Pentax 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

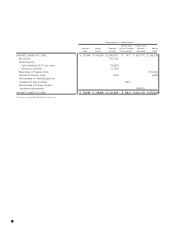

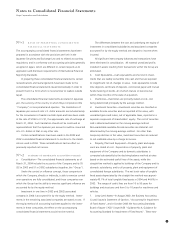

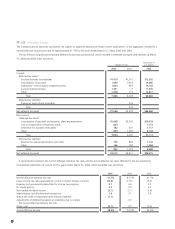

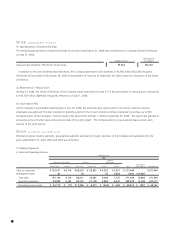

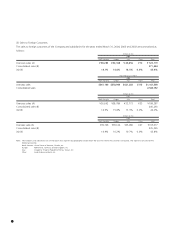

No»10 SHAREHOLDERS’ EQUITY

Japanese companies are subject to the Code to which certain

amendments became effective from October 1, 2001.

The Code was revised whereby common stock par value was

eliminated resulting in all shares being recorded with no par value

and at least 50% of the issue price of new shares is required to be

recorded as common stock and the remaining net proceeds as

additional paid-in capital. The Code permits Japanese companies,

upon approval of the Board of Directors, to issue shares to existing

shareholders without consideration as a stock split. Such issuance

of shares generally does not give rise to changes within the

shareholders' accounts.

The revised Code also provides that an amount at least equal to

10% of the aggregate amount of cash dividends and certain other

appropriations of retained earnings associated with cash outlays

applicable to each period shall be appropriated as a legal reserve (a

component of retained earnings) until such reserve and additional

paid-in capital equals 25% of common stock. The amount of total

additional paid-in capital and legal reserve that exceeds 25% of

the common stock may be available for dividends by resolution of

the shareholders. In addition, the Code permits the transfer of a

portion of additional paid-in capital and legal reserve to the

common stock by resolution of the Board of Directors.

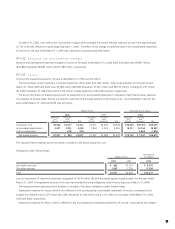

The revised Code eliminated restrictions on the repurchase and

use of treasury stock allowing Japanese companies to repurchase

treasury stock by a resolution of the shareholders at the general

shareholders meeting and dispose of such treasury stock by

resolution of the Board of Directors beginning April 1, 2002. The

repurchased amount of treasury stock cannot exceed the amount

available for future dividend plus amount of common stock,

additional paid-in capital or legal reserve to be reduced in the case

where such reduction was resolved at the general shareholders

meeting.

The amount of retained earnings available for dividends under

the Code was ¥119,888 million ($1,131,019 thousand) as of

March 31, 2004, based on the amount recorded in the Company's

general books of account. In addition to the provision that

requires an appropriation for a legal reserve in connection with the

cash payment, the Code imposes certain limitations on the

amount of retained earnings available for dividends.

The general shareholders meeting held in June 2003 approved

the introduction of the Committees System stipulated in the Code.

Before the Committees System was introduced, dividends had

been approved by the general shareholders meeting held subse-

quent to the fiscal year to which the dividends were applicable.

After introducing the Committees System, dividends may be paid

upon resolution of the Board of Directors, subject to certain

limitations imposed by the Code. Semiannual interim dividends

may also be paid upon resolution of the Board of Directors, subject

to certain limitations imposed by the Code.

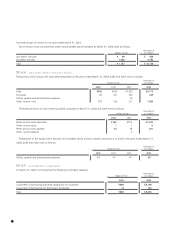

On June 20, 2003 and June 21, 2002, the Company's share-

holders approved a stock option plan for the Group's directors and

key employees. Under the plan, 1,066 thousand options were

granted to them to purchase shares of the Company's common

stock during the exercise period from October 1, 2004 to Septem-

ber 30, 2008 or from October 1, 2003 to September 30, 2007.

The options were granted at an exercise price of ¥9,750, ¥7,670

or ¥6,690.