Red Lobster 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

Table of contents

-

Page 1

-

Page 2

... casual test restaurant, all developed internally. Darden employs more than 140,000 individuals and is based in Orlando, Florida. The Company trades on the New York Stock Exchange under the symbol DRI.

2003 Financial Highlights

(In millions, except per share amounts)

Darden Restaurants Fiscal Year...

-

Page 3

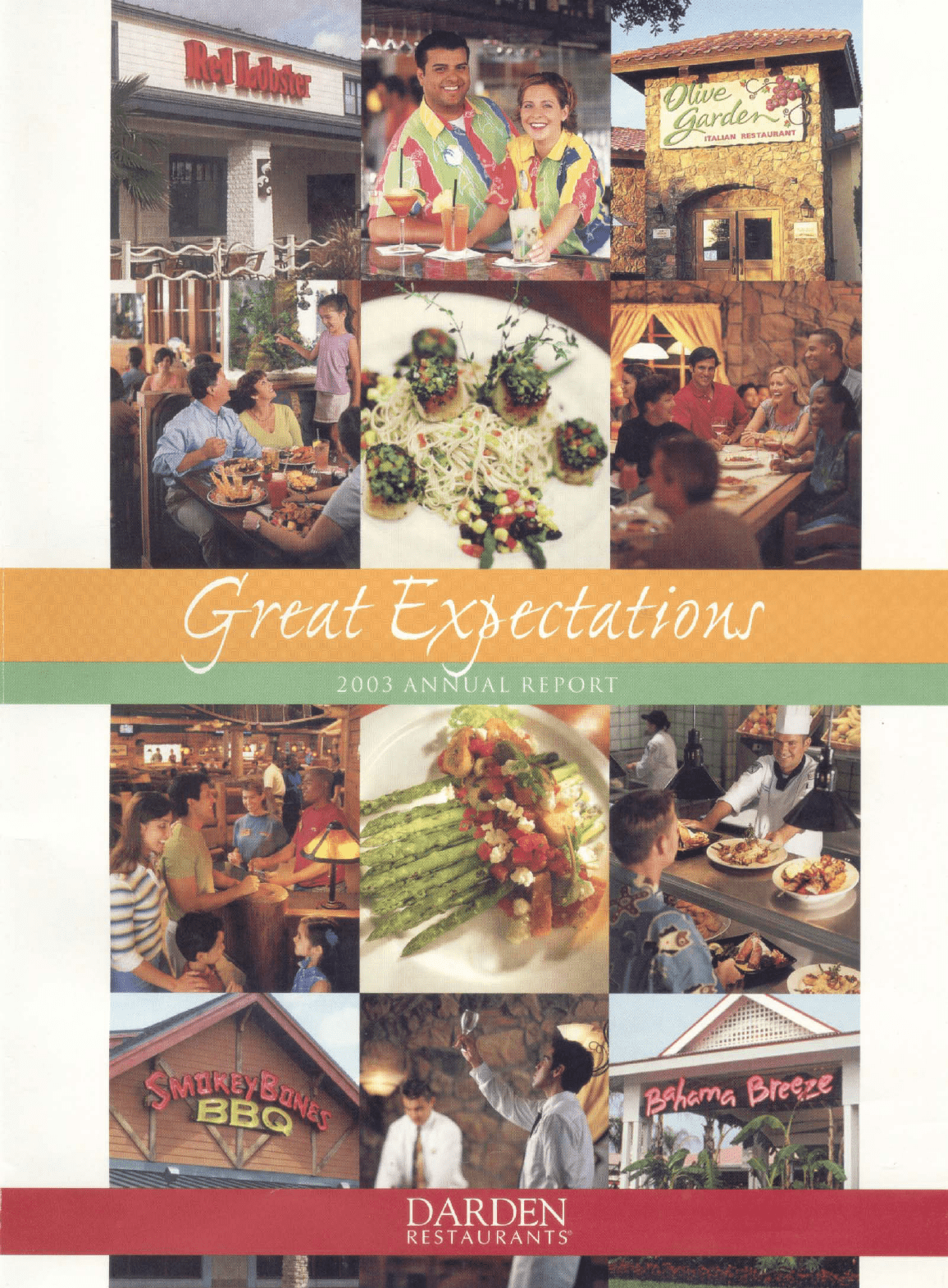

Great Expectations

Every time guests walk through our doors, we aspire to greatness...

-

Page 4

-

Page 5

-

Page 6

-

Page 7

-

Page 8

-

Page 9

-

Page 10

... industry-leading shareholder value. Still, the Company was able to deliver financial improvement in a number of areas. • Sales increased 6.6% to $4.65 billion due primarily to continued same-restaurant sales growth at Red Lobster and Olive Garden and accelerated new restaurant growth across the...

-

Page 11

... 2003, Darden opened Seasons 52, a new test restaurant, in Orlando, Florida. Seasons 52 is a casually sophisticated fresh grill and wine bar. It has seasonally inspired menus offering fresh ingredients to create great tasting, nutritionally balanced meals lower in calories than comparable restaurant...

-

Page 12

... restaurant support and in-restaurant processes so they are more effective and less costly. To better manage and prioritize the many technology-driven process improvement opportunities before us, in fiscal 2003 we established three cross-company process councils focused on human resources, culinary...

-

Page 13

... Red Lobster. • Continue to grow sales and earnings at Olive Garden. • PrepareBahama Breeze for future growth. • Sustain excellence at Smokey Bones and expand aggressively. • Continue our test of Seasons 52 and research new concepts. • Use process improvement as a platform to balance cost...

-

Page 14

... result has been greater guest satisfaction, as evidenced by improved Guest Satisfaction Survey ratings. • Communicating and living Share the Love™, our powerful message to consumers that captures the opportunity to enjoy the food they love with people they love at Red Lobster, while being cared...

-

Page 15

...new high of $1.99 billion, up 6.8 percent year-over-year, while average annual sales per restaurant were $3.9 million. Record financial performance reflects being brilliant with the basics in all areas, including: compelling marketing that communicates "when you're here, you're family;" well-planned...

-

Page 16

... peak hours. Here, too, we saw immediate results, with a nine-point rise in service assessments on the wait and quote time accuracy. The program also has led to improved table management skills and a generally more welcome and hospitable experience for guests waiting to be seated. New strategies...

-

Page 17

... performance. Smokey Bones' financial results in fiscal 2003 reflect high levels of customer satisfaction as indicated by a number of measurement tools introduced this year. The Fan Survey is the restaurants' guest satisfaction"shopper" program, and the company has set a minimum score of 90 percent...

-

Page 18

...easy to "birth" a new concept, but it's a critical process to ensure sustained, long-term growth. The New Business team's latest project is Seasons 52 - a casually sophisticated fresh grill and wine bar, operating as a test restaurant in Orlando, Florida. Seasons 52 has been designed as a vehicle to...

-

Page 19

Financial Review 2003

Management's Discussion and Analysis of Financial Condition and Results of Operations Report of Management Responsibilities Independent Auditors' Report Consolidated Statements of Earnings Consolidated Balance Sheets Consolidated Statements of Changes in Stockholders' Equity ...

-

Page 20

... of Financial Condition and Results of Operations

This discussion and analysis should be read in conjunction with our consolidated financial statements and related notes found elsewhere in this report. As of May 25, 2003, Darden Restaurants, Inc. operated 1,271 Red Lobster, Olive Garden, Bahama...

-

Page 21

Financial Review 2003

ManagementÕs Discussion and Analysis of Financial Condition and Results of Operations

check and a 3.2 percent increase in guest counts. Average annual sales per restaurant for Olive Garden were $3.9 million in fiscal 2002. Bahama Breeze opened eight new restaurants during ...

-

Page 22

... due to increases in sales at both Red Lobster and Olive Garden and decreases in food and beverage costs and restaurant labor as a percent of sales. Diluted net earnings per share also reflected a reduction in the average diluted shares outstanding due to our share repurchase activities. Seasonality...

-

Page 23

... from operations, we use a combination of long-term and short-term borrowings to fund our capital needs.

We manage our business and our financial ratios to maintain an investment grade bond rating, which allows access to financing at reasonable costs. Currently, our publicly issued long-term debt...

-

Page 24

Darden Restaurants

ManagementÕs Discussion and Analysis of Financial Condition and Results of Operations

A summary of our contractual obligations and commercial commitments as of May 25, 2003, is as follows (in thousands):

Payments Due by Period Contractual Obligations Long-term debt (1) Operating ...

-

Page 25

...decrease earnings before income taxes by less than $0.1 million. If the health care cost trend rates were to be increased or decreased by one percentage point each future year, the aggregate of the service cost and interest cost components of net periodic post-retirement benefit cost would change by...

-

Page 26

...as a result of increases in accounts payable of $16 million and unearned revenues of $16 million. The increase in accounts payable is primarily due to the timing of our inventory purchases at the end of fiscal 2003. The increase in unearned revenues is primarily due to an increase in gift card sales...

-

Page 27

... downturns; demographic trends; our expansion plans, capital expenditures, and business development activities; and our long-term goals of increasing market share, expanding margins on incremental sales, and earnings growth. These forward-looking statements are based on assumptions concerning...

-

Page 28

... of earnings, changes in stockholders' equity and accumulated other comprehensive income, and cash flows for each of the years in the three-year period ended May 25, 2003. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an...

-

Page 29

Financial Review 2003

Consolidated Statements of Earnings

Fiscal Year Ended

(In thousands, except per share data)

May 25, 2003 $ 4,654,971

May 26, 2002 $ 4,366,911

May 27, 2001 $ 3,992,419

Sales Costs and expenses: Cost of sales: Food and beverage Restaurant labor Restaurant expenses Total cost ...

-

Page 30

... stock, 96,513 and 86,291 shares, at cost, respectively Accumulated other comprehensive income Unearned compensation Officer notes receivable Total stockholders' equity Total liabilities and stockholders' equity

See accompanying notes to consolidated financial statements.

28

DARDEN RESTAURANTS...

-

Page 31

...Employee Stock Purchase Plan and other plans (336 shares) 1,661 Issuance of officer notes, net - Balance at May 27, 2001 $1,405,799 Comprehensive income: Net earnings - Other comprehensive income: Foreign currency adjustment - Change in fair value of derivatives, net of tax of $234 - Minimum pension...

-

Page 32

... and loan costs Change in current assets and liabilities Change in other liabilities Contribution to defined benefit pension plans Loss on disposal of land, buildings, and equipment Change in cash surrender value of trust-owned life insurance Deferred income taxes Income tax benefits credited to...

-

Page 33

... compensation plan. The cash surrender value of the policies is included in other assets while changes in cash surrender value are included in selling, general, and administrative expenses.

Liquor Licenses

Inventories are valued at the lower of weighted-average cost or market.

Land, Buildings, and...

-

Page 34

... gift cards and certificates are redeemed, we recognize restaurant sales and reduce the deferred liability.

Income Taxes

We provide for federal and state income taxes currently payable as well as for those deferred because of temporary differences between reporting income and expenses for financial...

-

Page 35

... associated with opening new restaurants are expensed as incurred.

(18,386) $222,097

(15,023) $184,542

Production costs of commercials and programming are charged to operations in the fiscal year the advertising is first aired. The costs of other advertising, promotion, and marketing programs...

-

Page 36

... unrealized portion of changes in the fair value of cash flow hedges, and amounts associated with minimum pension liability adjustments.

Foreign Currency

As of May 25, 2003, we operated 1,271 Red Lobster, Olive Garden, Bahama Breeze, Smokey Bones BBQ and Seasons 52 restaurants in North America...

-

Page 37

.... The transition guidance and annual disclosure provisions of SFAS No.148 are effective for financial statements issued for fiscal years ending after December 15, 2002. The interim disclosure provisions are effective for financial reports containing financial statements for interim periods beginning...

-

Page 38

... costs of buildings and equipment prior to disposal, employee severance costs, lease buy-out provisions, and other costs associated with the restructuring action. All restaurant closings and other activities under this restructuring action were completed as of May 25, 2003. During fiscal 2003...

-

Page 39

... effective annual interest rate is 7.57 percent for the notes and 7.82 percent for the debentures, after consideration of loan costs, issuance discounts, and interest rate swap termination costs. We also maintain a credit facility that expires in October 2004, with a consortium of banks under which...

-

Page 40

Darden Restaurants

Notes to Consolidated Financial Statements

NOTE 7 Derivative Instruments and Hedging Activities

We use interest rate-related derivative instruments to manage our exposure on debt instruments, as well as commodities derivatives to manage our exposure to commodity price fluctuations...

-

Page 41

... the 1998 Stock Purchase/Option Award Loan Program (Loan Program) in conjunction with our Stock Option and Long-Term Incentive Plan of 1995. The Loan Program provided loans to our officers and awarded two options for every new share purchased, up to a maximum total share value equal to a designated...

-

Page 42

Darden Restaurants

Notes to Consolidated Financial Statements

NOTE 10 Leases

An analysis of rent expense incurred under operating leases is as follows:

2003 Restaurant minimum rent $48,121 Restaurant percentage rent 3,682 Restaurant equipment minimum rent 5,719 Restaurant rent averaging expense (663...

-

Page 43

... service and compensation factors, and for a group of hourly employees, in which a fixed level of benefits is provided. Pension plan assets are primarily invested in U.S., international, and private equities; long duration fixed income securities and real assets. Our policy is to fund, at a minimum...

-

Page 44

Darden Restaurants

Notes to Consolidated Financial Statements

The following provides a reconciliation of the changes in the plan benefit obligation, fair value of plan assets, and the funded status of the plans as of February 28, 2003 and 2002:

Defined Benefit Plans (1) 2003 Change in Benefit ...

-

Page 45

... reported for defined benefit pension plans. A quarter percentage point change in the defined benefit plans' discount rate and the expected long-term rate of return on plan assets would increase or decrease earnings before income taxes by $610 and $360, respectively. The assumed health care cost...

-

Page 46

... to non-employee directors. Under all of the plans, stock options are granted at a price equal to the fair value of the shares at the date of grant, for terms not exceeding ten years, and have various vesting periods at the discretion of the Compensation Committee. Outstanding options generally vest...

-

Page 47

...Financial Statements

The per share weighted-average fair value of stock options granted during fiscal 2003, 2002, and 2001 was $9.01, $6.05, and $4.48, respectively. These amounts were determined using the Black Scholes option-pricing model, which values options based on the stock price at the grant...

-

Page 48

... our consolidated financial statements.

NOTE 15 Employee Stock Purchase Plan

We maintain the Darden Restaurants Employee Stock Purchase Plan to provide eligible employees who have completed one year of service (excluding senior officers subject to Section 16(b) of the Securities Exchange Act of...

-

Page 49

...Financial Statements

NOTE 17 Quarterly Data (Unaudited)

The following table summarizes unaudited quarterly data for fiscal 2003 and 2002:

Aug. 25 Sales Earnings before income taxes Net earnings Net earnings per share: Basic Diluted Dividends paid per share Stock price: High Low...2003 ANNUAL REPORT

47

-

Page 50

... Financial Summary

(In thousands, except per share data)

Fiscal Year Ended

May 25, 2003 $ 4,654,971

May 26, 2002 $ 4,366,911

May 27, 2001 $ 3,992,419

May 28, 2000 $3,675,461

May 30, 1999 $ 3,432,375

Operating Results Sales Costs and expenses: Cost of sales: Food and beverage Restaurant labor...

-

Page 51

... employees with the financial resources of our philanthropy program enables us to multiply the efforts of both, creating a powerful engine to drive transformation in our communities. Back in 1968 when Bill Darden, our founder and namesake, opened the first Red Lobster in Lakeland, Florida, corporate...

-

Page 52

Corporate Responsibility

(From Left to Right) • Last Labor Day, Red Lobster and Olive Garden restaurants around the country delivered meals to over 1,100 community agencies and public servants, just to say "thanks!" • myregion.org is helping Orlando, Florida, and the surrounding counties move ...

-

Page 53

... for high-achieving students who have expressed a willingness to return to work for their communities. In fiscal 2003, the Darden Restaurants Foundation supported that goal with financial support for Native American business students interested in careers in culinary science/hospitality programs...

-

Page 54

... Senior Vice President, Purchasing, Distribution and Food Safety Bottom Row, left to right Valerie K. Collins Senior Vice President, Chief Information Officer Daniel M. Lyons Senior Vice President, Human Resources Stephen E. Helsel Senior Vice President, Corporate Controller

52

DARDEN RESTAURANTS

-

Page 55

....com Company Address Darden Restaurants, Inc. 5900 Lake Ellenor Drive Orlando, FL 32809 Phone: (407) 245-4000 Mailing Address Darden Restaurants, Inc. P.O. Box 593330 Orlando, FL 32859-3330

Designed and produced by Corporate Reports Inc./Atlanta www.corporatereport.com

2003 ANNUAL REPORT

53

-

Page 56

®

Darden Restaurants, Inc. 5900 Lake Ellenor Drive Orlando, Florida 32809 (407) 245-4000 www.darden.com