OG&E 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

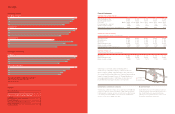

14 OGE Energy Corp. OGE Energy Corp. 15

Results of Operations

The following discussion and analysis presents factors that affected the

Company’s consolidated results of operations for the years ended

December 31, 2014, 2013 and 2012 and the Company’s consolidated

financial position at December 31, 2014 and 2013. The following

information should be read in conjunction with the Consolidated

Financial Statements and Notes thereto. Known trends and

contingencies of a material nature are discussed to the extent

considered relevant.

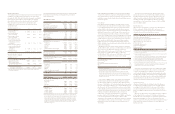

Year ended December 31

(In millions except per share data) 2014 2013 2012

Net income attributable

to OGE Energy $ 395.8 $ 387.6 $ 355.0

Basic average common

shares outstanding 199.2 198.2 197.1

Diluted average common

shares outstanding 199.9 199.4 198.1

Basic earnings per average

common share attributable

to OGE Energy common

shareholders $ 1.99 $ 1.96 $ 1.80

Diluted earnings per average

common share attributable

to OGE Energy common

shareholders $ 1.98 $ 1.94 $ 1.79

Dividends declared

per common share $0.95000 $0.85125 $0.79750

Results by Business Segment

Year ended December 31

(In millions) 2014 2013 2012

Net Income attributable to OGE Energy

OG&E (Electric Utility) $292.0 $292.6 $280.3

OGE Holdings (Natural

Gas Midstream Operations) 102.3 99.9 74.1

Other Operations (A) 1.5 (4.9) 0.6

Consolidated net income

attributable to OGE Energy $395.8 $387.6 $355.0

(A) Other Operations primarily includes the operations of the holding company and

consolidating eliminations.

The following operating results analysis by business segment includes

intercompany transactions that are eliminated in the Consolidated

Financial Statements.

OG&E (Electric Utility)

Year ended December 31 (Dollars in millions) 2014 2013 2012

Operating revenues $2,453.1 $2,262.2 $2,141.2

Cost of sales 1,106.6 965.9 879.1

Other operation and maintenance 453.2 438.8 446.3

Depreciation and amortization 270.8 248.4 248.7

Taxes other than income 84.5 83.8 77.7

Operating income 538.0 525.3 489.4

Allowance for equity funds used

during construction 4.2 6.6 6.2

Other income 4.8 8.1 8.2

Other expense 1.9 4.6 4.3

Interest expense 141.5 129.3 124.6

Income tax expense 111.6 113.5 94.6

Net income $ 292.0 $ 292.6 $ 280.3

Operating revenues by classification

Residential $ 925.5 $ 901.4 $ 878.0

Commercial 583.3 554.2 523.5

Industrial 224.5 220.6 206.8

Oilfield 188.3 176.4 163.4

Public authorities and street light 220.3 214.3 202.4

Sales for resale 52.9 59.4 54.9

System sales revenues 2,194.8 2,126.3 2,029.0

Off-system sales revenues 94.1 14.7 36.5

Other 164.2 121.2 75.7

Total operating revenues $2,453.1 $2,262.2 $2,141.2

Reconciliation of gross margin to revenue:

Operating revenues $2,453.1 $2,262.2 $2,141.2

Cost of sales 1,106.6 965.9 879.1

Gross margin $1,346.5 $1,296.3 $1,262.1

MWH sales by classification (in millions)

Residential 9.4 9.4 9.1

Commercial 7.2 7.1 7.0

Industrial 3.8 3.9 4.0

Oilfield 3.4 3.4 3.3

Public authorities and street light 3.2 3.2 3.3

Sales for resale 1.0 1.2 1.3

System sales 28.0 28.2 28.0

Off-system sales 2.2 0.4 1.4

Total sales 30.2 28.6 29.4

Number of customers 814,982 806,940 798,110

Weighted-average cost of energy

per kilowatt-hour-cents

Natural gas 4.506 3.905 2.930

Coal 2.152 2.273 2.310

Total fuel 2.752 2.784 2.437

Total fuel and purchased power 3.493 3.178 2.806

Degree days(A)

Heating – Actual 3,569 3,673 2,667

Heating – Normal 3,349 3,349 3,349

Cooling – Actual 2,114 2,106 2,561

Cooling – Normal 2,092 2,092 2,092

(A)

Degree days are calculated as follows: The high and low degrees of a particular day

are added together and then averaged. If the calculated average is above 65 degrees,

then the difference between the calculated average and 65 is expressed as cooling

degree days, with each degree of difference equaling one cooling degree day. If the

calculated average is below 65 degrees, then the difference between the calculated

average and 65 is expressed as heating degree days, with each degree of difference

equaling one heating degree day. The daily calculations are then totaled for the

particular reporting period.

2014 compared to 2013. OG&E’s net income decreased 0.6 million,

or 0.2 percent, in 2014 as compared to 2013 primarily due to higher

gross margin, which was almost offset by higher other operations and

maintenance expense, higher depreciation and amortization expense,

and interest expense.

Gross Margin

Gross Margin is defined by OG&E as operating revenues less fuel,

purchased power and certain transmission expenses. Gross margin

is a non-GAAP financial measure because it excludes depreciation

and amortization, and other operation and maintenance expenses.

Expenses for fuel and purchased power are recovered through fuel

adjustment clauses and as a result changes in these expenses are

offset in operating revenues with no impact on net income. OG&E

believes gross margin provides a more meaningful basis for evaluating

its operations across periods than operating revenues because gross

margin excludes the revenue effect of fluctuations in these expenses.

Gross margin is used internally to measure performance against

budget and in reports for management and the Board of Directors.

OG&E’s definition of gross margin may be different from similar terms

used by other companies.

Operating revenues were $2,453.1 million in 2014 as compared to

$2,262.2 million in 2013, an increase of $190.9 million, or 8.4 percent.

Cost of sales were $1,106.6 million in 2014 as compared to

$965.9 million in 2013, an increase of $140.7 million, or 14.6 percent.

Gross margin was $1,346.5 million in 2014 as compared to

$1,296.3 million in 2013, an increase of $50.2 million, or 3.9 percent.

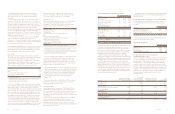

The below factors contributed to the change in gross margin:

(In millions) $ Change

Wholesale transmission revenue (A) $ 43.8

New customer growth 13.8

Price variance (B) 6.8

Non-residential demand and related revenues 1.4

Other (1.7)

Quantity variance (primarily weather) (13.9)

Change in gross margin $ 50.2

(A) Increased primarily due to higher investments related to certain FERC approved

transmission projects included in formula rates.

(B) Increased due to higher rider revenues primarily from the Oklahoma Demand

Program rider, the Oklahoma Storm Recovery rider and the Arkansas Demand

Program rider partially offset by lower rider revenues from the Oklahoma Crossroads

rider, Oklahoma Smart Grid rider, Oklahoma System Hardening rider and the

Arkansas Crossroads rider.

Cost of sales for OG&E consists of fuel used in electric generation,

purchased power and transmission related charges. Fuel expense

was $627.5 million in 2014 as compared to $672.7 million in 2013, a

decrease of $45.2 million, or 6.7 percent, primarily due to lower natural

gas used offset by higher natural gas prices. In 2014, OG&E’s fuel mix

was 61 percent coal, 32 percent natural gas and seven percent wind.

In 2013, OG&E’s fuel mix was 53 percent coal, 40 percent natural gas

and seven percent wind. Purchased power costs were $444.1 million

in 2014 as compared to $267.6 million in 2013, an increase of

$176.5 million, or 66.0 percent, primarily due to an increase in

purchases from the SPP, reflecting the impact of OG&E’s participation

in the SPP Integrated Market, which began on March 1, 2014.

Transmission related charges were $35.0 million in 2014 as compared

to $25.6 million in 2013, an increase of $9.4 million, or 36.7 percent,

primarily due to higher SPP charges for the base plan projects of

other utilities.

The actual cost of fuel used in electric generation and certain

purchased power costs are passed through to OG&E’s customers

through fuel adjustment clauses. The fuel adjustment clauses are

subject to periodic review by the OCC, the APSC and the FERC.

The OCC, the APSC and the FERC have authority to review the

appropriateness of gas transportation charges or other fees OG&E

pays to its affiliate, Enable.

Operating Expenses

Other operation and maintenance expenses were $453.2 million in

2014 as compared to $438.8 million in 2013, an increase of

$14.4 million, or 3.3 percent. The below factors contributed to the

change in other operations and maintenance expense:

(In millions) $ Change

Reduction in capitalized labor (A) $11.4

Corporate overhead and allocations (B) 4.0

Contract professional services (primarily marketing services) 3.8

Ongoing maintenance at power plants 3.5

Other marketing, sales and commercial (C) 2.3

Software expense (D) 2.3

Fees, permits and licenses (E) 2.3

Vegetation management (F) (4.5)

Employee benefits (G) (4.9)

Salaries and wages (H) (5.8)

Change in other operation and maintenance expense $14.4

(A) Portion of labor costs capitalized into projects decreased as a result of less work

performed on storm restoration.

(B) Increased primarily due to higher allocated costs from the holding company resulting

from the formation of Enable during 2013.

(C) Increased primarily due to demand side management customer payments which are

recovered through a rider partially offset by a reduction in media services expense.

(D) Increased as a result of higher expenditures related to Smart Grid software.

(E) Increased primarily due to higher SPP administration and assessment fees.

(F) Decreased primarily due to increased spending on system hardening in 2013 which

includes costs that are being recovered through a rider.

(G) Decreased primarily due to lower pension expense, postretirement and other benefits.

(H) Decreased primarily due to incentive compensation and lower overtime wages

partially offset by higher regular salaries and wages.

Depreciation and amortization expense was $270.8 million in 2014

as compared to $248.4 million in 2013, an increase of $22.4 million,

or 9.0 percent, primarily due to additional assets being placed in

service primarily related to transmission lines being placed in service

throughout 2013 and 2014, along with an increase resulting from the

amortization of the deferred pension credits regulatory liability which

was fully amortized in July 2014. These were offset by the pension

regulatory asset which was fully amortized in July 2013.

Additional Information

Allowance for Equity Funds Used During Construction. Allowance

for equity funds used during construction was $4.2 million in 2014

as compared to $6.6 million in 2013, a decrease of $2.4 million or

36.4 percent, primarily due to lower construction work in progress

balances resulting from transmission projects being placed in service

in 2014.

Other Income. Other income was $4.8 million in 2014 as compared

to $8.1 million in 2013, a decrease of $3.3 million or 40.7 percent,

primarily due to decreased margins recognized in the guaranteed flat

bill program during 2014 as a result of cooler weather in the first

quarter as compared to the same period in 2013 along with a decrease

in the tax gross up related to the allowance for equity funds used

during construction.