transparency of financial reporting. Entities are

required to provide enhanced disclosures about (a) how and why an entity

uses derivative instruments, (b) how derivative instruments and related

hedged items are accounted for under SFAS 133 and its related inter-

pretations, and (c) how derivative instruments and related hedged

items affect an entity’s financial position, financial performance, and

cash flows. SFAS 161 is effective for financial statements issued for

fiscal years and interim periods beginning after November 15, 2008.

SFAS 161 will be effective for our fiscal year 2009 interim and annual

consolidated financial statements and the relevant disclosures will be

added at such time.

Reclassifications

Reclassifications have been made to prior year amounts to conform to

the current year presentation.

NOTE 3.

BUSINESS COMBINATION

In November 2006, we completed our acquisition of Pullmantur, a

Madrid-based cruise and tour operator. The Pullmantur brand increases

our presence in Spain and provides us with an opportunity to further

grow our business in Europe and Latin America and to increase our

product offerings. Pullmantur also provides us an opportunity for incre-

mental guest, revenue and earnings growth. We purchased all of the

capital stock of Pullmantur for approximately `436.3 million, or approxi-

mately $558.9 million. We include Pullmantur’s results of operations

on a two-month lag to allow for more timely preparation of our

consolidated financial statements.

The acquisition was accounted for as a business purchase combination

using the purchase method of accounting under the provisions of State-

ment of Financial Accounting Standards No. 141, “Business Combi

nations.” The purchase price was allocated to tangible and identifi

able intangible assets acquired and liabilities assumed based on their

estimated fair values at the acquisition date, with the excess allocated

to goodwill. Approximately `352.3 million or $451.4 million was

allocated to goodwill and approximately `189.4 million or $242.6 mil-

lion was allocated to acquired intangible assets.

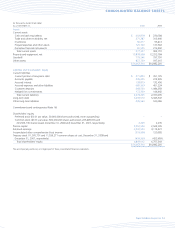

(in thousands) United States $

Total current assets $ 58,931

Property and equipment (mostly ships) 366,800

Other non-current assets 5,488

Goodwill 451,355

Other intangible assets 242,600

Current portion of long-term debt (14,897)

Other current liabilities (110,520)

Long-term debt (338,700)

Other long-term liabilities (102,109)

Net assets acquired $ 558,948

Of the $242.6 million of acquired intangible assets, approximately

`168.6 million or $216.0 million was assigned to the value associated

with the awareness and reputation of the Pullmantur brand among

its passengers and is considered an indefinite-life intangible asset.

Finite-life intangible assets identified of approximately `20.8 million

or $26.6 million have a weighted-average useful life of approximately

4.8 years. The amount allocated to goodwill was adjusted in 2007

by `20.2 million or approximately $25.9 million as a result of the

finalization of the purchase price allocation to the net assets acquired,

primarily driven by our completion of the fleet valuation.

NOTE 4.

GOODWILL

In 2008, 2007 and 2006, we completed our annual goodwill impair-

ment test and determined there was no impairment. The carrying

amount of goodwill attributable to our Royal Caribbean International

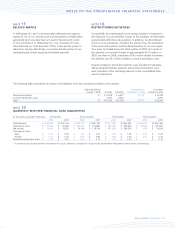

and the Pullmantur reporting units was as follows (in thousands):

Royal

Caribbean

International Pullmantur Total

Balance at December 31, 2006 $283,723 $437,791 $721,514

Foreign currency

translation adjustment – 50,377 50,377

Purchase price adjustments – 25,900 25,900

Balance at December 31, 2007 283,723 514,068 797,791

Foreign currency

translation adjustment – (18,545) (18,545)

Balance at December 31, 2008 $283,723 $495,523 $779,246

We performed the annual impairment review for goodwill during the

fourth quarter of 2008. We determined the fair value of our two reporting

units which include goodwill, Royal Caribbean International and Pullmantur,

using a probability-weighted discounted cash flow model. The principal

assumptions used in the discounted cash flow model are projected

operating results, weighted average cost of capital, and terminal value.

Cash flows were calculated using our 2009 projected operating results

as a base. To that base we added future years’ cash flows assuming

multiple revenue and expense scenarios that reflect the impact on each

reporting unit of different global economic environments beyond 2009.