Omron 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

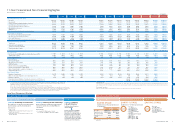

The dividend per share in fiscal

2013 marked an all-time high. The

shareholder return policy will be changed from

“a dividend payout

ratio of more than

25%” to a policy “targeting a dividend payout ratio

of

30%” by fiscal 2016.

–150

0

90

60

30

120

180

150

–60

–30

–90

–120

210

0

50

25

75

100

125

07 08 09 10 11 12 13

185.9

42

22.6%

106.4%

24.7%

37.6%

27.0% 25.3%

–132.2

25 16.0 17

121.7

30

74.5

28

137.2

37

53

209.8

Yen %

(FY)

EPS ¥

209.8

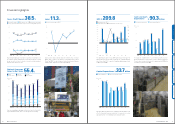

Earnings per share (EPS)

Dividends per share Dividend payout ratio (right scale)

To realize the establishment of a“self-driven growth structure

”

priority will be given to the allocation of cash to growth investments.

This allocation is expected to amount to approximately ¥10 0

billion

over the three years to fiscal 2016.

0

50

75

25

100

07 08 09 10 11 12 13

18.2

40.640.6

53.0

46.646.6

36.6

51.751.7

45.5

74.774.7

18.8

45.345.3

5.6

0.5

55.755.7

90.3

90.3

Billions of yen

(FY)

Interest-bearing liabilities

Cash and cash equivalents

Although capital expenditures were temporarily decreased due to the

effects of global financial instability, the amounts invested

subsequently have exceeded depreciation and amortization.

0

20

30

10

40

07 08 09 10 11 12 13

37.1 36.3 36.8

33.5

27.0

19.5

23.2 23.0

28.3

22.6

28.3

22.5

25.1

33.7

(FY)

Depreciation and amortization

Capital expenditures

Billions of yen

Cash and Cash

Equivalents ¥

90.3

billion

Capital Expenditures

¥ 33.7 billion

Financial Highlights

8.6

0.9 2.5

7.8

6.5

7.0

8.8

0

20

10

40

30

50

07 08 09 10 11 12 13

38.4

38.4

23.1

34.834.8

26.2 25.4

23.0 23.5 23.4

6.7

7.7 7.2

6.7

6.8

6.7 6.2

23.5

35.135.1

37.537.5 36.836.8 37.137.1 38.538.5

% %

(FY)

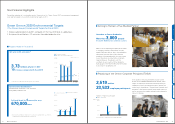

Improved profitability due to production automation and reduction in

the number of parts and materials contained in products. Looking

ahead, we will continue to allocate research and development

expenses at the

6%-to-7% level.

Each business division breaks down the elements that constitute

ROIC, aims to improve the quality of management through a

Down-Top ROIC Tree by setting each elements as key performance

indicator (KPIs), and promotes enhanced profitability.

Gross Profit Margin

38.5

%

Selling, general and administrative expenses ratio (excluding R&D expenses)

R&D expenses ratio Operating income margin

Gross profit margin

–10

0

5

10

–5

15

07 08 09 10 11 12 13

10.4

–7.6

1.0

7.8

4.8

8.6

11.3

(FY)

ROIC

11.3

%

Return on invested capital (ROIC)

0

400

200

800

600

07 08 09 10 11 12 13

763.0763.0

627.2627.2

524.7524.7

617.8617.8619.5619.5

650.5650.5

773.0773.0

47.9%

12.8%

50.3%

49.3%

12.0%

48.6%47.8%

12.1%12.4%

48.9%

44.6%

13.1%

6.1%

3.0%

12.0%12.0%14.7%15.7%16.3%16.3%

18.4%

17.6%

6.4%

2.0%1.9%1.6%1.5%

1.8%

2.0%

7.6%8.1%8.5%8.4%9.3%

13.4%

16.4%

11.7%

14.8%

13.7%13.5%12.4%

13.1%

Billions of yen

(FY)

Sales are expanding in emerging countries, such as in the Asia Pacific

region and Greater China, where economic growth is continuing.

Japan Americas Europe

Direct Exports

Greater China Asia Pacific

Ratio of Overseas

Sales to Net Sales 55.4%

About Omron Where We’re Headed Corporate Value Initiatives Corporate Value Foundation Financial Section

10 Omron Corporation Integrated Report 2014 11