Office Depot 2001 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

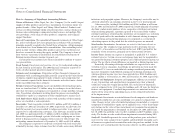

Revenue Recognition: Revenue is recorded at the time of shipment for deliv-

ery and catalog sales, and at the point of sale for essentially all retail store

transactions. When revenue is recorded, an allowance for sales returns is esti-

mated based on past experience. Revenue from sales of extended warranty

service plans is either recognized at the point of sale or over the warranty

period, depending on various states’ laws determination of legal obligor status.

All performance obligations and risk of loss associated with such contracts

are transferred to an unrelated third party administrator at the time the con-

tracts are sold. Costs associated with these contracts are recognized in the

same period as the related revenue.

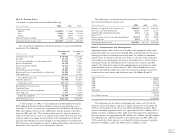

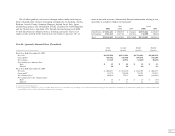

Shipping and Handling Fees and Costs: Income generated from shipping

and handling fees is classified as revenues for all periods presented. The costs

related to shipping and handling are presented as a component of store and

warehouse operating and selling expenses. These costs were $748.6 million in

2001, $756.6 million in 2000 and $594.2 million in 1999.

Advertising: Advertising costs are either charged to expense when incurred

or, in the case of direct marketing advertising, capitalized and amortized in

proportion to the related revenues. We participate in cooperative advertising

programs with our vendors in which they reimburse us for a portion of our

advertising costs. Advertising expense, net of cooperative advertising allow-

ances, amounted to $317.0 million in 2001, $295.8 million in 2000 and

$285.3 million in 1999.

Pre-opening Expenses: Pre-opening expenses related to opening new stores

and warehouses or relocating existing stores and warehouses are expensed as

incurred and included in other operating expenses.

Self-Insurance: Office Depot is primarily self-insured for workers’ compen-

sation, auto and general liability and employee medical insurance programs.

Self-insurance liabilities are based on claims filed and estimates of claims

incurred but not reported. These liabilities are not discounted.

Comprehensive Income (Loss): Comprehensive income (loss) represents

the change in stockholders’ equity from transactions and other events and

circumstances arising from non-stockholder sources. Comprehensive income

(loss) consists of net earnings, foreign currency translation adjustments and

realized or unrealized gains (losses) on investment securities that are available

for sale, net of applicable income taxes.

Derivative Financial Instruments: Certain derivative financial instruments

may be used to hedge the exposure to foreign currency exchange rate and

interest rate risks, subject to established risk management policies. Such

approved financial instruments include swaps, options, caps, forwards and

futures. Use of derivative financial instruments for trading or speculative

purposes is prohibited by Company policies.

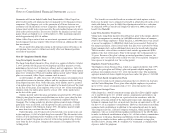

New Accounting Standards: In July 2001, the Financial Accounting Standards

Board (“FASB”) issued Statement No. 141, Accounting for Business Combina-

tions, and Statement No. 142, Goodwill and Other Intangible Assets. These

Statements modify accounting for business combinations after June 30, 2001

and will affect the Company’s treatment of goodwill and other intangible

assets at the start of fiscal year 2002. The Statements require that goodwill

existing at the date of adoption be reviewed for possible impairment and that

impairment tests be periodically repeated, with impaired assets written-down

to fair value. The initial test of goodwill must be completed within six months

of adoption, or by June 2002 for Office Depot, with a completion of testing

by the end of 2002. Additionally, existing goodwill and intangible assets must

be assessed and classified consistent with the Statements’ criteria. Intangible

assets with estimated useful lives will continue to be amortized over those

periods. Amortization of goodwill and intangible assets with indeterminate

lives will cease. We have not yet completed the initial test of existing goodwill

and, accordingly, cannot estimate the full impact of these rules. However,

goodwill amortization, which totaled $7.0 million for 2001, will no longer

be recorded.

In July 2001, the FASB issued Statement No. 143, Accounting for Asset

Retirement Obligations. This Statement requires capitalizing any retirement

costs as part of the total cost of the related long-lived asset and subsequently

allocating the total expense to future periods using a systematic and rational

method. Adoption of this Statement is required for Office Depot with the

beginning of fiscal year 2003. We have not yet completed our evaluation of

the impact of adopting this Statement.

In October 2001, the FASB issued Statement No. 144, Accounting for the

Impairment or Disposal of Long-Lived Assets. This Statement supersedes

Statement No. 121 but retains many of its fundamental provisions. Addition-

ally, this Statement expands the scope of discontinued operations to include

more disposal transactions. The provisions of this Statement are effective for

Office Depot with the beginning of fiscal year 2002. We do not anticipate

a significant impact to the Company’s results of operations from adoption of

this Statement.

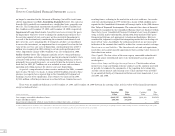

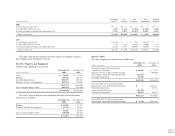

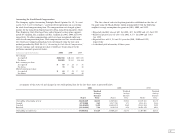

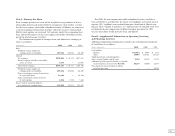

Note B—2000 Comprehensive Business Review and Other

During the second half of 2000, following a change in senior management,

Company personnel performed a comprehensive review of the business. As

a result of this review, a significant number of facilities were closed, assets

were written down and employees were severed. At the same time, initiatives

were launched to enhance the shoppers’ experience and improve efficiency.

Essentially all actions resulting from the business review were put in place

during the last part of 2000 or early 2001. Additionally in 2000, costs were

recorded relating to executive severance arrangements and gains were realized

from the sale of certain Internet investments. The primary elements of the