Red Lobster 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 ANNUAL REPORT 29

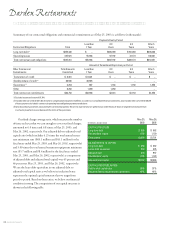

Financial Review 2003

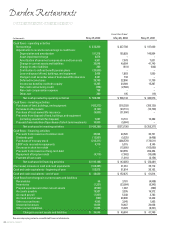

Consolidated Statements of Changes in StockholdersÕ Equity

and Accumulated Other Comprehensive Income

Common Accumulated

Stock Other Officer Total

and Retained Treasury Comprehensive Unearned Notes Stockholders’

(In thousands, except per share data)

Surplus Earnings Stock Income Compensation Receivable Equity

Balance at May 28, 2000 $1,351,707 $344,579 $ (666,837) $(12,457) $(56,522) $(1,868) $ 958,602

Comprehensive income:

Net earnings – 197,000 – – – – 197,000

Other comprehensive income, foreign

currency adjustment – – – (645) – – (645)

Total comprehensive income 196,355

Cash dividends declared ($0.053 per share) – (9,458) – – – – (9,458)

Stock option exercises (4,670 shares) 33,158 – – – – – 33,158

Issuance of restricted stock (443 shares),

net of forfeiture adjustments 3,986 – 1,035 – (5,109) – (88)

Earned compensation – – – – 4,164 – 4,164

ESOP note receivable repayments – – – – 8,145 – 8,145

Income tax benefits credited to equity 15,287 – – – – – 15,287

Purchases of common stock for treasury (12,660 shares) – – (176,511) – – – (176,511)

Issuance of treasury stock under Employee Stock

Purchase Plan and other plans (336 shares) 1,661 – 2,059 – – – 3,720

Issuance of officer notes, net – – – – – (56) (56)

Balance at May 27, 2001 $1,405,799 $532,121 $ (840,254) $(13,102) $(49,322) $(1,924) $1,033,318

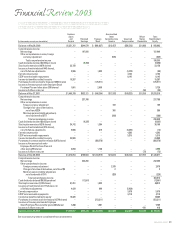

Comprehensive income:

Net earnings – 237,788 – – – – 237,788

Other comprehensive income:

Foreign currency adjustment – – – 169 – – 169

Change in fair value of derivatives,

net of tax of $234 – – – 380 – – 380

Minimum pension liability adjustment,

net of tax benefit of $177 – – – (288) – – (288)

Total comprehensive income 238,049

Cash dividends declared ($0.053 per share) – (9,225) – – – – (9,225)

Stock option exercises (4,310 shares) 34,742 – 1,364 – – – 36,106

Issuance of restricted stock (374 shares),

net of forfeiture adjustments 5,666 – 815 – (6,493) – (12)

Earned compensation – – – – 4,392 – 4,392

ESOP note receivable repayments – – – – 5,315 – 5,315

Income tax benefits credited to equity 24,989 – – – – – 24,989

Purchases of common stock for treasury (8,972 shares) – – (208,578) – – – (208,578)

Issuance of treasury stock under

Employee Stock Purchase Plan and

other plans (290 shares) 2,858 – 1,738 – – – 4,596

Issuance of officer notes, net – – – – – (73) (73)

Balance at May 26, 2002 $1,474,054 $760,684 $(1,044,915) $(12,841) $(46,108) $(1,997) $1,128,877

Comprehensive income:

Net earnings – 232,260 – – – – 232,260

Other comprehensive income:

Foreign currency adjustment – – – 2,579 – – 2,579

Change in fair value of derivatives, net of tax of $0 – – – 2 – – 2

Minimum pension liability adjustment,

net of tax benefit of $141 –

––

(229) – – (229)

Total comprehensive income 234,612

Cash dividends declared ($0.080 per share) – (13,501) – – – – (13,501)

Stock option exercises (3,133 shares) 27,261 – 1,652 – – – 28,913

Issuance of restricted stock (177 shares), net

of forfeiture adjustments 4,429 – 600 – (5,029) – –

Earned compensation – – – – 3,579 – 3,579

ESOP note receivable repayments – – – – 4,710 – 4,710

Income tax benefits credited to equity 16,385 – – – – – 16,385

Purchases of common stock for treasury (10,746 shares) – – (213,311)

––

– (213,311)

Issuance of treasury stock under Employee

Stock Purchase Plan and other plans (280 shares) 3,828 – 1,681 – – – 5,509

Issuance of officer notes, net – – – – – 418 418

Balance at May 25, 2003 $1,525,957 $979,443 $(1,254,293) $(10,489) $(42,848) $(1,579) $1,196,191

See accompanying notes to consolidated financial statements.