Red Lobster 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 DARDEN RESTAURANTS

We granted restricted stock and RSUs during fiscal 2003,

2002, and 2001 totaling 275,610, 428,280, and 563,306 shares,

respectively. The per share weighted-average fair value of the awards

granted in fiscal 2003, 2002, and 2001 was $26.53, $17.10, and

$10.67, respectively. After giving consideration to assumed forfeiture

rates and subsequent forfeiture adjustments, compensation expense

recognized in net earnings for awards granted in fiscal 2003, 2002,

and 2001 amounted to $3,579, $4,392, and $4,164, respectively.

NOTE 15

Employee Stock Purchase Plan

We maintain the Darden Restaurants Employee Stock Purchase

Plan to provide eligible employees who have completed one year

of service (excluding senior officers subject to Section 16(b) of the

Securities Exchange Act of 1934) an opportunity to purchase

shares of our common stock, subject to certain limitations. Under

the plan, employees may elect to purchase shares at the lower of

85 percent of the fair market value of our common stock as of

the first or last trading days of each quarterly participation period.

During fiscal 2003, 2002, and 2001, employees purchased shares

of common stock under the plan totaling 261,409, 284,576,

and 328,338, respectively. As of May 25, 2003, an additional

778,456 shares are available for issuance.

No compensation expense has been recognized for shares

issued under the plan. The impact of recognizing compensation

expense for purchases made under the plan in accordance with the

fair value method specified in SFAS No. 123 is less than $800 and

has no impact on reported basic or diluted net earnings per share.

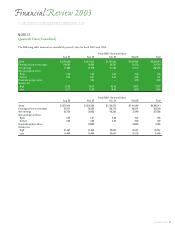

NOTE 16

Commitments and Contingencies

We make trade commitments in the course of our normal opera-

tions. As of May 25, 2003, and May 26, 2002, we were contin-

gently liable for approximately $8,301 and $9,786, respectively,

under outstanding trade letters of credit issued in connection

with purchase commitments. These letters of credit have terms

of one month or less and are used to collateralize our obligations

to third parties for the purchase of inventories.

As collateral for performance on contracts and as credit

guarantees to banks and insurers, we were contingently liable

for guarantees of subsidiary obligations under standby letters of

credit. As of May 25, 2003, and May 26, 2002, we had $41,442

and $30,000, respectively, of standby letters of credit related to

workers’ compensation and general liabilities accrued in our

consolidated financial statements. As of May 25, 2003, and

May 26, 2002, we had $7,503 and $8,608, respectively, of standby

letters of credit related to contractual operating lease obligations

and other payments. All standby letters of credit are renewable

annually. As of May 25, 2003, and May 26, 2002, we had other

commercial commitments of $2,250 and $0, respectively.

As of May 25, 2003 and May 26, 2002, we had $4,254

and $5,463, respectively, of guarantees associated with third-

party sublease or assignment obligations. These amounts repre-

sent the maximum potential amount of future payments under

the guarantees. The fair value of these potential payments

discounted at our pre-tax cost of capital at May 25, 2003 and

May 26, 2002 amounted to $2,935 and $3,769, respectively.

We did not accrue for the guarantees, as the likelihood of the

third parties defaulting on the sublease or assignment

agreements was less than probable. In the event of default by a

third party, the indemnity and/or default clauses in our sublease

and assignment agreements govern our ability to recover from

and pursue the third party for damages incurred as a result of its

default. We do not hold any third-party assets as collateral

related to these sublease or assignment agreements, except to

the extent that the sublease or assignment allows us to repossess

the building and personal property. These guarantees expire

over their respective lease terms, which range from fiscal 2004

through fiscal 2012.

We are involved in litigation arising from the normal course

of business. In our opinion, this litigation is not expected to

materially impact our consolidated financial statements.

Darden Restaurants

Notes To Consolidated Financial Statements