Red Lobster 2001 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2001 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

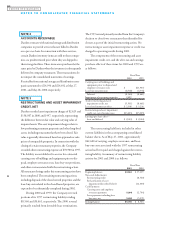

The Company is exposed to a variety of market risks,

including fluctuations in interest rates, foreign currency

exchange rates, and commodity prices. To manage this

exposure, Darden periodically enters into interest rate,

foreign currency exchange, and commodity instruments

for other than trading purposes.

The Company uses the variance/covariance method

to measure value at risk, over time horizons ranging from

one week to one year, at the 95 percent confidence level.

As of May 27, 2001, the Company’s potential losses in future

net earnings resulting from changes in foreign currency

exchange rates, commodity prices, and floating rate debt

interest rate exposures were approximately $1 million over

a period of one year. The Company issued $225 million

of new long-term fixed rate debt during fiscal 2001. The

value at risk from an increase in the fair value of all of the

Company’s long-term fixed rate debt, over a period of one

year, was approximately $40 million. The fair value of the

Company’s long-term fixed rate debt during fiscal 2001

averaged $359 million, with a high of $472 million and

a low of $229 million. The Company’s interest rate risk

management objective is to limit the impact of interest

rate changes on earnings and cash flows by targeting an

appropriate mix of variable and fixed rate debt.

FUTURE APPLICATION OF ACCOUNTING STANDARDS

In June 1998, the Financial Accounting Standards Board

(FASB) issued Statement of Financial Accounting Standards

(SFAS) 133, “Accounting for Derivative Instruments and

Hedging Activities.” SFAS 133 requires that all derivative

instruments be recorded on the balance sheet at fair value.

Gains or losses resulting from changes in the fair values

of those derivatives are recorded each period in current

earnings or other comprehensive income, depending on

whether a derivative is designated as part of a hedge

transaction and the type of hedge transaction. The ineffec-

tive portion of all hedges will be recognized in earnings.

In June 1999, the FASB issued SFAS 137, which deferred

the effective date of adoption of SFAS 133 for one year.

In June 2000, the FASB issued SFAS 138, “Accounting

for Certain Derivative Instruments and Certain Hedging

Activities - an Amendment of FASB Statement No. 133.”

SFAS 138, which amends the accounting and reporting

standards of SFAS 133 for certain derivative instruments

and hedging activities, must be adopted concurrently with

SFAS 133. The Company adopted SFAS 133 and SFAS 138

in the first quarter of fiscal 2002. Adoption of SFAS 133

and SFAS 138 did not materially impact the Company’s

consolidated financial position, results of operations, or

cash flows.

FORWARD-LOOKING STATEMENTS

Certain statements included in this report are forward

looking within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. Words or phrases such

as “believe,” “plan,” “will,” “expect,” “intend,” “is anticipated,”

“estimate,” “project,” and similar expressions are intended

to identify forward-looking statements. All of these state-

ments, and any other statements in this report that are not

historical facts, are forward looking. Examples of forward-

looking statements include, but are not limited to, projec-

tions regarding expected casual dining sales growth; the

ability of the casual dining segment to weather economic

downturns; demographic trends; the Company’s expan-

sion plans and business development activities; and the

Company’s long-term goals of increasing market share,

expanding margins on incremental sales, and growing

earnings 15 percent to 20 percent per year on a compound

annual basis. Forward-looking statements are based on

assumptions concerning important risks and uncertainties

that could significantly affect anticipated results. These

risks and uncertainties include, but are not limited to,

(i) the highly competitive nature of the restaurant industry,

especially pricing, service, location, personnel, and type

and quality of food; (ii) economic, market, and other con-

ditions, including changes in consumer preferences and

demographic trends; (iii) changes in food and other costs

and the general impact of inflation; (iv) the availability of

desirable restaurant locations; (v) government regulations,

including those relating to zoning, land use, environmen-

tal matters, and liquor licenses; and (vi) growth plans,

including real estate development and construction

activities, the issuance and renewal of licenses, and permits

for restaurant development and the availability of funds

to finance growth. If the Company’s projections and

estimates regarding these key factors differ materially from

what actually occurs, the Company’s actual results could

vary significantly from the performance projected in its

forward-looking statements.

21

2001

DARDEN RESTAURANTS