Red Lobster 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

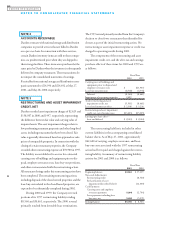

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Asset impairment charges of $12,000 included in

the beginning 2000 restructuring liability have been

reclassified to reduce the carrying value of land for all

periods presented. This reclassification related to asset

impairment charges recorded in 1997 for long-lived

assets associated with Canadian restaurants.

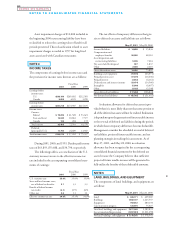

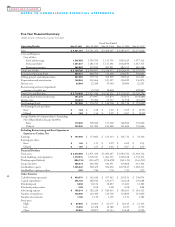

NOTE 4

INCOME TAXES

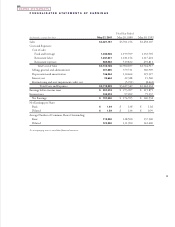

The components of earnings before income taxes and

the provision for income taxes thereon are as follows:

Fiscal Year

2001 2000 1999

Earnings before

income taxes:

U.S. $296,160 $269,802 $212,585

Canada 5,058 4,105 3,290

Earnings before

income taxes $301,218 $273,907 $215,875

Income taxes:

Current:

Federal $ 79,285 $ 61,528 $ 53,621

State and local 13,049 10,861 7,577

Canada 134 204 172

Total current 92,468 72,593 61,370

Deferred

(principally U.S.) 11,750 24,609 13,967

Total income taxes $104,218 $ 97,202 $ 75,337

During 2001, 2000, and 1999, Darden paid income

taxes of $63,893, $53,688, and $34,790, respectively.

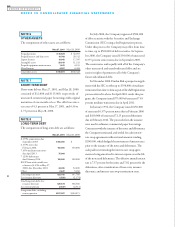

The following table is a reconciliation of the U.S.

statutory income tax rate to the effective income tax

rate included in the accompanying consolidated state-

ments of earnings:

Fiscal Year

2001 2000 1999

U.S. statutory rate 35.0% 35.0% 35.0%

State and local income taxes,

net of federal tax benefits 3.1 3.3 3.3

Benefit of federal income

tax credits (4.1) (3.9) (4.5)

Other, net 0.6 1.1 1.1

Effective income tax rate 34.6% 35.5% 34.9%

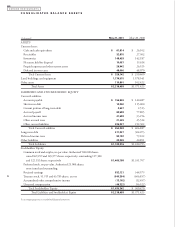

The tax effects of temporary differences that give

rise to deferred tax assets and liabilities are as follows:

May 27, 2001 May 28, 2000

Accrued liabilities $ 14,899 $ 15,836

Compensation and

employee benefits 50,902 48,310

Asset disposition and

restructuring liabilities 5,306 7,616

Net assets held for disposal 937 1,837

Other 2,436 2,210

Gross deferred tax assets 74,480 75,809

Buildings and equipment (73,578) (64,071)

Prepaid pension asset (17,376) (16,406)

Prepaid interest (3,812) (4,161)

Deferred rent and interest income (13,474) (14,560)

Intangibles (5,840) (4,497)

Other (3,182) (3,146)

Gross deferred tax liabilities (117,262) (106,841)

Net deferred tax liabilities $ (42,782) $ (31,032)

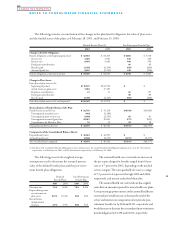

A valuation allowance for deferred tax assets is pro-

vided when it is more likely than not that some portion or

all of the deferred tax assets will not be realized. Realization

is dependent upon the generation of future taxable income

or the reversal of deferred tax liabilities during the periods

in which those temporary differences become deductible.

Management considers the scheduled reversal of deferred

tax liabilities, projected future taxable income, and tax

planning strategies in making this assessment. As of

May 27, 2001, and May 28, 2000, no valuation

allowance has been recognized in the accompanying

consolidated financial statements for the deferred tax

assets because the Company believes that sufficient

projected future taxable income will be generated to

fully utilize the benefits of these deductible amounts.

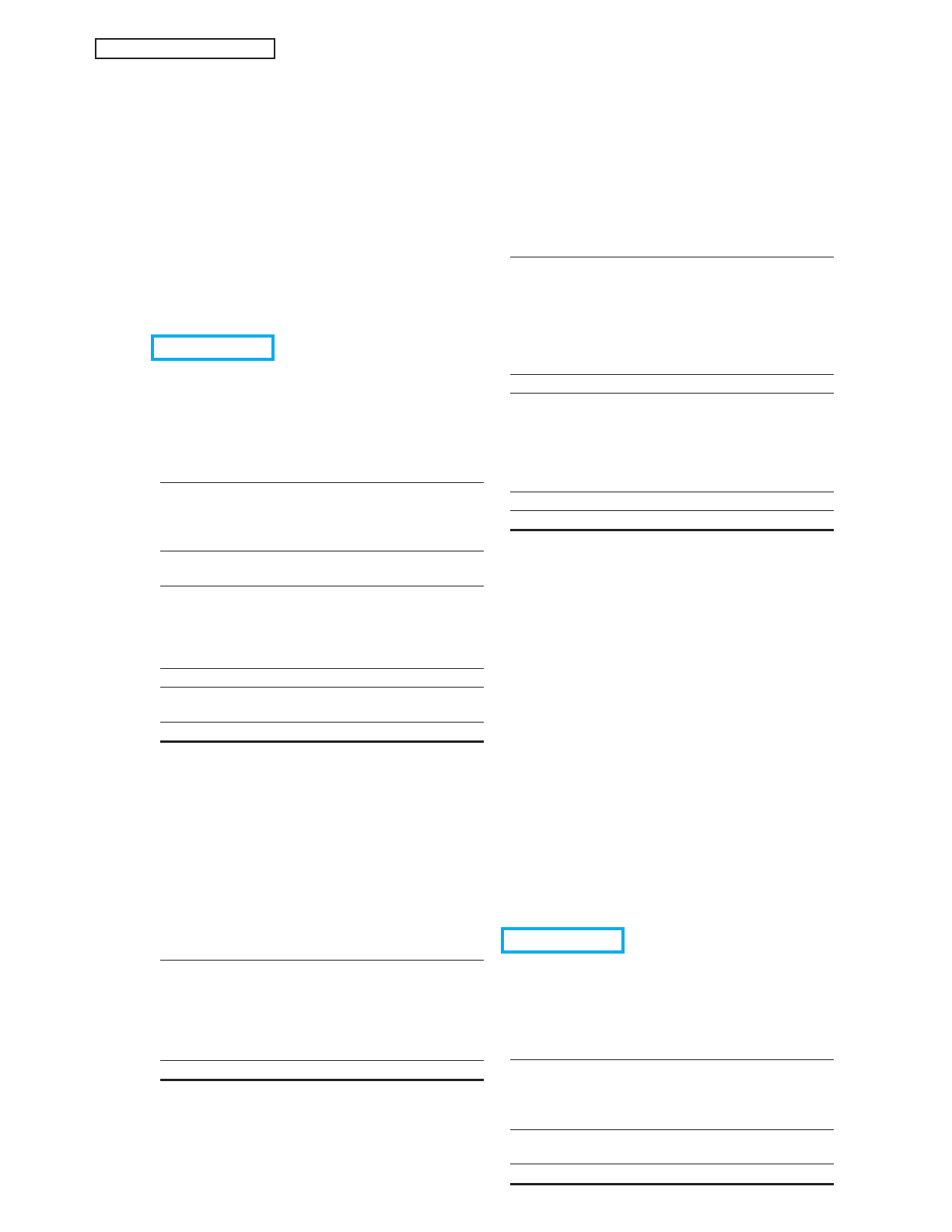

NOTE 5

LAND, BUILDINGS, AND EQUIPMENT

The components of land, buildings, and equipment are

as follows:

May 27, 2001 May 28, 2000

Land $ 426,171 $ 409,069

Buildings 1,562,107 1,425,557

Equipment 759,812 680,178

Construction in progress 128,976 75,027

Total land, buildings, and equipment 2,877,066 2,589,831

Less accumulated depreciation (1,097,551) (1,011,290)

Net land, buildings, and equipment $ 1,779,515 $ 1,578,541

31

2001

DARDEN RESTAURANTS