Red Lobster 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

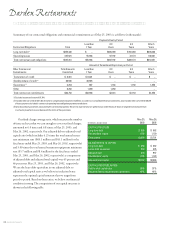

20 DARDEN RESTAURANTS

Net earnings and diluted net earnings per share for fiscal 2002

increased 20.7 percent and 22.6 percent, respectively, compared to

fiscal 2001. The increase in both net earnings and diluted net earn-

ings per share was primarily due to increases in sales at both Red

Lobster and Olive Garden and decreases in food and beverage costs

and restaurant labor as a percent of sales. Diluted net earnings per

share also reflected a reduction in the average diluted shares

outstanding due to our share repurchase activities.

Seasonality

Our sales volumes fluctuate seasonally. During fiscal 2003, 2002,

and 2001, our sales were highest in the spring, lowest in the fall,

and comparable during winter and summer. Holidays, severe

weather, storms, and similar conditions may impact sales volumes

seasonally in some operating regions. Because of the seasonality of

our business, results for any quarter are not necessarily indicative of

the results that may be achieved for the full fiscal year.

Impact of Inflation

We do not believe inflation had a significant overall effect on our

operations during fiscal 2003, 2002, and 2001. We believe we

have historically been able to pass on increased operating costs

through menu price increases and other strategies.

Critical Accounting Policies

We prepare our consolidated financial statements in conformity

with accounting principles generally accepted in the United States

of America. The preparation of these financial statements requires

us to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements, and the

reported amounts of revenues and expenses during the reporting

period (see Note 1 to our consolidated financial statements). Actual

results could differ from those estimates.

Critical accounting policies are those we believe are both

most important to the portrayal of our financial condition and

operating results, and require our most difficult, subjective or

complex judgments, often as a result of the need to make

estimates about the effect of matters that are inherently uncer-

tain. Judgments and uncertainties affecting the application of

those policies may result in materially different amounts being

reported under different conditions or using different assump-

tions. We consider the following policies to be most critical in

understanding the judgments that are involved in preparing our

consolidated financial statements.

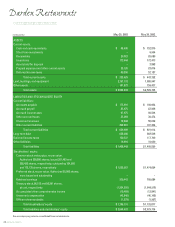

Land, Buildings, and Equipment

Land, buildings, and equipment are recorded at cost, less accumu-

lated depreciation. Building components are depreciated over

estimated useful lives ranging from seven to 40 years using the

straight-line method. Leasehold improvements, which are a com-

ponent of buildings, are amortized over the lesser of the lease term

or the estimated useful lives of the related assets using the straight-

line method. Equipment is depreciated over estimated useful

lives ranging from three to ten years also using the straight-line

method. Accelerated depreciation methods are generally used for

income tax purposes.

Our accounting policies regarding land, buildings, and equip-

ment, including leasehold improvements, include our judgments

regarding the estimated useful lives of these assets, the residual values

to which the assets are depreciated or amortized, and the determina-

tion as to what constitutes enhancing the value of, or increasing the

life of, existing assets. These judgments and estimates may produce

materially different amounts of reported depreciation and amortiza-

tion expense if different assumptions were used. As discussed further

below, these judgments may also impact our need to recognize an

impairment charge on the carrying amount of these assets as the cash

flows associated with the assets are realized.

Impairment of Long-Lived Assets

Land, buildings, and equipment and certain other assets, includ-

ing capitalized software costs and liquor licenses, are reviewed for

impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset may not be recover-

able. Recoverability of assets to be held and used is measured by a

comparison of the carrying amount of the assets to the future net

cash flows expected to be generated by the assets. If these assets

are determined to be impaired, the impairment to be recognized

is measured by the amount by which the carrying amount of the

assets exceeds their fair value. Fair value is generally determined

based on appraisals or sales prices of comparable assets.

Restaurant sites and certain other assets to be disposed of are

reported at the lower of their carrying amount or fair value, less

estimated costs to sell. Restaurant sites and certain other assets to

be disposed of are included in assets held for disposal when certain

criteria are met. These criteria include the requirement that the

likelihood of disposing of these assets within one year is probable.

Those assets whose disposal is not probable within one year

remain in land, buildings, and equipment until their disposal is

probable within one year.

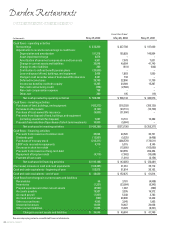

Darden Restaurants

ManagementÕs Discussion and Analysis of Financial Condition and Results of Operations