Pentax 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

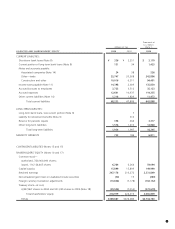

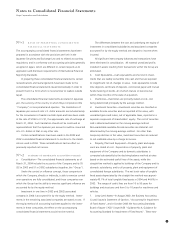

pronouncements are effective for fiscal years beginning on or after

April 1, 2005 with early adoption permitted for fiscal years ending

on or after March 31, 2004.

The Group adopted the new accounting standard for

impairment of fixed assets for the year ended March 31, 2004.

The Group reviews its long-lived assets for impairment

whenever events or changes in circumstance indicate the carrying

amount of an asset or asset group may not be recoverable. An

impairment loss would be recognized if the carrying amount of an

asset or asset group exceeds the sum of the undiscounted future

cash flows expected to result from the continued use and eventual

disposition of the asset or asset group. The impairment loss would

be measured as the amount by which the carrying amount of the

asset exceeds its recoverable amount, which is the higher of the

discounted cash flows from the continued use and eventual

disposition of the asset or the net selling price at disposition.

The effect of adoption of the new accounting standard for

impairment of fixed assets was to decrease income before income

taxes and minority interests for the year ended March 31, 2004 by

¥2,040 million ($19,245 thousand).

g. Intangible Assets—Intangible assets are carried at cost less

accumulated amortization, which is calculated by the straight-line

method. Amortization of software is calculated by the straight-

line method over 5 years. Goodwill recognized under the Japanese

Commercial Code (the "Code") is fully charged to income when

incurred.

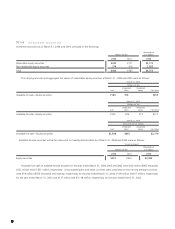

h. Retirement Benefits—The Company and certain subsidiaries

had a contributory funded pension plan and an unfunded retire-

ment benefit plan which covered substantially all of their employees.

Effective April 1, 2000, the Company and domestic subsidiar-

ies adopted a new accounting standard for employees' retirement

benefits and accounted for the liability for retirement benefits

based on projected benefit obligations and plan assets at the

balance sheet date. The transitional obligation of ¥3,166 million,

determined as of April 1, 2000, was being amortized over 15 years

and presented as other expense in the consolidated statements of

income.

For the year ended March 31, 2003, the contributory funded

pension plan was dissolved and the unfunded retirement benefit

plan was abolished. The remaining balance of transitional

obligation at the dissolution of the contributory funded pension

plan and the abolishment of the unfunded retirement benefit plan

was charged to income.

The annual provision for accrued retirement benefits for

directors and corporate auditors of the Company and its domestic

subsidiaries was also calculated to state the liability at the amount

that would be required if all directors and corporate auditors

retired at each balance sheet date. The provisions for the retire-

ment benefits are not funded.

For the year ended March 31, 2004, the Company and its

domestic subsidiaries abolished the retirement benefit plan for

directors and corporate auditors.

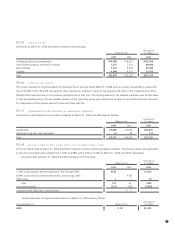

i. Research and Development Expenses—Research and develop-

ment expenses are charged to income when incurred.

j. Leases—All leases are accounted for as operating leases.

Under Japanese accounting standards for leases, finance leases

that deem to transfer ownership of the leased property to the

lessee are to be capitalized, while other finance leases are

permitted to be accounted for as operating lease transactions if

certain "as if capitalized" information is disclosed in the notes to

the lessee's consolidated financial statements.

k. Income Taxes—The provision for income taxes is computed

based on the pretax income included in the consolidated state-

ments of income. The asset and liability approach is used to

recognize deferred tax assets and liabilities for the expected future

tax consequences of temporary differences between the carrying

amounts and the tax bases of assets and liabilities. Deferred taxes

are measured by applying currently enacted tax laws to the

temporary differences.

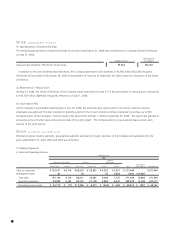

l. Appropriations of Retained Earnings—Appropriations of

retained earnings at each year end are reflected in the consoli-

dated financial statements for the following year upon sharehold-

ers' approval or resolution of the Board of Directors.

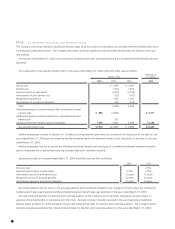

m. Foreign Currency Transactions—All short-term and long-term

monetary receivables and payables denominated in foreign

currencies are translated into Japanese yen at the exchange rates

at the balance sheet date. The foreign exchange gains and losses

from translation are recognized in the statements of income to the

extent that they are not hedged by forward exchange contracts.

n. Foreign Currency Financial Statements—The balance sheet

accounts of the consolidated overseas subsidiaries and associated

companies are translated into Japanese yen at the current

exchange rates as of the balance sheet dates except for sharehold-

ers' equity, which is translated at historical exchange rates.

Differences arising from such translation are shown as "Foreign

currency translation adjustments" in a separate component of

shareholders' equity.

50