Office Depot 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

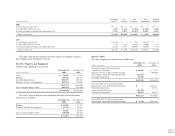

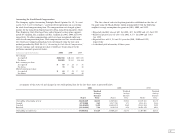

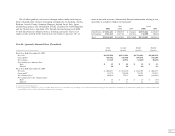

Note J—Earnings Per Share

Basic earnings per share is based on the weighted average number of shares

outstanding during each period. Diluted earnings per share further assumes

that the zero coupon, convertible subordinated notes, if dilutive, are converted

as of the beginning of the period and that, under the treasury stock method,

dilutive stock options are exercised. Net earnings under this assumption have

been adjusted for interest on the zero coupon, convertible subordinated notes,

net of the related income tax effect.

The information required to compute basic and diluted net earnings per

share is as follows:

(In thousands) 2001 2000 1999

Basic:

Weighted average number of

common shares outstanding 298,054 309,301 361,499

Diluted:

Net earnings $201,043 $ 49,332 $257,638

Interest expense related to convertible

notes, net of tax 7,238 — 12,068

Adjusted net earnings $208,281 $ 49,332 $269,706

Weighted average number of

common shares outstanding 298,054 309,301 361,499

Shares issued upon assumed conversion

of convertible notes 13,846 — 24,744

Shares issued upon assumed exercise

of stock options 4,524 1,930 7,414

Shares used in computing diluted

net earnings per common share 316,424 311,231 393,657

For 2000, the zero coupon convertible subordinated notes would have

been anti-dilutive, and therefore the shares (23.0 million) and related interest

expense ($12.1 million) were excluded from our calculation of diluted earn-

ings per share. Options to purchase 12.7 million shares of common stock were

not included in our computation of diluted earnings per share for 2001

because their effect would also have been anti-dilutive.

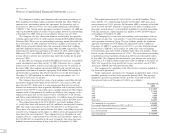

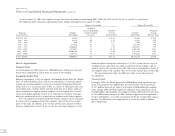

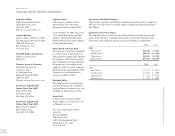

Note K—Supplemental Information on Operating, Investing,

and Financing Activities

Additional supplemental information related to the Consolidated Statements

of Cash Flows is as follows:

(Dollars in thousands) 2001 2000 1999

Cash paid for:

Interest $17,802 $ 9,099 $ 6,472

Taxes 15,008 132,743 118,157

Supplemental non-cash information:

Assets acquired under capital leases 8,256 12,569 37,881

Additional paid-in capital related to tax benefit

on stock options exercised (See Note H)10,218 (4,640) 22,987

Unrealized gain on investment securities,

net of income taxes —— 62,128