Red Lobster 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 Annual Report Darden Restaurants, Inc. 55

Notes to Consolidated Financial Statements

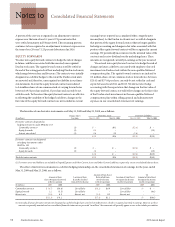

period in which they occur. As of May 31, 2009 and May 25, 2008 we

were party to natural gas swap contracts, which were not designated

as cash flow hedging instruments, with notional values of $1.3 million

and $3.1 million respectively.

OTHER COMMODITY CONTRACTS

We enter into other commodity futures and swaps (typically for

soybean oil, milk, diesel fuel and butter) to reduce the risk of

fluctuations in the price we pay for these commodities, which are

either used directly in our restaurants (e.g., class III milk contracts

for cheese and soybean oil for salad dressing) or are components

of the cost we pay for items used in our restaurants (e.g., diesel fuel

contracts to mitigate risk related to diesel fuel surcharges charged

by our distributors). To the extent these derivatives are effective in

offsetting the variability of the hedged cash flows, and otherwise

meet the hedge accounting criteria of SFAS No. 133, changes in the

derivatives’ fair value are not included in current earnings but are

included in accumulated other comprehensive income (loss). These

changes in fair value will subsequently be reclassified into earnings

as a component of food and beverage expenses when the product

is purchased for use in our restaurants. Ineffectiveness measured

in the hedging relationship is recorded currently in earnings in the

period it occurs. As of May 31, 2009 and May 25, 2008, we were party

to commodity contracts designated as effective cash flow hedging

instruments with notional values of $0.0 million and $5.8 million,

respectively. To the extent the hedge accounting criteria of SFAS

No. 133 are not met, the commodity contracts are utilized as

economic hedges and changes in the fair value of these contracts

are recorded currently in earnings in the period in which they

occur. As of May 31, 2009, we were party to commodity contracts

not designated as cash flow hedging instruments, with notional

values of $0.3 million. There were no such contracts outstanding as

of May 25, 2008.

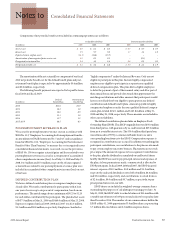

INTEREST RATE LOCKS

We entered into treasury-lock derivative instruments with

$150.0 million of notional value to hedge a portion of the risk of

changes in the benchmark interest rate associated with the expected

issuance of long-term debt to refinance our $150.0 million senior

notes due August 2010 and our $75.0 million medium-term notes

due April 2011, as changes in the benchmark interest rate will cause

variability in our forecasted interest payments. These derivative

instruments are designated as cash flow hedges and to the extent

they are effective in offsetting the variability of the hedged cash

flows, changes in the derivatives’ fair value are not included in

current earnings but are included in accumulated other compre-

hensive income (loss). These changes in fair value will subsequently

be reclassified into earnings as a component of interest expense as

interest is incurred on the forecasted debt issuance. Ineffectiveness

measured in the hedging relationship is recorded currently in

earnings in the period it occurs.

We entered into treasury-lock derivative instruments with

$550.0 million of notional value to hedge a portion of the risk of

changes in the benchmark interest rate prior to the issuance of

the New Senior Notes, as changes in the benchmark interest rate

would cause variability in our forecasted interest payments. These

instruments were all settled at the issuance of the New Senior Notes

during the second quarter of fiscal 2008 for a cumulative gain of

$6.2 million. These instruments were designated as effective cash

flow hedges, therefore, the gain was recorded in accumulated other

comprehensive income (loss) and is reclassified into earnings as an

adjustment to interest expense as interest on the New Senior Notes

or similar debt is incurred.

INTEREST RATE SWAPS

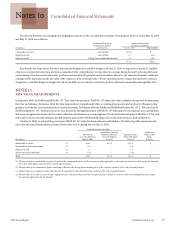

During the quarter ended August 24, 2008, we entered into interest

rate swap agreements with $225.0 million of notional value to

limit the risk of changes in fair value of our $150.0 million senior

notes due August 2010 and $75.0 million medium-term notes due

April 2011 attributable to changes in the benchmark interest rate,

between now and maturity of the related debt. The swap agree-

ments effectively swap the fixed rate obligations for floating rate

obligations, thereby mitigating changes in fair value of the related

debt prior to maturity. The swap agreements were designated as

fair value hedges of the related debt and met the requirements

to be accounted for under the short-cut method, resulting in no

ineffectiveness in the hedging relationship. During the quarter

ended November 23, 2008, we terminated these interest rate swap

agreements for a gain of approximately $1.9 million, which will be

recorded as a reduction to interest expense over the remaining life

of the related long-term debt.

During fiscal 2005 and fiscal 2004, we entered into interest rate

swap agreements to hedge the risk of changes in interest rates on

the cost of a future issuance of fixed-rate debt. The swaps, which

had a $100.0 million notional principal amount of indebtedness,

were used to hedge a portion of the interest payments associated

with $150.0 million of unsecured 4.875 percent senior notes

due in August 2010, which were issued in August 2005. The

swaps were settled at the time of the related debt issuance with a

net loss of $1.2 million being recognized in accumulated other

comprehensive income (loss). The net loss on the swaps is being

amortized into earnings as an adjustment to interest expense over

the same period in which the related interest costs on the related

debt issuance are being recognized in earnings.

We also had interest rate swaps with a notional amount of

$200.0 million, which we used to convert variable rates on our

long-term debt to fixed rates effective May 30, 1995, related to the

issuance of our $150.0 million 6.375 percent notes due February

2006 and our $100.0 million 7.125 percent debentures due February

2016. We received the one-month commercial paper interest rate and

paid fixed-rate interest ranging from 7.51 percent to 7.89 percent. The

swaps were settled during January 1996 at a cost to us of $27.7 million.