Red Lobster 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

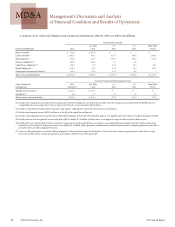

MD&A Management’s Discussion and Analysis

of Financial Condition and Results of Operations

2009 Annual Report Darden Restaurants, Inc. 31

time in whole or from time to time in part, at the principal amount

plus a make-whole premium. If we experience a change of control

triggering event, we may be required to purchase the New Senior

Notes from the holders.

All of our long-term debt currently outstanding is expected to

be repaid entirely at maturity with interest being paid semi-annually

over the life of the debt. The aggregate maturities of long-term

debt for each of the five fiscal years subsequent to May 31, 2009,

and thereafter are $0.0 million in 2010, $225.0 million in 2011,

$0.0 million in 2012, $350.0 million in 2013, $0.0 million in 2014

and $1.06 billion thereafter.

We entered into treasury-lock derivative instruments with

$150.0 million of notional value to hedge a portion of the risk of

changes in the benchmark interest rate associated with the expected

issuance of long-term debt to refinance our $150.0 million senior

notes due August 2010 and our $75.0 million medium-term notes

due April 2011, as changes in the benchmark interest rate will cause

variability in our forecasted interest payments. These derivative

instruments are designated as cash flow hedges and to the extent they

are effective in offsetting the variability of the hedged cash flows,

changes in the derivatives’ fair value are not included in current

earnings but are included in accumulated other comprehensive

income (loss). These changes in fair value will subsequently be reclas-

sified into earnings as a component of interest expense as interest is

incurred on the forecasted debt issuance. Ineffectiveness measured

in the hedging relationship is recorded currently in earnings in the

period it occurs. The fair value of these outstanding treasury-lock

derivative instruments was a net loss of $2.8 million at May 31, 2009

and is included, net of tax of $1.1 million, in accumulated other

comprehensive income (loss).

During the second quarter of fiscal 2008, we entered into

treasury-lock derivative instruments with $550.0 million of notional

value to hedge a portion of the risk of changes in the benchmark

interest rate prior to the issuance of the New Senior Notes, as

changes in the benchmark interest rate would cause variability in

our forecasted interest payments. These instruments were all settled

at the issuance of the New Senior Notes for a cumulative gain of

$6.2 million. These instruments were designated as effective cash

flow hedges, therefore, the gain was recorded in accumulated other

comprehensive income (loss) and is reclassified into earnings as an

adjustment to interest expense as interest on the New Senior Notes or

similar debt is incurred. Gains of $0.8 million and $0.5 million were

recognized in earnings during fiscal 2009 and 2008, respectively, as

an adjustment to interest expense.

In March 2007, we repaid, at maturity, our $150.0 million

unsecured 5.750 percent medium-term notes with cash from

operations and short-term borrowings.

At May 31, 2009, our long-term debt consisted principally of:

• $150.0 million of unsecured 4.875 percent senior notes due in

August 2010;

• $75.0 million of unsecured 7.450 percent medium-term notes

due in April 2011;

• $350.0 million of unsecured 5.625 percent senior notes due in

October 2012;

• $100.0 million of unsecured 7.125 percent debentures due in

February 2016;

• $500.0 million of unsecured 6.200 percent senior notes due in

October 2017;

• $150.0 million of unsecured 6.000 percent senior notes due in

August 2035;

• $300.0 million of unsecured 6.800 percent senior notes due in

October 2037; and

• An unsecured, variable rate $11.6 million commercial bank

loan due in December 2018 that is used to support a loan

from us to the Employee Stock Ownership Plan portion of the

Darden Savings Plan.

Through our shelf registration statement on file with the SEC,

depending on conditions prevailing in the public capital markets, we

may issue unsecured debt securities from time to time in one or more

series, which may consist of notes, debentures or other evidences of

indebtedness in one or more offerings.