Pfizer 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 2005 Financial Report

Financial Review

Pfizer Inc and Subsidiary Companies

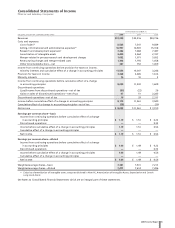

Adjusted income as shown above excludes the following items:

YEAR ENDED DEC. 31,

_______________________________________________________________

(MILLIONS OF DOLLARS) 2005 2004 2003

Purchase accounting adjustments, pre-tax:

In-process research and development charges(a) $1,652 $1,071 $ 5,052

Intangible amortization and other(b) 3,295 3,285 2,336

Sale of acquired inventory written up to fair value(c) 440 2,747

Total purchase accounting adjustments, pre-tax 4,951 4,396 10,135

Income taxes (978) (1,007) (1,469)

Total purchase accounting adjustments—net of tax 3,973 3,389 8,666

Merger-related costs, pre-tax:

Integration costs(d) 550 496 871

Restructuring costs(d) 393 697 187

Total merger-related costs, pre-tax 943 1,193 1,058

Income taxes (319) (407) (399)

Total merger-related costs—net of tax 624 786 659

Discontinued operations, pre-tax:

Loss/(income) from discontinued operations(e) 33 39 (43)

Gains on sales of discontinued operations(e) (77) (75) (3,885)

Total discontinued operations, pre-tax (44) (36) (3,928)

Income taxes 28 71,617

Total discontinued operations—net of tax (16) (29) (2,311)

Cumulative effect of a change in accounting principles—net of tax 25 —30

Certain significant items, pre-tax:

Asset impairment charges(f) 1,240 702 —

Restructuring charges—Adapting to Scale(d) 450 ——

Implementation costs—Adapting to Scale(g) 330 ——

Gain on disposals of investments(h) (134) ——

Litigation-related charges(h) —369 1,402

Contingent income earned from the prior year sale of a product-in-development(h) —(100) —

Operating results of divested legacy Pharmacia research facility(i) —64 —

Total certain significant items, pre-tax 1,886 1,035 1,402

Income taxes (654) (406) (44)

Resolution of certain tax positions(j) (586) ——

Tax impact of the repatriation of foreign earnings(j) 1,664 ——

Total certain significant items—net of tax 2,310 629 1,358

Total purchase accounting adjustments, merger-related costs, discontinued

operations, cumulative effect of a change in

accounting principles and certain significant items—net of tax $6,916 $4,775 $ 8,402

(a) Included in Merger-related in-process research and development charges. (See Notes to Consolidated Financial Statements—Note 2,

Acquisitions.)

(b) Included primarily in Amortization of intangible assets. (See Notes to Consolidated Financial Statements—Note 12, Goodwill and Other

Intangible Assets.)

(c) Included in Cost of sales. (See Notes to Consolidated Financial Statements—Note 2, Acquisitions.)

(d) Included in Restructuring charges and merger-related costs. (See Notes to Consolidated Financial Statements—Note 4, Adapting to Scale

Initiative and Note 5, Merger-Related Costs.)

(e) Included in Discontinued operations—net of tax. (See Notes to Consolidated Financial Statements—Note 3, Dispositions.)

(f) In 2005, primarily Cost of sales ($73 million), Selling, informational and administrative expenses ($8 million) and Other (income)/deductions—

net ($1.2 billion) related to the suspension of sales of Bextra. In 2004, primarily Other (income)/deductions—net related to an impairment

charge related to the Depo-Provera brand. (See Notes to Consolidated Financial Statements—Note 12B, Goodwill and Other Intangible Assets:

Other Intangible Assets.)

(g) Included in Cost of Sales ($124 million), Selling, informational and administrative expenses ($156 million), and Research and development

expenses ($50 million) for 2005. (See Notes to Consolidated Financial Statements—Note 4, Adapting to Scale Initiative.)

(h) Included in Other (income)/deductions—net. (See Notes to Consolidated Financial Statements—Note 6, Other (Income)/Deductions—Net.)

(i) Included in Research and development expenses.

(j) Included in Provision for taxes on income. (See Notes to Consolidated Financial Statements—Note 7, Taxes on Income.)