Pfizer 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 Financial Report 53

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

All derivative contracts used to manage interest rate risk are

measured at fair value and reported as assets or liabilities on the

balance sheet. Changes in fair value are reported in earnings or

deferred, depending on the nature and effectiveness of the

offset or hedging relationship, as follows:

•We recognize the earnings impact of interest rate swaps

designated as fair value hedges in Other (income)/deductions—

net upon the recognition of the change in fair value for interest

rate risk related to the hedged items.

•We recognize the earnings impact of interest rate swaps

designated as cash flow hedges in Other (income)/deductions—

net upon the recognition of the interest related to the hedged

items.

Any ineffectiveness in a hedging relationship is recognized

immediately into earnings. There was no significant ineffectiveness

in 2005, 2004 or 2003.

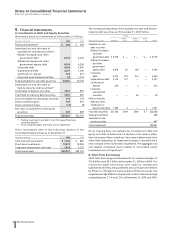

E. Fair Value

The following methods and assumptions were used to estimate

the fair value of derivative and other financial instruments at the

balance sheet date:

•short-term financial instruments (cash equivalents, accounts

receivable and payable, held-to-maturity debt securities and

debt)—we use cost or contract value because of the short

maturity period

•available-for-sale debt securities—we use a valuation model that

uses observable market quotes and credit ratings of the

securities

•available-for-sale equity securities—we use observable market

quotes

•derivative contracts—we use valuation models that use

observable market quotes and our view of the creditworthiness

of the derivative counterparty

•loans—we use cost because of the short interest-reset period

•held-to-maturity long-term investments and long-term debt—

we use valuation models that use observable market quotes

The differences between the estimated fair values and

carrying values of our financial instruments were not significant

at December 31, 2005 and 2004.

F. Credit Risk

On an ongoing basis, we review the creditworthiness of

counterparties to foreign exchange and interest rate agreements

and do not expect to incur a loss from failure of any counterparties

to perform under the agreements.

There are no significant concentrations of credit risk related to our

financial instruments with any individual counterparty. At

December 31, 2005, we had $3.2 billion due from a broad group

of banks around the world.

In general, there is no requirement for collateral from customers.

However, derivative financial instruments are executed under

master netting agreements with financial institutions. These

agreements contain provisions that provide for the ability for

collateral payments, depending on levels of exposure and the

credit rating of the counterparty and us.

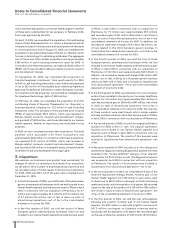

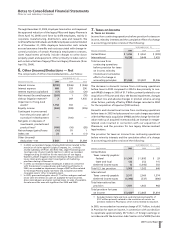

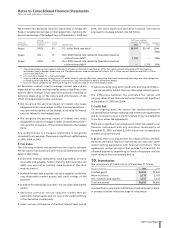

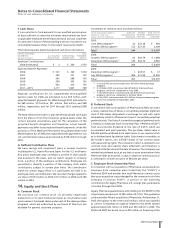

10. Inventories

The components of inventories as of December 31 follow:

(MILLIONS OF DOLLARS) 2005 2004

Finished goods $2,303 $2,643

Work-in-process 2,379 2,703

Raw materials and supplies 1,357 1,314

Total inventories $6,039 $6,660

A reclassification was made in 2004 from Finished Goods to Work-

in-process to better reflect the stage of completion.

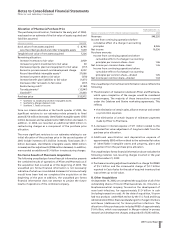

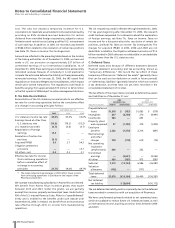

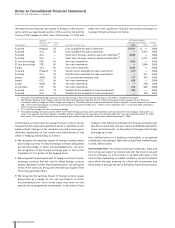

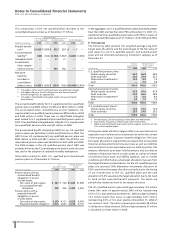

PRIMARY NOTIONAL AMOUNT

FINANCIAL BALANCE SHEET HEDGE (MILLIONS OF DOLLARS) MATURITY

______________________________

INSTRUMENT CAPTION(a) TYPE(b) HEDGED ITEM 2005 2004 DATE

Swaps ONCL FV U.S. dollar fixed rate debt(c) $5,141 $5,147 2006-

2028

Swaps OCL CF Yen LIBOR interest rate related to forecasted issuances

of short-term debt(d) 1,182 —2006

Swaps ONCL CF Yen LIBOR interest rate related to forecasted issuances

of short-term debt(d) —1,353 2006

(a) The primary balance sheet caption indicates the financial statement classification of the fair value amount associated with the financial

instrument used to hedge interest rate risk. The abbreviations used are defined as follows: OCL = Other current liabilities and ONCL = Other

noncurrent liabilities.

(b) CF = Cash flow hedge; FV = Fair value hedge.

(c) Serve to reduce exposure to long-term U.S. dollar interest rates by effectively converting fixed rates associated with long-term debt obligations

to floating rates (see Note 9C, Financial Instruments: Long-Term Debt for details of maturity dates).

(d) Serve to reduce variability by effectively fixing the maximum rates on short-term debt at 0.8%.

We entered into derivative financial instruments to hedge the

fixed or variable interest rates on the hedged item, matching the

amount and timing of the hedged item. At December 31, 2005 and

2004, the more significant derivative financial instruments

employed to manage interest rate risk follow: