Red Lobster 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 Darden Restaurants, Inc. 2009 Annual Report

Notes to Consolidated Financial Statements

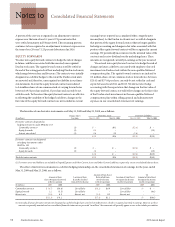

At the end of fiscal 2005, the ESOP borrowed $1.6 million from

us at a variable interest rate and acquired an additional 0.05 million

shares of our common stock, which were held in suspense within

the ESOP at May 29, 2005. The loan, which had a variable interest

rate of 0.69 percent at May 31, 2009, is due to be repaid no later than

December 2018. The shares acquired under this loan are accounted

for in accordance with Statement of Position (SOP) 93-6, “Employers’

Accounting for Employee Stock Ownership Plans.” Fluctuations in

our stock price are recognized as adjustments to common stock and

surplus when the shares are committed to be released. These ESOP

shares are not considered outstanding until they are committed to be

released and, therefore, have been excluded for purposes of calculating

basic and diluted net earnings per share at May 31, 2009. The fair value

of these shares at May 31, 2009 was $1.6 million.

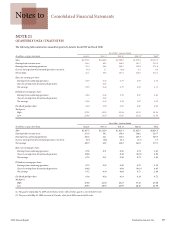

As part of the RARE acquisition, we assumed RARE’s employee

benefit plans. We merged these plans into our existing employee

benefit plans during fiscal 2009. As of the date of acquisition, RARE

provided its employees who met minimum service requirements

with retirement benefits under a 401(k) plan (RARE Plan). Under the

RARE Plan, eligible employees were eligible to make contributions

of between 1 percent and 20 percent of their annual compensation

to one or more investment funds. Officers and highly compensated

employees did not participate in the RARE Plan. Quarterly matching

contributions were made in an amount equal to 50 percent of the

first 5 percent of employee compensation contributed, resulting in a

maximum annual company contribution of 2.5 percent of employee

compensation. For fiscal 2009 and the period from the date of acqui-

sition through the end of fiscal 2008, we incurred expense under the

RARE Plan of $0.0 million and $0.6 million, respectively.

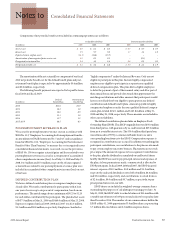

Effective January 1, 2000, RARE implemented the Supplemental

Deferred Compensation Plan (Supplemental Plan), a non-qualified

plan which allowed officers and highly compensated employees to

defer receipt of a portion of their compensation and contribute such

amounts to one or more investment funds. The maximum aggregate

amount deferred under the Supplemental Plan and the RARE Plan

could not exceed the lesser of 20 percent of annual compensation or

$50,000. Quarterly matching contributions were made in an amount

equal to 50 percent of the first 5 percent of employee compensation

contributed, with a maximum annual company contribution of the

lesser of 2.5 percent of employee compensation or $5,750. For fiscal

2009 and the period from the date of acquisition through the end of

fiscal 2008, we incurred expense under the Supplemental Plan of

$0.0 million and $0.4 million, respectively. Upon the acquisition of

RARE, all unvested Company contributions to both the RARE Plan and

the Supplemental Plan were immediately vested, however, contributions

subsequent to the date of acquisition vest according to the plans’

provisions. Company contributions vest at a rate of 20 percent each

year beginning after the employee’s first year of service and are made

in the form of cash. The Company entered into a rabbi trust agree-

ment to protect the assets of the Supplemental Plan. Participants’

accounts are comprised of their contribution; the company’s matching

contribution and each participant’s share of earnings or losses in the

Supplemental Plan. In accordance with EITF No. 97-14, “Accounting

for Deferred Compensation Arrangements Where Amounts Are

Held in a Rabbi Trust and Invested,” the accounts of the rabbi trust are

reported in our consolidated financial statements. Our consolidated

balance sheet includes the investments in other assets and the offset-

ting obligation is included in other liabilities. As of May 31, 2009 and

May 25, 2008, the balance of the Supplemental Plan was $9.1 million

and $13.2 million, respectively. The Supplemental Plan investments

are considered trading securities and are reported at fair value with

the realized and unrealized holding gains and losses related to these

investments, as well as the offsetting compensation expense, recorded

in selling, general and administrative expenses.

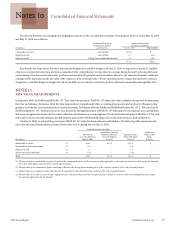

NOTE 18

StocK-BaSeD comPenSation

We maintain two active stock option and stock grant plans under

which new awards may still be issued, known as the Darden

Restaurants, Inc. 2002 Stock Incentive Plan (2002 Plan) and the

RARE Hospitality International, Inc. Amended and Restated 2002

Long-Term Incentive Plan (RARE Plan). We also have three other

stock option and stock grant plans under which we no longer can

grant new awards, although awards outstanding under the plans

may still vest and be exercised in accordance with their terms: the

Stock Plan for Directors (Director Stock Plan), the Stock Option and

Long-Term Incentive Plan of 1995 (1995 Plan) and the Restaurant

Management and Employee Stock Plan of 2000 (2000 Plan). All

of the plans are administered by the Compensation Committee of

the Board of Directors. The 2002 Plan provides for the issuance of

up to 9.55 million common shares in connection with the granting

of non-qualified stock options, incentive stock options, stock

appreciation rights, restricted stock, restricted stock units (RSUs),

stock awards and other stock-based awards to key employees and

non-employee directors. The RARE Plan provides for the issuance of

up to 3.9 million common shares in connection with the granting of

non-qualified stock options, incentive stock options and restricted

stock to employees. Awards under the RARE Plan are only permitted

to be granted to employees who were employed by RARE as of

the date of acquisition and continued their employment with the

Company. The Director Stock Plan provided for the issuance of up

to 0.375 million common shares out of our treasury in connection

with the granting of non-qualified stock options, restricted stock and

RSUs to non-employee directors. No new awards could be granted

under the Director Stock Plan after September 30, 2000. The Director

Compensation Plan provided for the issuance of 0.1 million shares

common shares out of our treasury to non-employee directors of the

Board. No new awards may be granted under the Director Compen-

sation Plan after September 30, 2005. The 1995 Plan provided for the

issuance of up to 33.3 million common shares in connection with the

granting of non-qualified stock options, restricted stock or RSUs to

key employees. The 2000 Plan provided for the issuance of up to 5.4

million shares of common stock out of our treasury as non-qualified

stock options, restricted stock or RSUs. Under all of these plans, stock