Red Lobster 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 1

SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

PRINCIPLES OF CONSOLIDATION

The accompanying 2001, 2000, and 1999 consolidated

financial statements include the operations of Darden

Restaurants, Inc. and its wholly owned subsidiaries (Darden

or the Company). All significant intercompany balances

and transactions have been eliminated in consolidation.

FISCAL YEAR

Darden’s fiscal year ends on the last Sunday in May. Fiscal

years 2001, 2000, and 1999 each consisted of 52 weeks.

INVENTORIES

Inventories are valued at the lower of weighted average

cost or market.

LAND, BUILDINGS, AND EQUIPMENT

All land, buildings, and equipment are recorded at cost.

Building components are depreciated over estimated

useful lives ranging from seven to 40 years using the

straight-line method. Equipment is depreciated over

estimated useful lives ranging from three to ten years also

using the straight-line method. Accelerated depreciation

methods are generally used for income tax purposes.

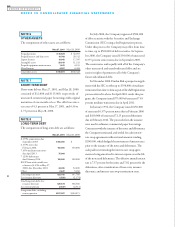

INTANGIBLE ASSETS

The cost of intangible assets at May 27, 2001, and May 28,

2000, amounted to $26,818 and $16,412, respectively.

Intangibles are amortized using the straight-line method

over their estimated useful lives ranging from three to

40 years. Costs capitalized principally represent software

and related development costs and the purchase costs of

leases with favorable rent terms. Accumulated amortiza-

tion on intangible assets as of May 27, 2001, and May 28,

2000, amounted to $6,199 and $5,201, respectively.

IMPAIRMENT OF LONG-LIVED ASSETS

Restaurant sites and certain identifiable intangibles are

reviewed for impairment whenever events or changes in

circumstances indicate that the carrying amount of an

asset may not be recoverable. Recoverability of assets to

be held and used is measured by a comparison of the

carrying amount of an asset to future net cash flows

expected to be generated by the asset. If such assets are

considered to be impaired, the impairment to be recog-

nized is measured by the amount by which the carrying

amount of the assets exceeds their fair value. Restaurant

sites and certain identifiable intangibles to be disposed

of are reported at the lower of their carrying amount or

fair value, less estimated costs to sell.

LIQUOR LICENSES

The costs of obtaining non-transferable liquor licenses

that are directly issued by local government agencies for

nominal fees are expensed in the year incurred. The costs

of purchasing transferable liquor licenses through open

markets in jurisdictions with a limited number of author-

ized liquor licenses are capitalized. If there is permanent

impairment in the value of a liquor license due to market

changes, the asset is written down to its net realizable

value. Annual liquor license renewal fees are expensed.

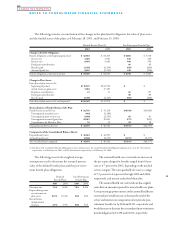

FOREIGN CURRENCY TRANSLATION

The Canadian dollar is the functional currency for

Darden’s Canadian restaurant operations. Assets and lia-

bilities denominated in Canadian dollars are translated

into U.S. dollars using the exchange rates in effect at the

balance sheet date. Results of operations are translated

using the average exchange rates prevailing throughout

the period. Translation gains and losses are reported as a

separate component of accumulated other comprehen-

sive income in stockholders’ equity. Gains and losses

from foreign currency transactions are included in the

consolidated statements of earnings for each period.

PRE-OPENING COSTS

Non-capital expenditures associated with opening new

restaurants are expensed as incurred.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollar amounts in thousands, except per share data)

27

2001

DARDEN RESTAURANTS