Red Lobster 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 DARDEN RESTAURANTS

Darden Restaurants

Report of Management Responsibilities Independent AuditorsÕ Report

The management of Darden Restaurants, Inc. is responsible for

the fairness and accuracy of the consolidated financial statements.

The consolidated financial statements have been prepared in

accordance with accounting principles generally accepted in the

United States of America, using management’s best estimates

and judgments where appropriate. The financial information

throughout this report is consistent with our consolidated

financial statements.

Management has established a system of internal controls

that provides reasonable assurance that assets are adequately safe-

guarded, and transactions are recorded accurately, in all material

respects, in accordance with management’s authorization. We

maintain a strong audit program that independently evaluates

the adequacy and effectiveness of internal controls. Our internal

controls provide for appropriate separation of duties and respon-

sibilities, and there are documented policies regarding utilization

of our assets and proper financial reporting. These formally stated

and regularly communicated policies set high standards of ethical

conduct for all employees.

The Audit Committee of the Board of Directors meets at

least quarterly to determine that management, internal auditors,

and independent auditors are properly discharging their duties

regarding internal control and financial reporting. The independ-

ent auditors, internal auditors, and employees have full and free

access to the Audit Committee at any time.

KPMG LLP, independent certified public accountants,

are retained to audit our consolidated financial statements.

Their report follows.

Joe R. Lee

Chairman of the Board and

Chief Executive Officer

The Board of Directors and Stockholders

Darden Restaurants, Inc.

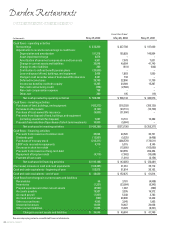

We have audited the accompanying consolidated balance sheets of

Darden Restaurants, Inc. and subsidiaries as of May 25, 2003, and

May 26, 2002, and the related consolidated statements of earn-

ings, changes in stockholders’ equity and accumulated other com-

prehensive income, and cash flows for each of the years in the

three-year period ended May 25, 2003. These consolidated

financial statements are the responsibility of the Company’s

management. Our responsibility is to express an opinion on

these consolidated financial statements based on our audits.

We conducted our audits in accordance with auditing stan-

dards generally accepted in the United States of America. Those

standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements

are free of material misstatement. An audit includes examining,

on a test basis, evidence supporting the amounts and disclosures

in the financial statements. An audit also includes assessing the

accounting principles used and significant estimates made by

management, as well as evaluating the overall financial statement

presentation. We believe that our audits provide a reasonable

basis for our opinion.

In our opinion, the consolidated financial statements

referred to above present fairly, in all material respects, the finan-

cial position of Darden Restaurants, Inc. and subsidiaries as of

May 25, 2003, and May 26, 2002, and the results of their opera-

tions and their cash flows for each of the years in the three-year

period ended May 25, 2003, in conformity with accounting

principles generally accepted in the United States of America.

Orlando, Florida

June 17, 2003