Red Lobster 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

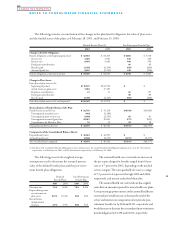

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

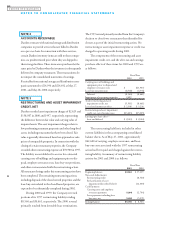

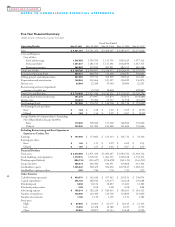

The following provides a reconciliation of the changes in the plan benefit obligation, fair value of plan assets,

and the funded status of the plans as of February 28, 2001, and February 29, 2000:

Defined Benefit Plans (1) Post-Retirement Benefit Plan

2001 2000 2001 2000

Change in Benefit Obligation:

Benefit obligation at the beginning of period $ 82,634 $ 83,205 $ 5,663 $ 5,718

Service cost 3,488 3,091 246 260

Interest cost 6,450 5,683 448 396

Participant contributions 96 89

Benefits paid (3,765) (4,204) (159) (206)

Actuarial (gain) loss 8,532 (5,141) 445 (594)

Benefit obligation at the end of period $ 97,339 $ 82,634 $ 6,739 $ 5,663

Change in Plan Assets:

Fair value of plan assets at the

beginning of period $115,872 $102,550 $$

Actual return on plan assets 7,894 17,495

Employer contributions 41 31 63 117

Participant contributions 96 89

Benefits paid (3,765) (4,204) (159) (206)

Fair value of plan assets at the end of period $120,042 $115,872 $$

Reconciliation of Funded Status of the Plan:

Funded status at end of year $ 22,703 $ 33,238 $(6,739) $(5,663)

Unrecognized transition asset (642) (1,284)

Unrecognized prior service cost (1,849) (2,305) 65 83

Unrecognized actuarial (gain) loss 22,857 10,843 (371) (835)

Contributions for March to May 10 10 28 38

Prepaid (accrued) benefit costs $ 43,079 $ 40,502 $(7,017) $(6,377)

Components of the Consolidated Balance Sheets:

Prepaid benefit costs $ 45,624 $ 42,893 $$

Accrued benefit costs (2,545) (2,391) (7,017) (6,377)

Net asset (liability) recognized $ 43,079 $ 40,502 $(7,017) $(6,377)

(1) For plans with accumulated benefit obligations in excess of plan assets, the accumulated benefit obligation and plan assets were $2,781 and zero,

respectively, as of February 28, 2001, and $2,460 and zero, respectively, as of February 29, 2000.

35

2001

DARDEN RESTAURANTS

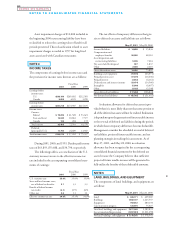

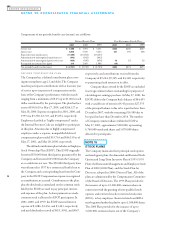

The following presents the weighted-average

assumptions used to determine the actuarial present

value of the defined benefit plans and the post-retire-

ment benefit plan obligations:

Defined Post-Retirement

Benefit Plans Benefit Plan

2001 2000 2001 2000

Discount rate 7.5% 8.0% 7.5% 8.0%

Expected long-term

rate of return on

plan assets 10.4% 10.4% N/A N/A

Rate of future

compensation

increases 4.0% 4.5% N/A N/A

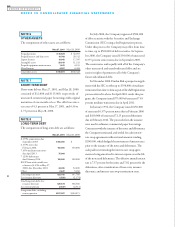

The assumed health care cost trend rate increase in

the per-capita charges for benefits ranged from 6.0 per-

cent to 4.7 percent for 2002, depending on the medical

service category. The rates gradually decrease to a range

of 5.5 percent to 4.6 percent through 2006 and 2004,

respectively, and remain at that level thereafter.

The assumed health care cost trend rate has a signifi-

cant effect on amounts reported for retiree health care plans.

A one-percentage-point variance in the assumed health care

cost trend rate would increase or decrease the total of the

service and interest cost components of net periodic post-

retirement benefit cost by $146 and $111, respectively, and

would increase or decrease the accumulated post-retirement

benefit obligation by $1,298 and $1,036, respectively.