Red Lobster 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

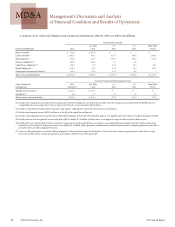

36 Darden Restaurants, Inc. 2009 Annual Report

MD&A Management’s Discussion and Analysis

of Financial Condition and Results of Operations

combination will generally be expensed as incurred. SFAS No. 141R is

effective for business combinations occurring in fiscal years beginning

after December 15, 2008, which will require us to adopt these provi-

sions for business combinations occurring in fiscal 2010 and thereafter.

Early adoption of SFAS No. 141R is not permitted. We do not believe

the adoption of SFAS No. 141R will have a significant impact on our

consolidated financial statements.

In June 2008, the FASB issued FASB Staff Position (FSP) EITF

03-6-1, “Determining Whether Instruments Granted in Share-Based

Payment Transactions Are Participating Securities.” FSP EITF 03-6-1

provides that unvested share-based payment awards that contain

nonforfeitable rights to dividends or dividend equivalents (whether

paid or unpaid) are participating securities and shall be included

in the computation of earnings per share pursuant to the two-class

method. The two-class method is an earnings allocation method

for computing earnings per share when an entity’s capital structure

includes either two or more classes of common stock or common

stock and participating securities. It determines earnings per share

based on dividends declared on common stock and participating

securities (i.e., distributed earnings) and participation rights of

participating securities in any undistributed earnings. FSP EITF

03-6-1 is effective for fiscal years beginning after December 15, 2008,

which will require us to adopt these provisions in fiscal 2010. We do

not believe the adoption of FSP EITF 03-6-1 will have a significant

impact on our consolidated financial statements.

In December 2008, the FASB issued FSP 132(R)-1, “Employers’

Disclosures about Postretirement Benefit Plan Assets,” which expands

the disclosure requirements about fair value measurements of plan

assets for pension plans, postretirement medical plans, and other

funded postretirement plans. This FSP is effective for fiscal years

ending after December 15, 2009, which will require us to adopt these

provisions in fiscal 2010. We are currently evaluating the impact

FSP 132(R)-1 will have on our consolidated financial statements.

FORWARDLOOKING STATEMENTS

Statements in this report regarding the expected net increase in

the number of our restaurants, U.S. same-restaurant sales, total

sales growth, diluted net earnings per share growth, and capital

expenditures in fiscal 2010, and all other statements that are not

historical facts, including without limitation statements concerning

or related to the financial condition, results of operations, plans,

objectives, future performance and business of Darden Restaurants,

Inc. and its subsidiaries that are preceded by, followed by or that

include words such as “may,” “will,” “expect,” “intend,” “anticipate,”

“continue,” “estimate,” “project,” “believe,” “plan” or similar expres-

sions, are forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995 and are identified,

together with this statement, for purposes of complying with the

safe harbor provisions of that Act. Any forward-looking statements

speak only as of the date on which such statements are made, and we

undertake no obligation to update such statements for any reason

to reflect events or circumstances arising after such date. By their

nature, forward-looking statements involve risks and uncertainties

that could cause actual results to differ materially from those set

forth in or implied by such forward-looking statements. In addition

to the risks and uncertainties of ordinary business obligations, the

forward-looking statements contained in this report are subject to

the risks and uncertainties described in Part I, Item 1A “Risk Factors”

in our Annual Report on Form 10-K for the year ended May 31, 2009,

which are summarized as follows:

• The intensely competitive nature of the restaurant industry,

especially pricing, service, location, personnel and type and

quality of food;

• Economic and business factors, both specific to the restaurant

industry and generally, that are largely out of our control,

including changes in consumer preferences, demographic

trends, severe weather conditions including hurricanes, a

protracted economic slowdown or worsening economy,

unemployment, energy prices, interest rates, industry-wide

cost pressures and public safety conditions, including actual

or threatened armed conflicts or terrorist attacks;