Pitney Bowes 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27 >

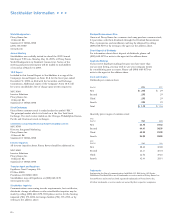

For the year 2002 2001 2000

Revenue $4,409,758 $4,122,474 $3,880,868

EBIT* $1,011,781 $996,902 $1,013,892

Income from continuing operations* $572,011 $556,274 $562,325

Diluted earnings per share from continuing operations* $2.37 $2.25 $2.17

Free cash flow* $681,964 $646,610 $570,781

EBIT to interest* 5.6x 5.4x 5.3x

Cash dividends per common share $1.18 $1.16 $1.14

Average common and potential common shares outstanding 241,483,539 247,615,560 258,602,218

Total employees 33,130 32,724 28,542

Summary of Selected Financial Data ∏ ∏ ∏

Dollars in thousands, except per share amounts

*Excludes special items as discussed in our Form 10-K for the year ended December 31, 2002.

Free cash flow is defined as net cash provided by operating activities, less net investments in fixed assets.

Free cash flow and earnings before interest and taxes (EBIT) are not presented as an alternative measure of operating results or cash flow from operations,

as determined in accordance with generally accepted accounting principles, but are presented because we believe they are widely accepted indicators of

our ability to incur and service debt. EBIT does not give effect to cash used for debt service requirements and capital expenditures and thus do not

reflect funds available for reinvestment, dividends or other discretionary uses. In addition, free cash flow and EBIT as presented in this summary schedule

may not be comparable to similarly titled measures reported by other companies.