OG&E 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 OGE Energy Corp. OGE Energy Corp. 13

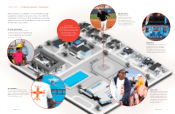

Marketplace, the SPP assumed balancing authority responsibilities for

its market participants. The SPP Integrated Marketplace functions as

a centralized dispatch, where market participants, including OG&E,

submit offers to sell power to the SPP from their resources and bid to

purchase power from the SPP for their customers. The SPP Integrated

Marketplace is intended to allow the SPP to optimize supply offers and

demand bids based upon reliability and economic considerations, and

determine which generating units will run at any given time for

maximum cost-effectiveness. As a result, OG&E’s generating units may

produce output that differs from OG&E’s customer load requirements.

Net fuel and purchased power costs are recovered through fuel

adjustment clauses.

Overview

Company Strategy

The Company’s mission, through OG&E and its equity interest in

Enable, is to fulfill its critical role in the nation’s electric utility and

natural gas midstream pipeline infrastructure and meet individual

customers’ needs for energy and related services focusing on safety,

efficiency, reliability, customer service and risk management. The

Company’s corporate strategy is to continue to maintain its existing

business mix and diversified asset position of its regulated electric

utility business and interest in a publicly traded midstream company,

while providing competitive energy products and services to customers

as well as seeking growth opportunities in both businesses.

OG&E is focused on:

• Providing exceptional customer experiences by continuing to improve

customer interfaces, tools, products and services that deliver high

customer satisfaction and operating productivity.

• Providing safe, reliable energy to the communities and customers we

serve. A particular focus is on enhancing the value of the grid by

improving distribution grid reliability by reducing the frequency and

duration of customer interruptions and leveraging previous grid

technology investments.

• Maintaining strong regulatory and legislative relationships for the

long-term benefit of our customers, investors and members.

• Continuing to grow a zero-injury culture and deliver top-quartile

safety results.

• Expanding transmission investments beyond traditional opportunities.

• Executing on the Company’s Environmental Compliance Plan.

• Ensuring we have the necessary mix of generation resources to

meet the long term needs of our customers.

• Continuing focus on operational excellence and efficiencies in order

to protect the customer bill.

Additionally, the Company wants to achieve a premium valuation of

its businesses relative to its peers, grow earnings per share with a

stable earnings pattern, create a high performance culture and achieve

desired outcomes with target stakeholders. The Company’s financial

objectives include a long-term annual earnings growth rate for OG&E

of three to five percent on a weather-normalized basis, maintaining a

strong credit rating as well as targeting dividend increases of

approximately 10 percent annually through 2019. The targeted annual

dividend increase has been determined after consideration of

numerous factors, including the largely retail composition of the

Company’s shareholder base, the Company’s financial position, the

Company’s growth targets and the composition of the Company’s

assets and investment opportunities. The Company also relies on cash

distributions from its investment in Enable to fund its capital needs and

support future dividend growth. The cash distributions from Enable are

expected to grow 3 percent to 7 percent in 2015 from the fourth quarter

2014 distribution. The Company believes it can accomplish these

financial objectives by, among other things, pursuing multiple avenues

to build its business, maintaining a diversified asset position, continuing

to develop a wide range of skills to succeed with changes in its

industries, providing products and services to customers efficiently,

managing risks effectively and maintaining strong regulatory and

legislative relationships.

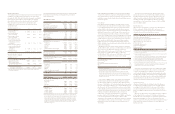

Summary of Operating Results

2014 compared to 2013. Net income attributable to OGE Energy was

$395.8 million, or $1.98 per diluted share, in 2014 as compared to

$387.6 million, or $1.94 per diluted share, in 2013. The increase in net

income attributable to OGE Energy of $8.2 million, or 2.1 percent, or

$0.04 per diluted share, in 2014 as compared to 2013 was primarily

due to:

• an increase in net income at OGE Holdings of $2.4 million, or

2.4 percent, or $0.01 per diluted share of the Company’s common

stock, due partially to the accretive effect to OGE Holdings of Enable

partially offset by a reduction in deferred state income taxes in 2013

associated with a remeasurement of the accumulated deferred taxes

related to the formation of Enable;

• an increase in net income at OGE Energy of $6.4 million, or

$0.04 per diluted share of the Company’s common stock, primarily

due to decreased transaction expenses related to the formation of

Enable and a decrease in losses for the deferred compensation plan;

and

• a decrease in net income at OG&E of $0.6 million, or 0.2 percent, or

$0.01 per diluted share of the Company’s common stock, reflecting

an increase in depreciation expense due to additional assets being

placed in service in 2014, a decrease in gross margin related to

milder weather compared to 2013, an increase in other operation and

maintenance expense and an increase in interest expense related to

the issuance of debt. Partially offsetting these items was an increase

in wholesale transmission revenues, an increase in customer growth

and a decrease in incentive compensation.

2013 compared to 2012. Net income attributable to OGE Energy was

$387.6 million, or $1.94 per diluted share, in 2013 as compared to

$355.0 million, or $1.79 per diluted share, in 2012. The increase in net

income attributable to OGE Energy of $32.6 million, or 9.2 percent, or

$0.15 per diluted share, in 2013 as compared to 2012 was primarily

due to:

• an increase in net income at OG&E of $12.3 million, or 4.4 percent,

or $0.06 per diluted share of the Company’s common stock, driven

by higher gross margin primarily related to increased wholesale

transmission revenue and lower other operation and maintenance

expense, partially offset by higher interest expense related to the

issuance of debt in May 2013;

• an increase in net income at OGE Holdings of $25.8 million, or

34.8 percent, or $0.13 per diluted share of the Company’s common

stock, due partially to the accretive effect to OGE Holdings of its

investment in Enable since May 1, 2013 and a reduction in deferred

state income taxes, associated with a remeasurement of the

accumulated deferred taxes related to the formation of Enable. Also

contributing to the increase was the performance of Enogex for the

first four months of 2013. Compared to the same period of 2012,

earnings were higher for Enogex due to increased gathering rates

and volumes and inlet processing volumes associated with its

expansion projects and gas gathering assets acquired in August

2012. These increases were partially offset by lower NGLs prices,

lower keep-whole processing spreads and the contract conversion

of the Texas production volumes of one of Enogex’s five largest

customers from keep-whole to fixed-fee; and

• a decrease in net income at OGE Energy of $5.5 million, or $0.04 per

diluted share of the Company’s common stock, primarily due to

transaction expenses related to the formation of Enable as discussed

in Note 3 of Notes to Condensed Consolidated Financial Statements.

A more detailed discussion regarding the financial performance of

OG&E and the Natural Gas Midstream Operations can be found under

“Results of Operations” below.

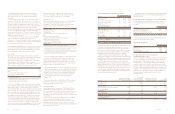

2015 Outlook

Key assumptions for 2015 include:

OG&E

The Company projects OG&E to earn approximately $282 million to

$298 million, or $1.41 to $1.49 per average diluted share in 2015 and

is based on the following assumptions:

• Normal weather patterns are experienced for the remainder of

the year;

• Gross margin on revenues of approximately $1.375 billion to

$1.385 billion based on sales growth of approximately 1 percent

on a weather-adjusted basis;

• Approximately $114 million of gross margin is primarily attributed

to regionally allocated transmission projects;

• Operating expenses of approximately $844 million to $861 million,

with operation and maintenance expenses comprising 54 percent of

the total;

• Interest expense of approximately $146 million which assumes a

$5 million allowance for borrowed funds used during construction

reduction to interest expense;

• Other income of approximately $17 million including approximately

$9 million of allowance for equity funds used during construction; and

• An effective tax rate of approximately 27 percent.

OG&E has significant seasonality in its earnings. OG&E typically

shows minimal earnings in the first and fourth quarters with a majority

of earnings in the third quarter due to the seasonal nature of air

conditioning demand.

Gross Margin is defined by OG&E as operating revenues less fuel,

purchased power and certain transmission expenses. Gross margin

is a non-GAAP financial measure because it excludes depreciation

and amortization, and other operation and maintenance expenses.

Expenses for fuel and purchased power are recovered through fuel

adjustment clauses and as a result changes in these expenses are

offset in operating revenues with no impact on net income. OG&E

believes gross margin provides a more meaningful basis for evaluating

its operations across periods than operating revenues because gross

margin excludes the revenue effect of fluctuations in these expenses.

Gross margin is used internally to measure performance against

budget and in reports for management and the Board of Directors.

OG&E’s definition of gross margin may be different from similar terms

used by other companies.

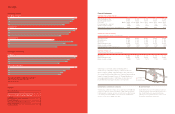

Reconciliation of gross margin to revenue:

Twelve Months Ended

(Dollars in millions) December 31, 2015(A)

Operating revenues $2,188

Cost of sales 808

Gross Margin $1,380

(A) Based on the midpoint of OG&E earnings guidance for 2015.

OGE Enogex Holdings LLC

The Company projects cash distributions from its ownership interest

in Enable Midstream to be between approximately $139 million to

$142 million, and the earnings contribution to be approximately

$70 million to $80 million or $0.35 to $0.40 per average diluted share.

Consolidated OGE

The Company’s 2015 earnings guidance is between approximately

$352 million and $378 million of net income, or $1.76 to $1.89 per

average diluted share and is based on the following assumptions:

• Approximately 200 million average diluted shares outstanding;

• An effective tax rate of approximately 29 percent.