Pfizer 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 2005 Financial Report

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

Act). The Jobs Act created a temporary incentive for U.S.

corporations to repatriate accumulated income earned abroad by

providing an 85% dividend-received deduction for certain

dividends from controlled foreign corporations, subject to various

limitations and restrictions including qualified U.S. reinvestment

of such earnings. In addition, in 2005, we recorded a tax benefit

of $586 million related to the resolution of certain tax positions

(see Note 7D, Taxes on Income:Tax Contingencies).

Amounts are reflected in the preceding tables based on the location

of the taxing authorities. As of December 31, 2005, we have not

made a U.S. tax provision on approximately $27 billion of

unremitted earnings of our international subsidiaries. As of

December 31, 2005, these earnings are intended to be permanently

reinvested overseas. Because of complexity, it is not practical to

compute the estimated deferred tax liability on these permanently

reinvested earnings. On January 23, 2006, the IRS issued final

regulations on Statutory Mergers and Consolidations, which impact

certain prior period transactions. The regulations could result in

benefits ranging from approximately $75 million to $214 million

in the first quarter of 2006 subject to certain management decisions.

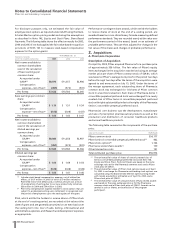

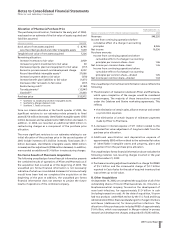

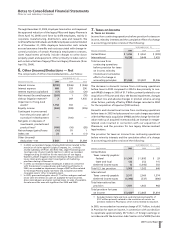

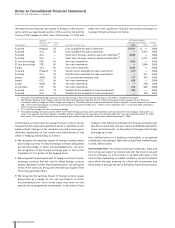

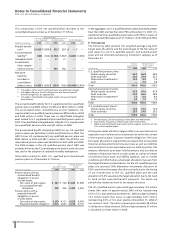

B. Tax Rate Reconciliation

Reconciliation of the U.S. statutory income tax rate to our effective

tax rate for continuing operations before the cumulative effect

of a change in accounting principles follows:

YEAR ENDED DEC. 31,

__________________________________________________

2005 2004 2003(a)

U.S. statutory income tax rate 35.0% 35.0% 35.0%

Earnings taxed at other than

U.S. statutory rate (19.5) (18.3) (53.2)

U.S. research tax credit (0.7) (0.6) (3.1)

Repatriation of foreign

earnings 14.4 ——

Resolution of certain tax

positions (5.1) ——

Acquired IPR&D 5.0 2.7 54.2

Litigation settlement

provisions ——13.7

All other—net 0.6 0.2 3.1

Effective tax rate for income

from continuing operations

before cumulative effect of

a change in accounting

principles 29.7% 19.0% 49.7%

(a) The large component percentages in 2003 reflect lower income

from continuing operations in 2003 due to the impact of the

Pharmacia acquisition.

We operate manufacturing subsidiaries in Puerto Rico and Ireland.

We benefit from Puerto Rican incentive grants that expire

between 2013 and 2023. Under the grants, we are partially

exempt from income, property and municipal taxes. Under Section

936 of the U.S. Internal Revenue Code, Pfizer is a “grandfathered”

entity and is entitled to the benefits under such statute until

September 30, 2006. In Ireland, we benefit from an incentive tax

rate effective through 2010 on income from manufacturing

operations.

The U.S. research tax credit is effective through December 31, 2005.

For tax years beginning after December 31, 2005, the research

credit has been suspended. For a discussion about the repatriation

of foreign earnings, see Note 7A, Taxes on Income:Taxes on

Income and for a discussion about the resolution of certain tax

positions, see Note 7D, Taxes on Income: Tax Contingencies.The

charges for acquired IPR&D in 2005, 2004 and 2003 are not

deductible. In addition, the litigation settlement provisions of $1.4

billion recorded in 2003 either are not deductible or are deductible

at rates lower than the U.S. statutory rate.

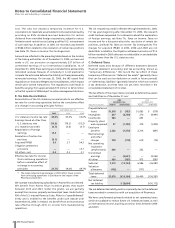

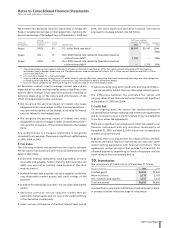

C. Deferred Taxes

Deferred taxes arise because of different treatment between

financial statement accounting and tax accounting, known as

“temporary differences.” We record the tax effect of these

temporary differences as “deferred tax assets” (generally items

that can be used as a tax deduction or credit in future periods)

or “deferred tax liabilities” (generally items for which we received

a tax deduction, but that have not yet been recorded in the

consolidated statement of income).

The tax effects of the major items recorded as deferred tax assets

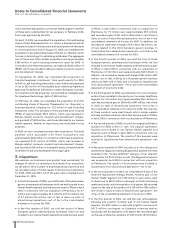

and liabilities as of December 31 are:

2005 2004

DEFERRED TAX DEFERRED TAX

_____________________________ _____________________________

(MILLIONS OF DOLLARS) ASSETS (LIABILITIES) ASSETS (LIABILITIES)

Prepaid/deferred

items $1,318 $ (753) $1,085 $ (579)

Intangibles 857 (8,748) 270 (9,991)

Inventories 583 — 693 —

Property, plant

and equipment 87 (1,183) 279 (1,402)

Employee

benefits 2,282 (1,376) 2,314 (891)

Restructurings

and other

charges 729 (118) 619 (74)

Net operating

loss/credit

carryforwards 406 — 353 —

Unremitted

earnings —(2,651) —(3,063)

All other 950 (335) 973 (581)

Subtotal 7,212 (15,164) 6,586 (16,581)

Valuation

allowance (142) — (177) —

Total deferred

taxes $7,070 $(15,164) $6,409 $(16,581)

Net deferred

tax liability $(8,094) $(10,172)

The net deferred tax liability position is primarily due to the deferred

taxes recorded in connection with our acquisition of Pharmacia.

We have carryforwards primarily related to net operating losses

which are available to reduce future U.S. federal and state, as well

as international income, expiring at various times between 2006

and 2025.