Royal Caribbean Cruise Lines 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 Royal Caribbean Cruises Ltd.

The recent turmoil in the credit and capital markets has increased the

volatility associated with interest rates, foreign currency exchange rates

and fuel prices. However, we are taking steps to mitigate these risks.

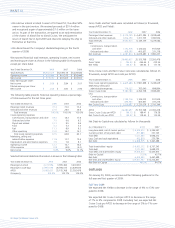

Interest Rate Risk

Our exposure to market risk for changes in interest rates relates to our

long-term debt obligations and our operating lease for Brilliance of the

Seas. At December 31, 2008, approximately 43% of our long-term debt

was effectively fixed and approximately 57% was floating. We enter

into interest rate swap agreements to modify our exposure to interest

rate movements and to manage our interest expense and rent expense.

Market risk associated with our long-term fixed rate debt is the poten-

tial increase in fair value resulting from a decrease in interest rates. At

December 31, 2008, our interest rate swap agreements effectively

changed $350.0 million of fixed rate debt with a fixed rate of 7.25%

to LIBOR-based floating rate debt, and E1.0 billion of fixed rate debt

with a fixed rate of 5.625% to EURIBOR-based floating rate debt. We

have cross currency swap agreements that effectively change E300.0 mil-

lion of the E1.0 billion floating EURIBOR-based debt to floating LIBOR-

based debt. (See Foreign Currency Exchange Rate Risk for further infor-

mation). The estimated fair value of our long-term fixed rate debt at

December 31, 2008, was $3.2 billion using quoted market prices,

where available, or using the present value of expected future cash

flows. The fair value of our associated interest rate swap agreements

was estimated to be an asset of $165.5 million as of December 31, 2008

based on the present value of expected future cash flows. A hypo-

thetical one percentage point decrease in interest rates at December 31,

2008 would increase the fair value of our long-term fixed rate debt by

approximately $12.1 million, net of an increase in the fair value of the

associated interest rate swap agreements.

Market risk associated with our long-term floating rate debt is the

potential increase in interest expense from an increase in interest rates.

A hypothetical one percentage point increase in interest rates would

increase our 2009 interest expense by approximately $24.7 million,

assuming no change in exchange rates.

Market risk associated with our operating lease for Brilliance of the

Seas is the potential increase in rent expense from an increase in

sterling LIBOR rates. As of January 2008, we have effectively changed

50% of the operating lease obligation from a floating rate to a fixed

rate obligation with a weighted-average rate of 4.76% through rate

fixings with the lessor. A hypothetical one percentage point increase in

sterling LIBOR rates would increase our 2009 rent expense by approxi-

mately $1.4 million, based on the exchange rate at December 31, 2008.

Foreign Currency Exchange Rate Risk

Our primary exposure to foreign currency exchange rate risk relates to

our ship construction firm commitments denominated in euros. We

enter into euro-denominated forward contracts to manage this risk.

The estimated fair value of such euro-denominated forward contracts

at December 31, 2008, was a net unrealized loss of approximately

$66.9 million, based on the present value of expected future cash

flows. At December 31, 2008, approximately 13.9% of the aggregate

cost of the ships was exposed to fluctuations in the euro exchange rate.

A hypothetical 10% strengthening of the euro as of December 31, 2008,

assuming no changes in comparative interest rates, would result in a

$588.5 million increase in the United States dollar cost of the foreign

currency denominated ship construction contracts. This increase

would be largely offset by an increase in the fair value of our euro-

denominated forward contracts.

As discussed above, we have cross currency swap agreements that

effectively change E300 million of floating EURIBOR-based debt to

$389 million of floating LIBOR-based debt at December 31, 2008.

(See Interest Rate Risk for further information). The estimated fair

value of these cross currency swap agreements at December 31, 2008,

was an asset of approximately $44.4 million based on the present value

of expected future cash flows. A hypothetical 10% strengthening of

the euro as of December 31, 2008, assuming no changes in compara-

tive interest rates, would result in an increase in the fair value of the

E300 million of floating EURIBOR-based debt by $42.8 million, offset

by an increase in the fair value of the cross currency swap agreements

of $43.7 million.

Also, we consider our investments in foreign subsidiaries to be denomi-

nated in relatively stable currencies and of a long-term nature. We partially

address the exposure of our investments in foreign subsidiaries by

denominating a portion of our debt in our subsidiaries’ functional

currencies (generally euros). Specifically, we have assigned debt of

approximately E393.0 million, or approximately $549.1 million, as

a hedge of our net investment in Pullmantur and, accordingly, have

included approximately $23.2 million of foreign-currency transaction

gains in the foreign currency translation adjustment component of

accumulated other comprehensive income (loss) at December 31, 2008. A

hypothetical 10% increase or decrease in the December 31, 2008 foreign

currency exchange rate would increase or decrease the fair value of our

assigned debt by $54.9 million, which would be offset by a corre-

sponding decrease or increase in the United States dollar value of

our net investment.

Fuel Price Risk

Our exposure to market risk for changes in fuel prices relates to the

consumption of fuel on our ships. Fuel cost (net of the financial impact

of fuel swap agreements), as a percentage of our total revenues, was

approximately 11.1% in 2008, 8.9% in 2007 and 9.2% in 2006. We

use a range of instruments including fuel swap agreements to mitigate

the financial impact of fluctuations in fuel prices. As of December 31,

2008, we had fuel swap agreements to pay fixed prices for fuel with

an aggregate notional amount of approximately $367.2 million,

maturing through 2010. The estimated fair value of these contracts

at December 31, 2008 was an unrealized loss of $191.3 million. We

estimate that a hypothetical 10% increase in our weighted-average

fuel price from that experienced during the year ended December 31,

2008 would increase our 2009 fuel cost by approximately $76.7 mil-

lion. This increase would be partially offset by an increase in the fair

value of our fuel swap agreements maturing in 2009 of approxi-

mately $28.9 million.

ITEM 8. FINANCIAL STATEMENTS AND

SUPPLEMENTARY DATA

Our Consolidated Financial Statements and Quarterly Selected Financial

Data are included beginning on page F-1 of this report.

PART II