Office Depot 2001 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

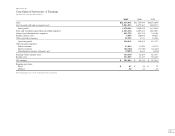

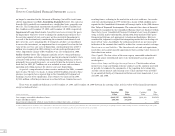

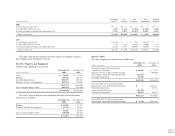

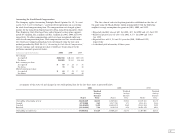

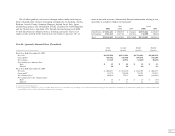

Note F—Income Taxes

Our income tax provision consisted of the following:

(Dollars in thousands) 2001 2000 1999

Current provision:

Federal $ 66,074 $ 71,407 $114,800

State 12,904 22,616 15,561

Foreign 33,913 30,918 26,318

Deferred expense (benefit) 196 (81,814) (430)

Total provision for income taxes $113,087 $ 43,127 $156,249

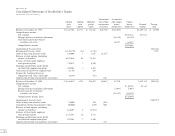

The tax-effected components of deferred income tax assets and liabilities

consisted of the following:

December 29, December 30,

(Dollars thousands) 2001 2000

Self-insurance accruals $ 28,020 $ 23,702

Inventory 25,150 17,790

Vacation pay and other accrued compensation 29,670 27,762

Reserve for bad debts 12,724 7,493

Reserve for facility closings 56,151 67,563

Merger costs 5,304 6,117

Unrealized loss on investments 19,266 17,499

Foreign and state net operating loss carryforwards 88,006 91,037

Other items, net 23,451 27,343

Gross deferred tax assets 287,742 286,306

Valuation allowance (72,605) (91,037)

Deferred tax assets 215,137 195,269

Basis difference in fixed assets 71,880 51,797

Capitalized leases 5,573 5,757

Excess of tax over book amortization 3,641 1,214

Other items, net 1,856 16,294

Deferred tax liabilities 82,950 75,062

Net deferred tax assets $132,187 $120,207

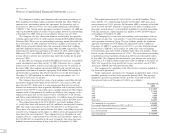

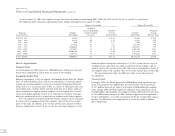

As of December 29, 2001, we had approximately $44 million of federal,

$105 million of foreign and $642 million of state net operating loss carry-

forwards. Of these carryforwards, approximately $28 million will expire in

2002, $12 million will carry over indefinitely, and the balance will expire

between 2003 and 2021. The valuation allowance has been developed to

reduce our deferred tax asset to an amount that is more likely than not to be

realized, and is based upon the uncertainty of the realization of certain for-

eign and state deferred tax assets relating to net operating loss carryforwards.

The federal net operating loss is subject to Internal Revenue Code Section 382

limitations, but is expected to be substantially realized.

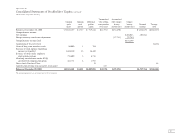

The following is a reconciliation of income taxes at the Federal statutory

rate to the provision for income taxes:

(Dollars in thousands) 2001 2000 1999

Federal tax computed at the statutory rate $109,945 $32,361 $144,862

State taxes, net of Federal benefit 13,333 6,899 12,383

Nondeductible goodwill amortization 1,834 1,744 1,964

Merger costs —969 2,920

Foreign income taxed at rates other than Federal (13,743) (667) (6,508)

Other items, net 1,718 1,821 628

Provision for income taxes $113,087 $43,127 $156,249

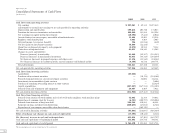

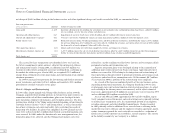

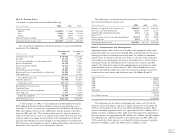

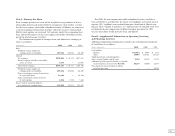

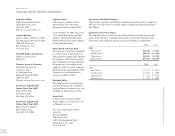

Note G—Commitments and Contingencies

Operating Leases: Office Depot leases facilities and equipment under agree-

ments that expire in various years through 2021. Substantially all such leases

contain provisions for multiple renewal options. In addition to minimum

rentals, there are certain executory costs such as real estate taxes, insurance

and common area maintenance on most of our facility leases. Certain leases

contain provisions for additional rent to be paid if sales exceed a specified

amount. The table below shows future minimum lease payments due under

non-cancelable leases as of December 29, 2001. These minimum lease pay-

ments do not include facility leases that were accrued as merger and restruc-

turing costs or store closure and relocation costs (See Notes B and C).

(Dollars in thousands)

2002 $ 400,021

2003 345,876

2004 299,922

2005 251,804

2006 217,219

Thereafter 1,075,627

2,590,469

Less sublease income 59,526

$2,530,943

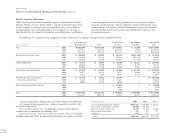

The Company is in the process of opening new stores and CSCs in the

ordinary course of business, and leases signed subsequent to December 29,

2001 are not included in the above described commitment amounts. Rent

expense, including equipment rental, was approximately $398.1 million, $393.5

million and $321.5 million in 2001, 2000 and 1999, respectively. Included in

this rent expense was approximately $0.7 million, $1.1 million, and $0.8 million

of contingent rent, otherwise known as percentage rent, in 2001, 2000, and

1999, respectively. Rent expense was reduced by sublease income of approxi-

mately $3.0 million in 2001 and 2000, and $3.2 million in 1999.