Office Depot 2001 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Office Depot, Inc.

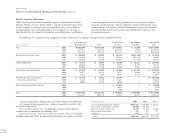

Notes to Consolidated Financial Statements (continued)

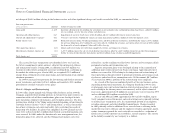

The Company’s 364-day term domestic credit agreement provides up to

$255.0 million of working capital availability through May 2002. While no

amounts were outstanding under this agreement, the borrowing rate at

December 29, 2001 was 0.95% over the London Interbank Offered Rate

(“LIBOR”). The 364-day credit agreement existing at December 30, 2000 pro-

vided up to $300.0 million of credit. Of that amount, $146.0 was outstanding

at December 30, 2000, with an average effective interest rate of 7.996%.

The Company also has a long-term domestic credit facility that provides

working capital and letters of credit capacity totaling $300.0 million through

February 2003. There were no outstanding borrowings under this credit facil-

ity at December 29, 2001 compared with $243.6 million at December 30,

2000. Letters of credit utilized under this agreement totaled $36.8 million

and $49.5 million for the fiscal years ending 2001 and 2000, respectively. The

borrowing rates under this agreement at December 29, 2001 and December 30,

2000 were 0.70% over LIBOR and 0.475% over LIBOR, respectively. The

average effective interest rate on borrowings under this facility for the prior

year was 7.001%.

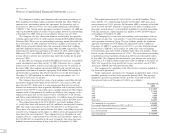

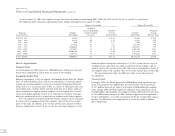

In July 2001, the Company issued $250 million of seven year, non-callable,

senior subordinated notes due on July 15, 2008. The notes have a coupon

interest rate of 10.00%, payable semi-annually on January 15 and July 15.

In August 2001, the Company entered into LIBOR-based variable rate swap

agreements with notional amounts aggregating $250 million that qualify for

shortcut hedge accounting. The effective interest rate on this borrowing at

December 29, 2001 including the effect of the swap agreements, was 7.8%

and will be reset every six months.

The Company has issued two series of zero coupon, convertible subordi-

nated notes (Liquid Yield Option Notes (LYONst), one series in 1992 and

one series in 1993. Each series is a zero coupon note that pays no current

interest, but increases in value to provide the holder with a constant yield to

maturity. Each LYONtis convertible into a specified amount of Office Depot

common stock at the option of the holder, is callable by the Company at the

original issue price plus accrued interest and is subordinated to all existing

and future senior indebtedness. Approximately 13.8 million shares of common

stock have been reserved for the possible conversion of these LYONs® issues.

The original proceeds of the 1992 LYONstwas $150.8 million. With a

5% yield, these notes will increase to $316.3 million by maturity in December

2007. The stock conversion rate on the 1992 LYONstis 43.895 per note.

These notes also contain an option feature that allows each holder to put the

security to the Company on December 11, 2002 in return for payment of the

issue price plus accrued interest. The Company may pay the holder in cash,

common stock or a combination of the two. Because the holder’s option on

the 1992 LYONstis exercisable in the next 12 months, this series has been

included in current maturities of long-term debt at December 29, 2001.

The original proceeds of the 1993 LYONstwas $190.5 million. These

notes provide a 4% yield through maturity in November 2008 and a stock

conversion rate of 31.851 per note. In November 2000, a majority of the hold-

ers of the 1993 LYONstrequired us to purchase the notes at original issue

price plus accrued interest. A total of $249.2 million was paid in connection

with this repurchase. Approximately $2.2 million of 1993 LYONs® remain

outstanding at December 29, 2001.

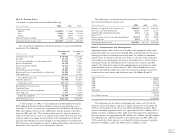

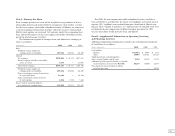

The Company has a term loan and revolving credit agreements with sev-

eral Japanese banks (the “yen facilities”) to provide financing for operating

and expansion activities in Japan. The yen facilities provide for maximum

aggregate borrowings of ¥9.76 billion (the equivalent of $74.5 million at

December 29, 2001) at an interest rate of 0.875% over the Tokyo Interbank

Offered Rate (“TIBOR”). At December 29, 2001 there were outstanding

yen borrowings equivalent to $74.5 million under these yen facilities, which

had an average effective interest rate of 1.118%. The total amount outstanding

is included in current maturities of long-term debt because the facility expires

in July 2002. The Company has entered into a yen interest rate swap agree-

ment with a U.S. dollar notional equivalent of $18.6 million at December 29,

2001. The terms of the swap specify that we pay an interest rate of 0.700%

and receive TIBOR and will expire in July 2002.

The Company is in compliance with all restrictive covenants included in

the above debt agreements.

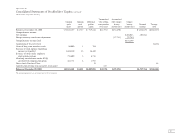

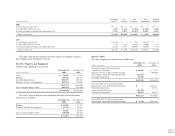

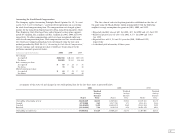

Under capital lease agreements, the Company is required to make certain

monthly, quarterly or annual lease payments through 2020. The aggregate

minimum capital lease payments for the next five years and beyond, with

their present value as of December 29, 2001, are as follows:

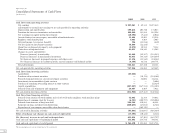

December 29,

(Dollars in thousands) 2001

2002 $ 15,937

2003 15,134

2004 9,962

2005 7,009

2006 6,224

Thereafter 68,675

Total minimum lease payments 122,941

Less amount representing interest at 5.00% to 10.27% 42,484

Present value of net minimum lease payments 80,457

Less current portion 10,486

Long-term portion $ 69,971