Red Lobster 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

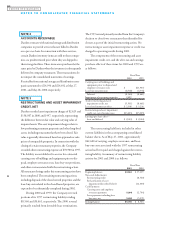

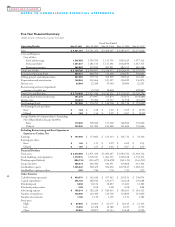

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

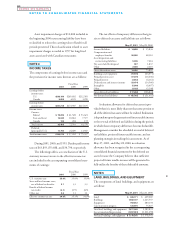

NOTE 6

OTHER ASSETS

The components of other assets are as follows:

May 27, 2001 May 28, 2000

Prepaid pension $ 45,624 $ 42,893

Prepaid interest and loan costs 19,768 20,312

Liquor licenses 18,642 17,599

Intangible assets 20,619 11,211

Prepaid equipment maintenance 1,641 4,103

Miscellaneous 4,507 6,304

Total other assets $110,801 $102,422

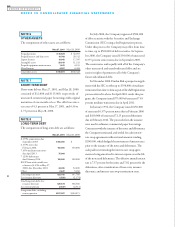

NOTE 7

SHORT-TERM DEBT

Short-term debt at May 27, 2001, and May 28, 2000,

consisted of $12,000 and $115,000, respectively, of

unsecured commercial paper borrowings with original

maturities of one month or less. The debt bore inter-

est rates of 4.3 percent at May 27, 2001, and 6.36 to

6.75 percent at May 28, 2000.

NOTE 8

LONG-TERM DEBT

The components of long-term debt are as follows:

May 27, 2001 May 28, 2000

8.375% senior notes due

September 2005 $150,000 $

6.375% notes due

February 2006 150,000 150,000

7.45% medium-term notes

due April 2011 75,000

7.125% debentures

due February 2016 100,000 100,000

ESOP loan with variable rate

of interest (4.45% at May 27,

2001) due December 2018 44,455 52,600

Other 2,647 5,160

Total long-term debt 522,102 307,760

Less issuance discount (1,528) (1,174)

Total long-term debt, less

issuance discount 520,574 306,586

Less current portion (2,647) (2,513)

Long-term debt, excluding

current portion $517,927 $304,073

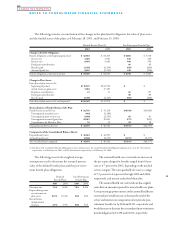

In July 2000, the Company registered $500,000

of debt securities with the Securities and Exchange

Commission (SEC) using a shelf registration process.

Under this process, the Company may offer, from time

to time, up to $500,000 of debt securities. In Septem-

ber 2000, the Company issued $150,000 of unsecured

8.375 percent senior notes due in September 2005.

The senior notes rank equally with all of the Company’s

other unsecured and unsubordinated debt and are

senior in right of payment to all of the Company’s

future subordinated debt.

In November 2000, Darden filed a prospectus supple-

ment with the SEC to offer up to $350,000 of medium-

term notes from time to time as part of the shelf registration

process referred to above. In April 2001, under this pro-

gram, the Company issued $75,000 of unsecured 7.45

percent medium-term notes due in April 2011.

In January 1996, the Company issued $150,000

of unsecured 6.375 percent notes due in February 2006

and $100,000 of unsecured 7.125 percent debentures

due in February 2016. The proceeds from the issuance

were used to refinance commercial paper borrowings.

Concurrent with the issuance of the notes and debentures,

the Company terminated and settled for cash interest-

rate swap agreements with notional amounts totaling

$200,000, which hedged the movement of interest rates

prior to the issuance of the notes and debentures. The

cash paid in terminating the interest-rate swap agree-

ments is being amortized to interest expense over the life

of the notes and debentures. The effective annual interest

rate is 7.57 percent for the notes and 7.82 percent for the

debentures, after consideration of loan costs, issuance

discounts, and interest-rate swap termination costs.

32

2001

DARDEN RESTAURANTS