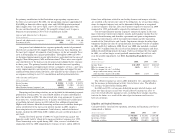

Office Depot 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

the primary contribution to the fluctuation in pre-opening expenses over

the three years presented. For 2001, our pre-opening expenses approximated

$160,000 per domestic office supply store and $101,000 per international

office supply store. Our cost to open a new CSC varies significantly with

the size and location of the facility. We currently estimate costs to open a

domestic or international CSC to be $1.5 million per facility.

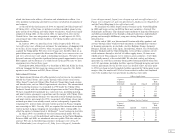

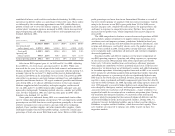

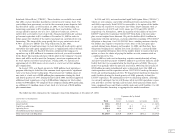

General and Administrative Expenses

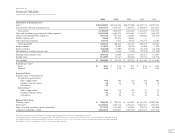

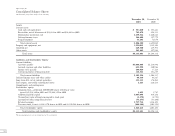

(Dollars in thousands) 2001 2000 1999

General and administrative expenses $451,722 $453,784 $328,108

Percentage of sales 4.0% 3.9% 3.2%

Our general and administrative expenses primarily consist of personnel-

related costs associated with support functions. Because these functions, for

the most part, support all segments of our business, we do not consider these

costs in determining our segment profitability. Throughout 2000 and 1999,

we developed improvements in our infrastructure, particularly in the areas of

Supply Chain Management, MIS and International. These areas were signifi-

cant contributors to the increases in our general and administrative expenses

in those years. The primary benefits derived from this increased spending

were the expansion and improvement of our e-commerce services, a new data

center, improvements in our inventory in-stock positions and support for our

rapidly growing International Division. Also included in this category in 1999

are expenses relating to our CSC consolidation and integration initiatives.

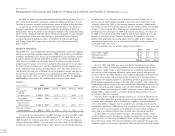

Other Income and Expense

(Dollars in thousands) 2001 2000 1999

Interest income $ 13,058 $ 11,502 $ 30,176

Interest expense (44,302) (33,901) (26,148)

Miscellaneous income (expense), net (9,057) 4,632 (3,514)

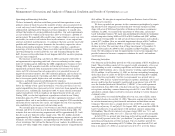

Financing and investing activities are not included in determining segment

profitability. During 2001, we issued $250 million of senior subordinated

notes that mature in 2008. We also entered into swap agreements to convert

these notes to a variable interest rate, to balance our fixed and variable inter-

est portfolio. Interest expense in 2001 reflects this additional borrowing.

Higher cash balances from this borrowing and increased cash flow from oper-

ations contributed to the increase in interest income in 2001, despite a

decreasing interest rate environment. Cash balances, and related interest

income, declined in 2000 from $300.8 million of cash used for purchases of

our stock.

During the fourth quarter of 2000, we began borrowing against our

domestic credit facility, which led to increased interest expense over 1999.

These borrowings were repaid during 2001. Also, reserves established in

connection with the 2000 comprehensive business review, and in 2001 for

future lease obligations related to our facility closures and merger activities,

are recorded at the net present value of the obligation. As we pay these obliga-

tions, the imputed interest cost on the discounted obligations is recognized

as interest expense. This has also caused interest expense to increase in 2000

compared to 1999 and should be expected to continue in future years.

Our net miscellaneous income (expense) consists of equity in the earn-

ings of our joint venture investments, royalty and franchise income that we

generate from licensing and franchise agreements and gains or impairments

on Internet investments. All of our equity investments involve operations

outside of the United States and Canada. Impairment charges for other than

temporary declines in value of certain Internet investments were $14.7 million

in 2001 and $45.5 million in 2000. Fiscal year 2000 also included a realized

gain of $57.9 million from the sale of certain Internet investments and $11.1

million of goodwill impairment in Japan. Under accounting rules that apply

in 2002, we will no longer record goodwill amortization, but will test each

year for possible impairment. See New Accounting Standards below.

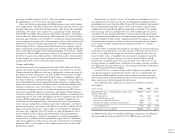

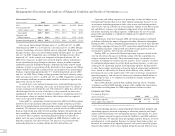

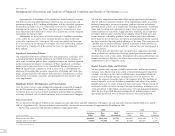

Income Taxes

(Dollars in thousands) 2001 2000 1999

Income Taxes $113,087 $43,127 $156,249

Effective income tax rate* 36.0% 46.6% 37.8%

Effective income tax rate*, excluding

merger and restructuring costs and

other one-time charges and credits 36.0% 37.0% 37.0%

*Income Taxes as a percentage of earnings before income taxes.

The effective income tax rate in 2001 declined to 36%, primarily reflect-

ing the increase in International activity taxed at lower rates. The effective

tax rate may decline further during 2002.

In 2000 and 1999, certain non-deductible merger-related charges and

other one-time charges caused our overall effective income tax rates to

rise. Our overall effective income tax rate, excluding these charges, may fluc-

tuate in the future as a result of the mix of pre-tax income and tax rates

between countries.

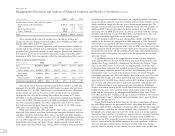

Liquidity and Capital Resources

Cash provided by (used in) our operating, investing and financing activities is

summarized as follows:

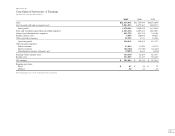

(Dollars in thousands) 2001 2000 1999

Operating activities $ 747,166 $ 316,482 $ 369,449

Investing activities (231,944) (239,365) (447,841)

Financing activities (85,403) (134,093) (405,849)