Pentax 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

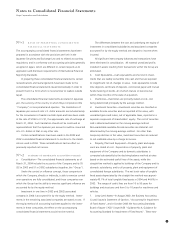

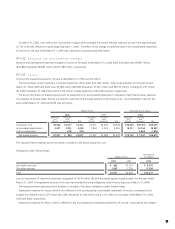

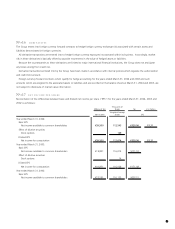

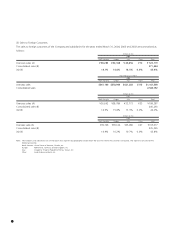

On March 31, 2003, a tax reform law was enacted in Japan which changed the normal effective statutory tax rate from approximately

41.7% to 40.4%, effective for years beginning April 1, 2004. The effect of this change on deferred taxes in the consolidated statements

of income for the year ended March 31, 2003 was a decrease of approximately ¥94 million.

No»12 RESEARCH AND DEVELOPMENT EXPENSES

Research and development expenses charged to income for the years ended March 31, 2004, 2003 and 2002 were ¥9,847 million

($92,896 thousand), ¥8,681 million and ¥7,289 million, respectively.

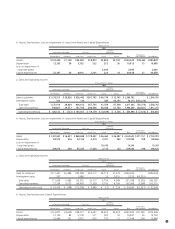

No»13 LEASES

Income from equipment leases for the year ended March 31, 2002 was ¥4 million.

The Group leases certain machinery, computer equipment, office space and other assets. Total rental expenses for the years ended

March 31, 2004, 2003 and 2002 were ¥6,748 million ($63,660 thousand), ¥7,967 million and ¥8,739 million, including ¥1,297 million

($12,236 thousand), ¥1,344 million and ¥1,413 million of lease payments under finance leases, respectively.

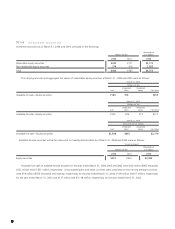

Pro forma information of leased property such as acquisition cost, accumulated depreciation, obligation under finance lease, deprecia-

tion expense of finance leases that do not transfer ownership of the leased property to the lessee on an "as if capitalized" basis for the

years ended March 31, 2004 and 2003 was as follows:

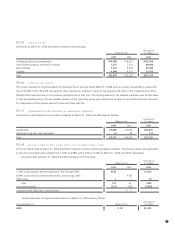

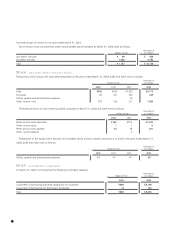

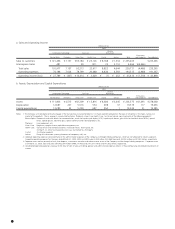

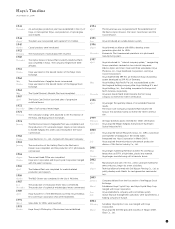

Millions of Yen Thousands of U.S. Dollars

2004 2003 2004

Machinery Furniture Machinery Furniture Machinery Furniture

and and and and and and

Vehicles Equipment Total Vehicles Equipment Total Vehicles Equipment Total

Acquisition cost ¥4,064 ¥3,277 ¥7,341 ¥3,571 ¥3,305 ¥6,876 $38,340 $30,915 $69,255

Accumulated depreciation 2,037 2,201 4,238 1,904 2,025 3,929 19,217 20,764 39,981

Loss on impairment 276 276 2,604 2,604

Net leased property ¥2,027 ¥ 800 ¥2,827 ¥1,667 ¥1,280 ¥2,947 $19,123 $ 7,547 $26,670

The imputed interest expense portion as lessee is included in the above acquisition cost.

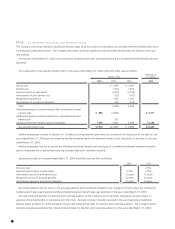

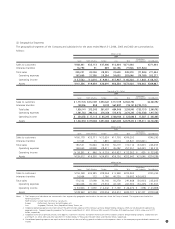

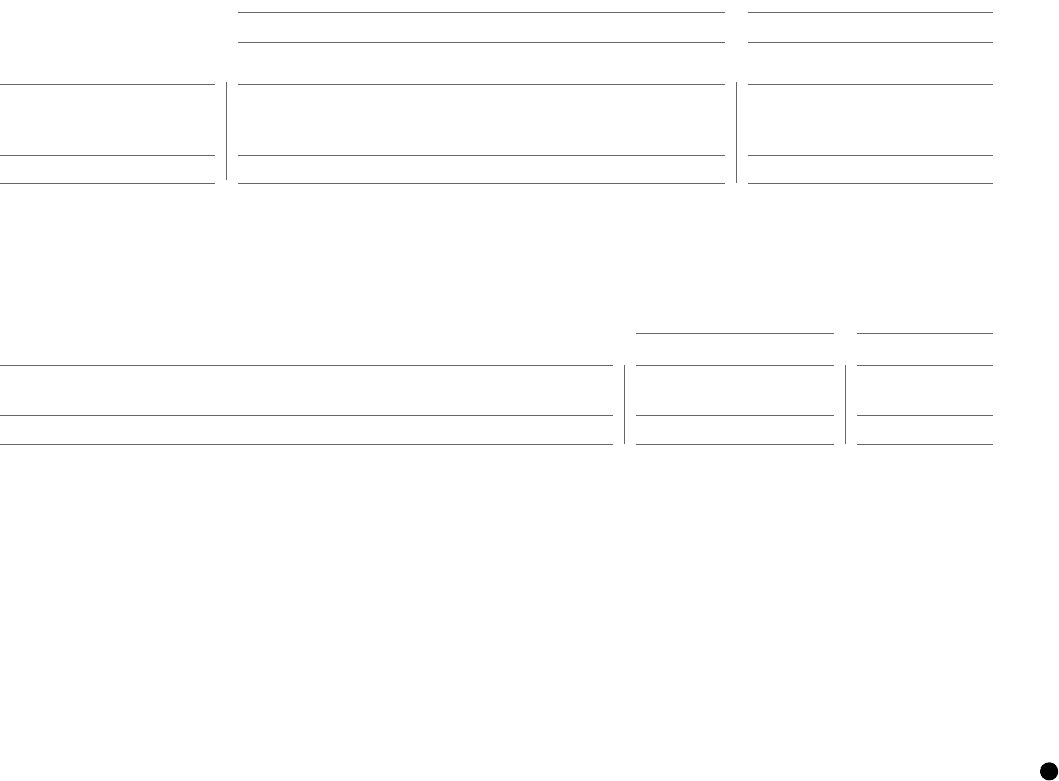

Obligations under finance leases:

Thousands of

Millions of Yen U.S. Dollars

2004 2003 2004

Due within one year ¥ 962 ¥1,191 $ 9,076

Due after one year 1,865 1,756 17,594

Total ¥2,827 ¥2,947 $26,670

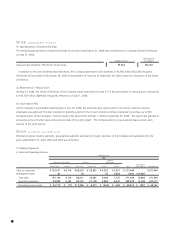

Loss on impairment of long-lived assets was recognized for ¥276 million ($2,604 thousand) against leased property for the year ended

March 31, 2004. The equivalent amount of the loss was excluded from the obligations under finance leases as of March 31, 2004.

The imputed interest expense portion as lessee is included in the above obligations under finance leases.

Depreciation expense for lessee, which is not reflected in the accompanying consolidated statements of income, computed by the

straight-line method was ¥1,297 million ($12,236 thousand), ¥1,344 million and ¥1,413 million for the years ended March 31, 2004,

2003 and 2002, respectively.

Depreciation expense for lessor, which is reflected in the accompanying consolidated statements of income, computed by the straight-