Pfizer 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 Financial Report 51

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

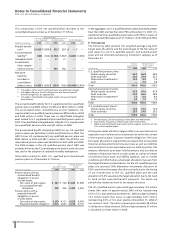

At December 31, 2005, we had access to $3.0 billion of lines of

credit, of which $1.1 billion expire within one year. Of these lines

of credit, $2.8 billion are unused, of which our lenders have

committed to loan us $1.7 billion at our request. $1.5 billion of

the unused lines of credit, which expire in 2010, may be used to

support our commercial paper borrowings.

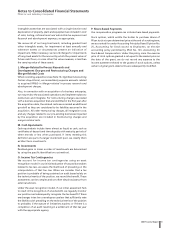

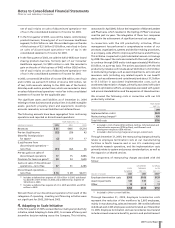

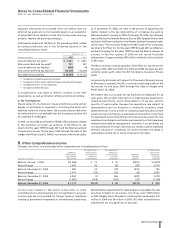

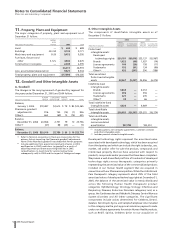

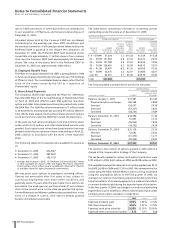

C. Long-Term Debt

Information about our long-term debt as of December 31 follows:

(MILLIONS OF DOLLARS) MATURITY DATE 2005 2004

Senior unsecured notes:

LIBOR-based floating-rate January 2007 $1,000 $—

LIBOR-based floating-rate January 2006 —1,000

5.625%(a) February 2006 —771

6.6%(a) December 2028 763 749

4.5%(a) February 2014 728 742

2.5%(a) March 2007 682 686

5.625%(a) April 2009 618 644

6.5%(a) December 2018 522 528

0.80% Japanese yen March 2008 513 586

4.65%(a) March 2018 293 294

3.3%(a) March 2009 288 294

6.0%(a) January 2008 255 266

Other:

Debentures, notes,

borrowings and mortgages(a) 685 719

Total long-term debt $6,347 $7,279

Current portion not included above(a) $778 $907

(a) Includes unrealized gains and losses for debt with fair value

hedges in 2005 and/or 2004 (see Note 9D, Financial Instruments:

Derivative Financial Instruments and Hedging Activities).

In November 2005, Pfizer issued $1 billion of senior unsecured

floating-rate notes at LIBOR, less a nominal amount, with an

initial maturity of 13 months. The debt holders have the option

to extend the term of the notes by one month, each month,

during the five-year maximum term of the notes. In addition, the

adjustment to LIBOR increases each December by a nominal

amount. The notes are callable by us at par plus accrued interest

to date every six months, with a notice of not less than thirty days,

but not more than sixty days. The LIBOR-based floating-rate

notes bear an interest rate of 4.33% as of December 31, 2005. The

floating-rate notes were issued through an international

subsidiary. They are guaranteed as to principal and interest by

Pfizer Inc. though the maturity date of the notes. These notes were

issued to fund certain international subsidiaries’ intercompany

dividends paid in 2005 in connection with the Jobs Act.

In July 2005, we decided to exercise Pfizer’s option to call, at par-

value plus accrued interest, $1 billion of senior unsecured floating-

rate notes, which were included in Long-term debt at December

31, 2004. Notice to call was given to the Trustees and the notes

were redeemed in September 2005.

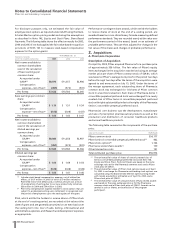

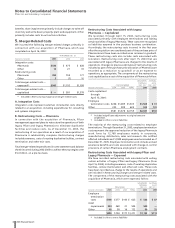

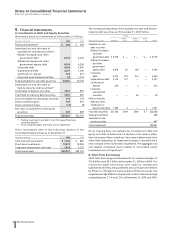

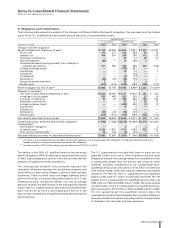

Long-term debt outstanding at December 31, 2005 matures in the

following years:

AFTER

(MILLIONS OF DOLLARS) 2007 2008 2009 2010 2010

Maturities $1,688 $979 $956 $2 $2,722

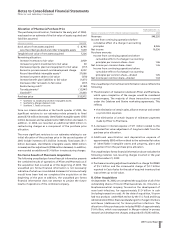

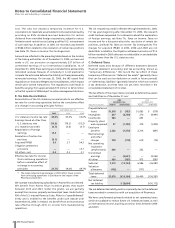

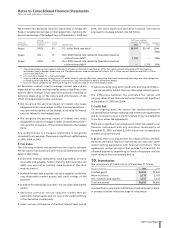

On February 22, 2006, we issued the following Japanese yen

fixed-rate bonds, which will be used for current general corporate

purposes:

•$508 million equivalent, senior unsecured notes, due February

2011, which pay interest semi-annually, beginning on August 22,

2006, at a rate of 1.2%; and

•$466 million equivalent, senior unsecured notes, due February

2016, which pay interest semi-annually, beginning on August 22,

2006, at a rate of 1.8%.

The notes were issued under a $5 billion debt shelf registration

filed with the SEC in November 2002. Such yen debt is designated

as a hedge of our yen net investments.

At February 24, 2006, we had the ability to borrow $1 billion by

issuing debt securities under our existing debt shelf registration

statement filed with the SEC in November 2002.

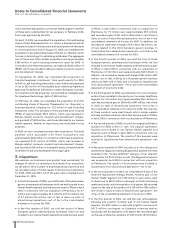

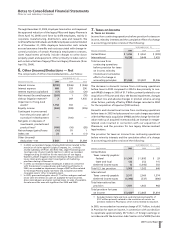

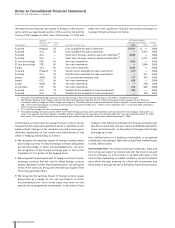

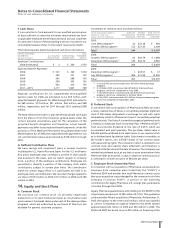

D. Derivative Financial Instruments and Hedging

Activities

Foreign Exchange Risk—A significant portion of revenues,

earnings and net investments in foreign affiliates is exposed to

changes in foreign exchange rates. We seek to manage our

foreign exchange risk in part through operational means,

including managing expected same currency revenues in relation

to same currency costs and same currency assets in relation to

same currency liabilities. Depending on market conditions, foreign

exchange risk is also managed through the use of derivative

financial instruments and foreign currency debt. These financial

instruments serve to protect net income and net investments

against the impact of the translation into U.S. dollars of certain

foreign exchange denominated transactions.