Omron 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

emerging countries could allow people to

devote their time to creative thinking. We

also expect more demand for electric vehicles

(EVs) and hybrid-electric vehicles (HEVs) due to

society’s greater concern for the environment.

Omron is contributing to the improvement

of these vehicles’ performance by providing

electric power steering controllers and the

world’s smallest and lightest DC power relay.

Our increased focus on the environmental

solutions business should provide solutions

to energy issues. In addition, there has been

growing concern for safety issues resulting

from the degradation of tunnel and bridge

infrastructure. Omron is at the forefront

of developing new technology to prevent

unexpected collapses through monitoring

vibration changes by sensors. Meanwhile,

we continue to focus on healthcare areas by

educating people on cardiovascular-related

diseases and raising awareness of the

importance of using blood pressure monitors

and other devices as more and more people are

expected to suffer from these diseases due to

aging populations.

Japan can be called a developed country

with many social issues. We plan to develop

businesses that will help resolve issues

related to such areas as energy and social

infrastructure in Japan first and then to

expand those solutions to the fast-growing

Asian countries.

Three Basic Strategies

and Operating Strategies

The EARTH-1 STAGE is a period in which we

will build on the various initiatives implemented

during the GLOBE STAGE, guided by three

Basic Strategies. Under the first of these, the

Existing Business Strategy, we will continue

to focus on strengthening the IA business.

Specifically, our plans include advancing

marketing capabilities for products launched in

the past three years and growing the business

by leveraging the Automation Centers*1 we

have established and our expanded sales

engineer staff.

Under the second strategy, the Super-

Global Growth Strategy, we will build stronger

infrastructure with the aim of achieving

dynamic business growth in

“wider Asia,”

which encompasses China and other Asian

countries. We consider growing businesses

in ASEAN countries and India as two main

business areas, in addition to our already

growing business in China. The building of

foundations for growth is essential to achieve

our goals, and we plan to enhance logistics

infrastructure and strengthen sales and

marketing efforts.

The third strategy, the New Business

Strategy for the Optimization Society, aims to

generate new businesses in fields related to the

environment, industry, society, and lifestyles. As

previously mentioned, we will continue to focus

on businesses that help resolve social issues.

■

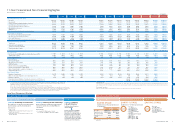

Shareholder Value Improvement under GLOBE STAGE

3. Management Indicators, Improvement of Shareholder Value

■

EARTH-1 STAGE: Policy and Targets (Fiscal 2016)

*1 Automation Centers: Engineering centers that help realize optimal automation

Policy Establishment of a “self-driven growth structure”

Targets*3

(FY2016)

Net sales Over ¥900.0 billion

Gross profit margin Over 40%

Operating income margin Over 10%

ROIC*2Approx. 13%

ROE Approx. 13%

EPS*2Approx. ¥290

*2 Newly introduced medium-term targets

*3 Assumed exchange rates: USD1 = ¥100, EUR1 = ¥135

*4 Total shareholder return is calculated on the assumption that dividends are not reinvested in additional share purchases.

GLOBE STAGE FY2013 (Actual) FY2010 (Actual)

EPS 72¥210 ¥122

ROIC 3.5%P 11.37.8

ROE 2.9%P 11.68.7

Share Price 82¥4,260 (year-end)

Record-high ¥4,730

on January 7, 2014

¥2,338 (year-end)

Dividend Per Share 77¥53 ¥30

3-Year TSR*4 (Total Shareholder Return) 87― ―

In regard to the Operating Strategies that

support the three Basic Strategies, we will

continue to implement the Profit Structure Reform

and the Global Human Resources Strategy.

I will discuss our human resources strategy later.

Medium-Term Performance Targets

For fiscal 2016, the final year of the EARTH-1

STAGE, we are targeting more than ¥900.0 billion

for net sales, 40% or higher for the gross profit

margin, 10% or higher for the operating income

margin, and approximately 13% for ROE. As

we are mindful of the cost of capital and aim

to live up to shareholder expectations over the

medium-to-long term, we set the new targets of

approximately 13% for ROIC and approximately

¥290 for earnings per share (EPS).

All Omron businesses are positioned

in growth fields, and we have a business

foundation capable of responding to such

issues as population aging, environmental

problems, and other global issues. I am

confident in Omron’s long-term growth

potential and ability to establish a

“self-driven

growth structure” during the EARTH-1 STAGE.

Entrenchment and Advancement

of ROIC-Based Management

As I said previously, we set our first medium-

term target for ROIC of approximately 13%

to be achieved in fiscal 2016. We will work

toward realizing this goal along with our existing

target for ROE. ROIC-based management is

entrenched throughout Omron. ROIC is not only

used in the performance-linked compensation

system for senior executives, but it is also used

in managing each business by using contributing

factors shown in a Down-Top ROIC Tree as key

performance indicators. We established the

position of Chief Financial Officer (CFO) in fiscal

2013, and we will continue to work together

to improve the quality of various initiatives and

manage the cost of capital and cash flows.

Improvement of Shareholder Value

During the three years of the GLOBE STAGE,

we were able to achieve an increase in EPS,

from ¥122 to ¥210, and a great improvement

in ROE. Further, Omron’s stock price rose 82%,

with a 77% increase in dividends. Therefore,

the total shareholder return (TSR) was

87% over the three-year period. This rise is

particularly impressive when compared with the

average performance of companies listed on

the First Section of the Tokyo Stock Exchange.

During the EARTH-1 STAGE, we will continue

About Omron Where We’re Headed Corporate Value Initiatives Corporate Value Foundation Financial Section

20 Omron Corporation Integrated Report 2014 21