Office Depot 2001 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

Office Depot, Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations(continued)

In 2002, we plan to expand our International Division by opening 10 to 15

new retail stores in France and Japan, adding the European Business Service

Division to two new countries and launching service in Spain and Switzerland.

As part of the overall restructuring of our management team, all of our

European operations were consolidated under the leadership of Rolf van

Kaldekerken, who is President of our European business. Mr. van Kaldekerken

reports to our Chairman and CEO, Bruce Nelson. During 2001, we also changed

the management of our operations in Japan, and named Richard Lepley,

an experienced international retailer, as President of Office Depot Japan

and Viking Japan. Mr. Lepley reports directly to our Chairman and CEO,

Bruce Nelson.

Results of Operations

Fiscal 2001 was a year of improved operational performance across the Company

and increased overall earnings compared to 2000, even in the face of difficult

economic conditions and a decline in our consolidated sales. Diluted earnings

per share improved to $0.66 from $0.16 in 2000, and down from $0.69 in

1999. Fiscal year 2000 was adversely affected by charges associated with a

comprehensive business review that resulted in the closing of 70 retail stores,

the write-down of certain assets and the elimination of some employee posi-

tions. Additional store closure and impairment costs, the write-down of cer-

tain Internet investments, settlement of certain employee claims and gain on

the sale of our London warehouse were recognized in 2001. Without these

charges and credits, EPS was $0.79 in 2001 and $0.70 in 2000. See Charges

and Credits section below for additional discussions on these items.

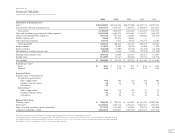

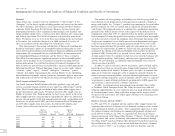

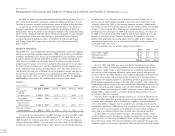

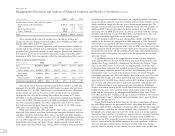

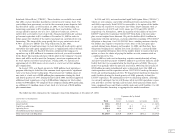

Overall

(Dollars in Millions) 2001 2000 1999

Sales $11,154.1 100.0% $11,569.7 100.0% $10,272.1 100.0%

Cost of goods

sold and

occupancy costs 7,984.0 71.6% 8,479.4 73.3% 7,450.6 72.5%

Gross profit 3,170.1 28.4% 3,090.3 26.7% 2,821.5 27.5%

Store and warehouse

operating and

selling expenses 2,343.4 21.0% 2,409.5 20.8% 2,023.1 19.7%

Store and warehouse

operating profit $ 826.7 7.4% $ 680.8 5.9% $ 798.4 7.8%

Our overall sales decreased 4% in 2001 and increased 13% in 2000, while

comparable sales decreased 2% in 2001 and grew 7% in 2000. Fiscal year

2000 included 53 weeks in accordance with our 52-53 week accounting con-

vention. Adjusting 2000 to a 52-week basis, sales decreased 2% in 2001. The

overall sales decrease in 2001 reflects a 10% decrease in our North American

Retail Division, a 4% increase in our Business Services Group and a 6%

increase in our International Division. Sales across the United States were

adversely affected in 2001 by the slowing domestic economy. Additionally,

the decline in sales of our North American Retail Division reflects our decision

to close 73 stores during 2001, following our comprehensive business review

performed in the latter part of 2000. The largest percentage sales increases

in 2000 were realized in our BSG segment, driven most significantly by the

growth in our contract and Internet businesses. E-commerce sales have

improved in all periods, increasing almost 60% in 2001 to $1.6 billion. Also

contributing significantly to our sales growth in 2000 was the continued

expansion of our store base.

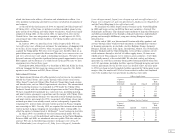

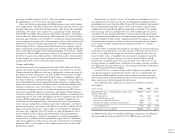

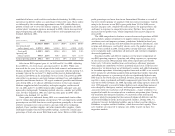

Our worldwide sales by product group were as follows:

2001 2000 1999

General office supplies 44.2% 41.7% 41.0%

Technology products 46.3% 47.5% 47.5%

Office furniture 9.5% 10.8% 11.5%

100.0% 100.0% 100.0%

In both 2001 and 2000, our sales mix shifted toward our core office

supply items. Sales of technology products decreased significantly in 2001,

reflecting to a large extent, a general slowing of technology-related product

sales in the overall economy. Moreover, many more general and specialty

retailers outside the office products retail segment (including discount retail-

ers, drug store chains and warehouse club retailers) have broadened their

assortments of technology products. Technology products generally have lower

profit margins compared to many of the core office supplies. Also, within the

technology products category, the mix shifted from technology hardware and

software towards machine supplies. Sales of office furniture declined, reflect-

ing lower volume and unit prices in 2001 and lower average selling prices

during 2000, as many business customers deferred large purchases because

of concerns about the economy.

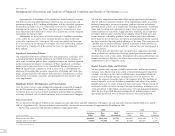

Our overall gross profit percentages fluctuate as a result of numerous fac-

tors, including competitive pricing pressures; changes in product, catalog and

customer mix; emergence of new technology; suppliers’ pricing changes; as

well as our ability to improve our net product costs through growth in total

merchandise purchases. Additionally, our occupancy costs may vary as we add

stores and CSCs in new markets with different rental and other occupancy

costs, and as we relocate and/or close existing stores in current markets.

In mid-2000, we reduced prices for paper and machine supplies across

all of our domestic sales channels in response to competitive pressures from

discount clubs and other non-traditional sellers of those supply items. These

price reductions, along with increased product costs, primarily for paper and

machine supplies, had the most significant effect on our decreased gross profit