Office Depot 2001 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

Office Depot, Inc.

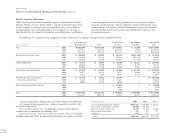

Notes to Consolidated Financial Statements (continued)

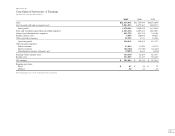

no longer be amortized in the Statement of Earnings, but will be tested annu-

ally for impairment (see New Accounting Standards below). For each year

through 2001, goodwill was amortized on a straight-line basis, generally over

40 years. The accumulated amortization of goodwill was $68.3 million and

$63.2 million as of December 29, 2001 and December 30, 2000, respectively.

Impairment of Long-Lived Assets: Long-lived assets are reviewed for possi-

ble impairment whenever events or changes in circumstances indicate that

the carrying amount of such assets may not be recoverable. Impairment is

assessed at the location level, considering the estimated undiscounted cash

flows over the asset’s remaining life. If estimated cash flows are insufficient

to recover the investment, an impairment loss is recognized based on the fair

value of the asset less any costs of disposition. An impairment loss of $19.3

million was recognized in 2001 relating to certain under-performing retail

stores. Impairment charges of $63.0 million were also recognized in 2000.

Facility Closure Costs: The Company regularly reviews store performance

against expectations and closes stores not meeting investment standards. Costs

associated with closures resulting from such on-going performance reviews,

principally lease cancellation costs, are accrued when the decision to close is

made and, in 2001, $5.7 million, net was included in store and warehouse

operating and selling expenses for closures and asset dispositions.

As part of a comprehensive business review conducted in 2000, a commit-

ment to close 70 stores was made. A charge of $110.0 million related to those

closures was reported on a separate line in the Consolidated Statements of

Earnings, because of its significance. This estimate was increased in 2001

by $8.4 million, reflecting an increase in estimated lease termination costs

resulting from a softening in the market for real estate subleases. An acceler-

ated store closure program in 1999 resulted in a charge of $40.4 million and is

reported in the Consolidated Statements of Earnings similar to the 2000 closures.

Fair Value of Financial Instruments: The estimated fair values of financial

instruments recognized in the Consolidated Balance Sheets or disclosed within

these Notes to our Consolidated Financial Statements have been determined

using available market information, information from unrelated third party

financial institutions and appropriate valuation methodologies. However,

considerable judgment is required in interpreting market data to develop esti-

mates of fair value. Accordingly, the estimates presented are not necessarily

indicative of the amounts that could be realized in a current market exchange.

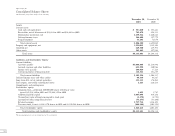

Short-term assets and liabilities: The fair values of cash and cash equivalents,

receivables and accounts payable approximate their carrying values because of

their short-term nature.

Notes Payable: The fair values of the zero coupon, convertible subordinated

notes and senior subordinated notes were determined based on quoted

market prices.

Interest Rate Swaps and Foreign Currency Contracts: The fair values of our

interest rate swaps and foreign currency contracts are the amounts receivable

or payable to terminate the agreements at the reporting date, taking into

account current interest and exchange rates. These amounts were provided

by an unrelated third party financial institution and were immaterial at year

end 2001 and 2000.

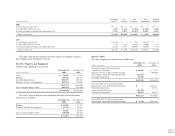

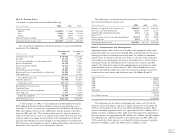

There were no significant differences as of December 29, 2001 and December 30, 2000 between the carrying values and fair values of the financial instruments

except as disclosed below:

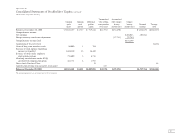

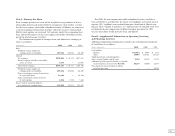

2001 2000

Carrying Fair Carrying Fair

(Dollars in thousands) Value Value Value Value

Zero coupon, convertible subordinated notes $235,747 $258,794 $224,438 $195,453

Senior subordinated notes 245,360 271,250 ——

Long-term investments for which it is practicable to estimate fair value—warrants(1) —— — 14,913

(1) We own 944,446 warrants to purchase shares of PurchasePro.com. Because the warrants have not been registered under the rules of the Securities Act of 1933, they are not publicly traded on a market exchange. In 2000, we determined the fair value of these

warrants using an option model with the assistance of our investment banker. At December 29, 2001, the fair value of the warrants was minimal.