Office Depot 2001 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Office Depot, Inc.

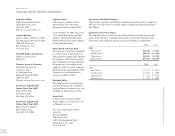

Notes to Consolidated Financial Statements (continued)

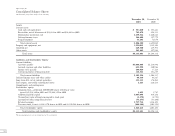

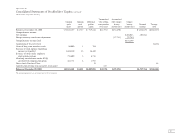

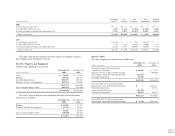

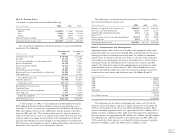

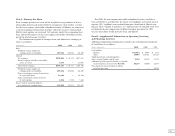

net charge of $260.6 million relating to the business review and other significant charges and credits recorded in 2000, are summarized below:

Line item presentation

(Dollars in millions) Amount Nature of charge or credit

Gross profit $ 48.9 Inventory adjustment of $38.4 million for write-down to net realizable value and liquidation from closed stores, and $10.5 million,

net, to establish a reserve for sales returns and allowances.

Operating and selling expenses 64.7 Impairment of assets in closed stores of $63.0 million and $1.7 million reduction in contract sales force.

General and administrative expenses 45.1 Severance costs of $33.9 million for changes in senior management and $11.2 million to write-off corporate assets.

Facility closure costs 110.0 Estimated costs for closing 70 under-performing stores and four inefficient warehouses. Included in the charge is $75.2 million

for net lease obligations, $21.7 million for asset write-offs, $2.8 million for severance and various other exit costs of $10.3 million

for items such as leased equipment, labor and facility clean up.

Other operating expenses (6.8) Merger and restructuring net credit from completed activities and changes in estimates.

Miscellaneous (income) expense, net (1.3) A $57.9 million gain on the sale of certain Internet investments, offset by a $45.5 million charge for an other than temporary

decline in value of other Internet investments and $11.1 million charge relating to goodwill impairment.

Total charges, net $260.6

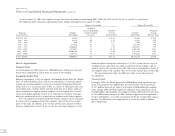

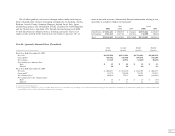

The accrual for lease termination costs identified above was based on

the future commitments under contract, adjusted for anticipated sublease

and termination benefits. During 2001, an additional net $8.4 million was

recorded to reflect lower anticipated recoveries resulting from a softening in

the market for sublease space. Also in 2001, we recognized $15.9 million of

charges from settlement of certain legal claims and amortization of an existing

retention agreement.

In 1999 we increased our provision for slow-moving and obsolete inventory

in our warehouses and stores by $56.1 million and recorded a $15.8 million

provision for extended warranty service plans.

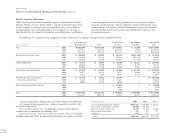

Note C—Merger and Restructuring

In 1998 Office Depot merged with Viking Office Products and in 1999 the

Company acquired full ownership interests in two previous joint ventures. In

connection with each of these combinations, plans were developed to inte-

grate operations, eliminate redundancies and streamline processes. The inte-

gration plans relating to the Viking merger included opening certain domestic

Customer Service Centers (“CSCs”) and closing others, as well as the installa-

tion of new systems in each surviving facility. After evaluating the results of

integrating two facilities, the plans were simplified. In 1999, planned net clo-

sures were reduced and $28.6 million of previously accrued integration costs

were reversed. In 2000, under the direction of a new management team, the

integration plans were adjusted, and the Viking-related merger costs were

reduced by a net $6.3 million to reflect fewer closures and to recognize added

personnel retention and termination costs.

Separate integration plans were developed relating to the acquisition of

additional joint venture interests in France and Japan. Approximately $23.5

million was accrued in 1999 relating to the integration and restructuring of

these operations, primarily related to personnel retention and severance, facil-

ity closures and related lease termination costs. Of this amount, $0.7 million

was reversed in 2000 as portions of the restructuring were completed.

As a result of the focus on continued growth of the core business and on

expanding international operations, the Company decided in 1998 to close

its photocopy stores and certain furniture-related retail operations. As actual

costs relating to the closure process were incurred, and to adjust estimated

lease costs, approximately $2.0 million of accrued costs were reversed in 1999

and an additional $0.2 million recorded in 2000.

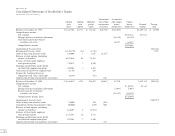

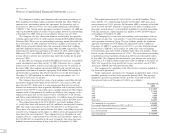

At year-end 2001 and 2000, approximately $4.9 and $3.9 million, respec-

tively, remained accrued for merger and restructuring costs, primarily relating

to residual lease termination costs, the unamortized portion of an employee

retention agreement and other identified commitments. Charges recorded

in 2001 primarily relate to additional lease accruals from a softening in the

market for real estate subleases and for employee retention agreement amorti-

zation. Amounts expensed for asset write-offs are recorded as a reduction of

fixed assets; all other amounts are recorded as accrued expenses. The activity

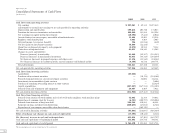

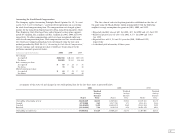

in the liability accounts by cost category is as follows: