Omron 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

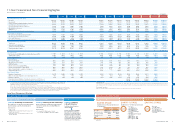

ROIC 7.8%4.8%8.6%11.3%approx. 12%approx. 13%

ROE 8.7%5.2%8.8%11.6%approx. 12%approx. 13%

EPS ¥121.7¥74.5¥137.2¥209.8¥231.7approx. ¥290

FY2010 FY2011 FY2012 FY2013 FY2014

(Plan)*2

FY2016

(Plan)*2

Net sales 617.8 619.5 650.5 773.0 800.0over 900.0

Operating income 48.0 40.1 45.3 68.1 74.0over 90.0

Operating income margin 7.8%6.5%7.0%8.8%9.3% over 10%

Free cash flow*121.7 5.5 24.6 47.9ー ー

Cash and cash equivalents 74.7 45.3 55.7 90.3ー ー

Total interest-bearing liabilities 45.5 18.8 5.6 0.5ー ー

Net cash 29.2 26.5 50.1 89.8ー ー

Billions of yen

*1 Net cash provided by operating activities + Net cash used in investing activities

*2 Assumed exchange rates: USD1 = ¥100, EUR1 = ¥135

In April 2013, Omron established the position of Chief Financial Officer (CFO). This move was an

attempt to improve portfolio management and expedite decision making and to better respond

to today’s volatile operating environment.

As the first CFO, I worked to fulfill this responsibility throughout my first year and while

attempting to find my own unique style in this role.

The Chief Executive Officer (CEO) is the head commander of Omron. Meanwhile, I, as CFO,

control financial management, including investment and shareholder return policies.

EARTH-1 STAGE:

Three Years of Prioritized

Growth Investment

Message from the CFO

July 2014

Yoshinori Suzuki

Executive Vice President and CFO

Placing Growth Investment First

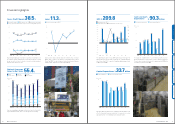

During the GLOBE STAGE, we successfully

strengthened our ability to generate cash by

improving the profitability of each of our busi-

nesses. In fact, free cash flow amounted to

¥47.9 billion in fiscal 2013, up ¥23.3 billion

from fiscal 2012, and net cash totaled approx-

imately ¥90.0 billion. What is most impressive

is that we accomplished these figures while

conducting forward-looking growth invest-

ment. We are committed to establishing a

growth structure for supporting future devel-

opment in the EARTH-1 STAGE. We will allo-

cate cash on hand as well as the cash to be

generated continually into the future to three

areas: growth investment, dividends, and

share buybacks. Growth investment will be of

particular priority.

Omron has designated the three-year period

from fiscal 2014 to fiscal 2016 as the EARTH-1

STAGE. During this period, we plan to invest

approximately ¥100 billion in the establishment

of a

“self-driven growth structure.” Specifically,

we will expand sales channels in the ASEAN

region, India, South Korea, and other parts of

Asia to develop operations in these areas into a

core business pillar alongside those in China. In

addition, we will accelerate new business de-

velopment in the industrial, social, lifestyle, and

environmental fields. Omron will also collabo-

rate with other companies and academia.

About Omron Where We’re Headed Corporate Value Initiatives Corporate Value Foundation Financial Section

24 Omron Corporation Integrated Report 2014 25