Pfizer 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 2005 Financial Report

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

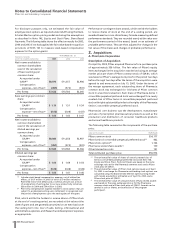

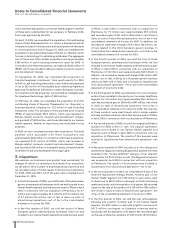

For disclosure purposes only, we estimated the fair value of

employee stock options, as required under GAAP, using the Black-

Scholes-Merton option-pricing model and using the assumptions

as described in Note 14E, Equity and Stock Plans: Share-Based

Payments. The following table shows the effect on results for 2005,

2004 and 2003 if we had applied the fair-value-based recognition

provisions of SFAS 123 to measure stock-based compensation

expense for the option grants:

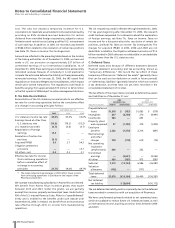

(MILLIONS OF DOLLARS, YEAR ENDED DEC. 31,

_____________________________________________________

EXCEPT PER COMMON SHARE DATA) 2005 2004 2003

Net income available to

common shareholders

used in the calculation

of basic earnings per

common share:

As reported under

GAAP(a) $8,079 $11,357 $3,906

Compensation

expense—net of tax(b) (457) (574) (541)

Pro forma $7,622 $10,783 $3,365

Basic earnings per common

share:

As reported under

GAAP(a) $1.10 $1.51 $ 0.54

Compensation

expense—net of tax(b) (0.06) (0.08) (0.07)

Pro forma $1.04 $1.43 $ 0.47

Net income available to

common shareholders

used in the calculation of

diluted earnings per

common share:

As reported under

GAAP(a) $8,080 $11,356 $3,907

Compensation

expense—net of tax(b) (457)(574) (541)

Pro forma $7,623 $10,782 $3,366

Diluted earnings per

common share:

As reported under

GAAP(a) $1.09 $1.49 $ 0.54

Compensation

expense—net of tax(b) (0.06)(0.08) (0.08)

Pro forma $1.03 $1.41 $ 0.46

(a) Includes stock-based compensation expense, net of related tax

effects, of $107 million in 2005 (of which $70 million related to

Restricted Stock Units (RSUs) and a nominal amount was a result

of acceleration of vesting due to our new productivity initiative),

$38 million in 2004 and $34 million in 2003.

(b) Pro forma compensation expense related to stock options that are

subject to accelerated vesting upon retirement is recognized over

the period of employment up to the vesting date of the grant.

RSUs, which entitle the holders to receive shares of Pfizer stock

at the end of a vesting period, are recorded at fair value at the

date of grant and are generally amortized on an even basis over

the vesting term into Cost of sales, Selling, informational and

administrative expenses, and Research and development expenses,

as appropriate.

Performance-contingent share awards, which entitle the holders

to receive shares of stock at the end of a vesting period, are

awarded based on a non-discretionary formula measuring defined

performance standards. They are recorded evenly at fair value over

the performance period of the award, based on an estimate of

probable performance. They are then adjusted for changes in the

fair value of the shares and changes in probable performance.

2. Acquisitions

A. Pharmacia Corporation

Description of Acquisition

On April 16, 2003, Pfizer acquired Pharmacia for a purchase price

of approximately $56 billion. The fair value of Pfizer’s equity

items exchanged in the acquisition was derived using an average

market price per share of Pfizer common stock of $29.81, which

was based on Pfizer’s average stock price for the period two days

before through two days after the terms of the acquisition were

agreed to and announced on July 15, 2002. Under the terms of

the merger agreement, each outstanding share of Pharmacia

common stock was exchanged for 1.4 shares of Pfizer common

stock in a tax-free transaction. Each share of Pharmacia Series C

convertible perpetual preferred stock was exchanged for a newly

created class of Pfizer Series A convertible perpetual preferred

stock with rights substantially similar to the rights of the Pharmacia

Series C convertible perpetual preferred stock.

Pharmacia’s core business was the development, manufacture

and sale of prescription pharmaceutical products as well as the

production and distribution of consumer healthcare products

and animal healthcare products.

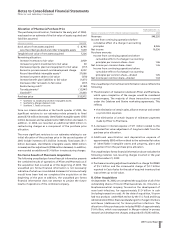

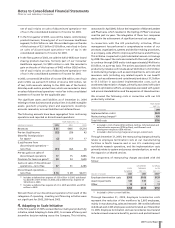

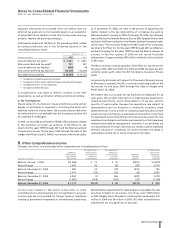

The following table summarizes the components of the purchase

price:

(MILLIONS OF DOLLARS) FAIR VALUE

Pfizer common stock $54,177

Pfizer Series A convertible perpetual preferred stock(a) 462

Pfizer stock options(b) 1,102

Pharmacia vested share awards(c) 130

Other transaction costs 101

Total estimated purchase price $55,972

(a) The estimated fair value of shares of a newly created class of

Series A convertible perpetual preferred stock (see Note 14B,

Equity and Stock Plans: Preferred Stock) was based on the same

exchange ratio as for the Pharmacia common stock and a Pfizer

stock price of $29.81.

(b) The estimated fair value of Pfizer stock options issued as of April

16, 2003 in exchange for Pharmacia outstanding stock options was

calculated using the Black-Scholes-Merton option pricing model

with model assumptions estimated as of April 16, 2003, and a

Pfizer stock price of $29.81.

(c) The estimated fair value of unissued shares of fully vested awards

was based on the same exchange ratio as for the Pharmacia

common stock and a Pfizer stock price of $29.81. Awards can be

settled in cash or shares, at the election of the program

participant.