Pfizer 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 Financial Report 45

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

net of tax) in Gains on sales of discontinued operations—net

of tax in the consolidated statement of income for 2003.

•In the first quarter of 2003, we sold the Adams confectionery

products business, formerly part of our Consumer Healthcare

segment, for $4.2 billion in cash. We recorded a gain on the sale

of this business of $3.1 billion ($1.8 billion, net of tax) in Gains

on sales of discontinued operations—net of tax in the

consolidated statement of income for 2003.

•In the first quarter of 2003, we sold the Schick-Wilkinson Sword

shaving products business, formerly part of our Consumer

Healthcare segment, for $930 million in cash. We recorded a

gain on the sale of this business of $462 million ($262 million,

net of tax) in Gains on sales of discontinued operations—net

of tax in the consolidated statement of income for 2003.

In 2005, we earned $29 million of income ($18 million, net of tax)

and in 2004, we earned $17 million of income ($10 million, net

of tax), both amounts relating to the 2003 sale of the femhrt,

Estrostep and Loestrin product lines, which was recorded in Gains

on sales of discontinued operations—net of tax in the consolidated

statement of income for the applicable year.

The significant assets and liabilities as of December 31, 2004

relating to these businesses and product lines included intangible

assets; goodwill; property, plant and equipment; inventory;

accounts receivable; accrued liabilities and deferred taxes.

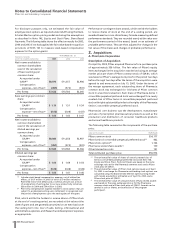

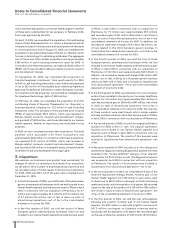

The following amounts have been segregated from continuing

operations and reported as discontinued operations:

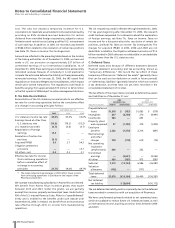

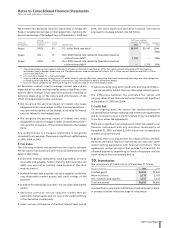

YEAR ENDED DEC. 31,

_________________________________________________

(MILLIONS OF DOLLARS) 2005 2004 2003

Revenues $ 55 $405 $1,214

Pre-tax (loss)/income (33) (39) 43

(Benefit) from/provision

for taxes(a) (2) (17) 17

(Loss)/income from

discontinued operations—

net of tax (31) (22) 26

Pre-tax gains on sales of

discontinued operations 77 75 3,885

Provision for taxes on gains(b) 30 24 1,600

Gains on sales of discontinued

operations—net of tax 47 51 2,285

Discontinued operations—

net of tax $ 16 $29 $2,311

(a) Includes a deferred tax expense of $23 million in 2005, a deferred

tax benefit of $15 million in 2004 and a deferred tax expense of

$8 million in 2003.

(b) Includes a deferred tax expense of nil in 2005 and 2004, and $744

million in 2003.

Net cash flows of our discontinued operations from each of the

categories of operating, investing and financing activities were

not significant for 2005, 2004 and 2003.

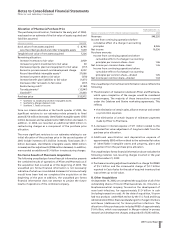

4. Adapting to Scale Initiative

In the first quarter of 2005, we launched our multi-year productivity

initiative, called Adapting to Scale (AtS), to increase efficiency and

streamline decision-making across the Company. This initiative,

announced in April 2005, follows the integration of Warner-Lambert

and Pharmacia, which resulted in the tripling of Pfizer’s revenues

over the past six years. The integration of those two companies

resulted in the achievement of significant annual cost savings.

In connection with the AtS productivity initiative, Pfizer

management has performed a comprehensive review of our

processes, organizations, systems and decision-making procedures,

in a company-wide effort to improve performance and efficiency.

This initiative is expected to yield substantial annual cost savings

by 2008. We expect the costs associated with this multi-year effort

to continue through 2008 and to total approximately $4 billion to

$5 billion, on a pre-tax basis. The actions associated with the AtS

productivity initiative will include about $2.8 billion to $3.5 billion

in restructuring charges, such as asset impairments, exit costs and

severance costs (including any related impacts to our benefit

plans, such as settlements and curtailments) and about $1.2 billion

to $1.5 billion in associated implementation costs, such as

accelerated depreciation charges, primarily associated with plant

network optimization efforts, and expenses associated with system

and process standardization and the expansion of shared services.

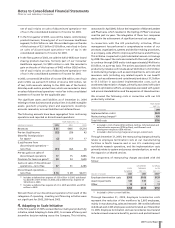

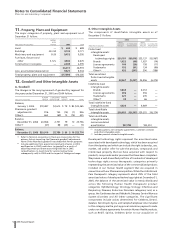

We incurred the following costs in connection with our AtS

productivity initiative:

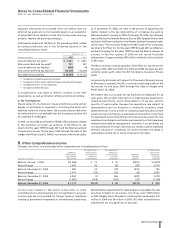

YEAR ENDED

DEC. 31,

______________

(MILLIONS OF DOLLARS) 2005

Implementation costs(a) $330

Restructuring charges(b) 450

Total AtS costs $780

(a) Included in Cost of sales ($124 million), Selling, informational and

administrative expenses ($156 million), and Research and

development expenses ($50 million).

(b) Included in Restructuring charges and merger-related costs.

Through December 31, 2005, the restructuring charges primarily

relate to employee termination costs at our manufacturing

facilities in North America and in our U.S. marketing and

worldwide research operations, and the implementation costs

primarily relate to system and process standardization, as well as

the expansion of shared services.

The components of restructuring charges associated with AtS

follow:

UTILIZATION ACCRUAL

COSTS THROUGH AS OF

INCURRED DEC. 31, DEC. 31,

__________ ___________ ___________

(MILLIONS OF DOLLARS) 2005 2005 2005(a)

Employee termination costs $305 $166 $139

Asset impairments 131 131 —

Other 14 3 11

$450 $300 $150

(a) Included in Other current liabilities.

Through December 31, 2005, Employee termination costs

represent the reduction of the workforce by 2,602 employees,

mainly in manufacturing, sales and research. We notified affected

individuals and 2,425 employees were terminated as of December

31, 2005. Employee termination costs are recorded as incurred and

include accrued severance benefits, pension and postretirement