Pfizer 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 Financial Report 41

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

intangible assets that are associated with a single function and

depreciation of property, plant and equipment are included in Cost

of sales, Selling, informational and administrative expenses and

Research and development expenses, as appropriate.

We review all of our long-lived assets, including goodwill and

other intangible assets, for impairment at least annually and

whenever events or circumstances present an indication of

impairment. When necessary, we record charges for impairments

of long-lived assets for the amount by which the present value of

future cash flows, or some other fair value measure, is less than

the carrying value of these assets.

L. Merger-Related In-Process Research and

Development Charges and Restructuring Charges and

Merger-Related Costs

When recording acquisitions (see Note 1E, Significant Accounting

Polices: Acquisitions), we immediately expense amounts related

to acquired IPR&D in Merger-related in-process research and

development charges.

Also, in connection with an acquisition of a business enterprise,

we may review the associated operations and implement plans to

restructure and integrate. For restructuring charges associated

with a business acquisition that are identified in the first year after

the acquisition date, the related costs are recorded as additional

goodwill as they are considered to be liabilities assumed in the

acquisition. All other restructuring charges, all integration costs

and any charges related to our pre-existing businesses impacted

by the acquisition are included in Restructuring charges and

merger-related costs.

M. Cash Equivalents

Cash equivalents include items almost as liquid as cash, such as

certificates of deposit and time deposits with maturity periods of

three months or less when purchased. If items meeting this

definition are part of a larger investment pool, we classify them

as Short-term investments.

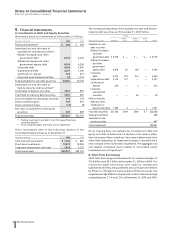

N. Investments

Realized gains or losses on sales of investments are determined

by using the specific identification cost method.

O. Income Tax Contingencies

We account for income tax contingencies using an asset

recognition model. In our initial evaluation of tax positions taken

related to tax law, we assess the likelihood of prevailing on the

interpretation of that tax law. When we consider that a tax

position is probable of being sustained on audit based solely on

the technical merits of the position, we record the benefit. These

assessments can be complex and we often obtain assistance from

external advisors.

Under the asset recognition model, if our initial assessment fails

to result in the recognition of a tax benefit, we regularly monitor

our position and subsequently recognize the tax benefit if there

are changes in tax law or analogous case law that sufficiently raise

the likelihood of prevailing on the technical merits of the position

to probable; if the statute of limitations expires; or if there is a

completion of an audit resulting in a settlement of that tax year

with the appropriate agency.

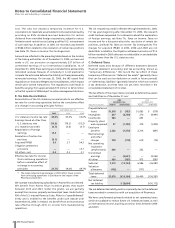

P. Share-Based Payments

Our compensation programs can include share-based payments.

Stock options, which entitle the holder to purchase shares of

Pfizer stock at a pre-determined price at the end of a vesting term,

are accounted for under Accounting Principles Board Opinion No.

25, Accounting for Stock Issued to Employees, an elective

accounting policy permitted by SFAS No. 123, Accounting for

Stock-Based Compensation. Under this policy, since the exercise

price of stock options granted is set equal to the market price on

the date of the grant, we do not record any expense to the

income statement related to the grants of stock options, unless

certain original grant-date terms are subsequently modified.