OG&E 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 OGE Energy Corp. OGE Energy Corp. 21

Operating Activities

The increase of $98.4 million, or 15.8 percent, in net cash provided

from operating activities in 2014 as compared to 2013 was primarily

due to:

• the absence of fuel refunds to customers during the twelve months

ended December 31, 2014, partially offset by fuel under recoveries

in the same period;

• an increase in cash distributions received from Enable in excess of

cash distributions and cash provided from the operating activities of

Enogex Holdings in 2013; and

• an increase in cash received during the twelve months ended

December 31, 2014 from transmission revenue.

These increases were partially offset by an increase in amounts paid

to vendors.

The decrease of $422.9 million, or 40.4 percent, in net cash provided

from operating activities in 2013 as compared to 2012 was primarily

due to:

• fuel refunds at OG&E in 2013 as compared to higher fuel recoveries

in 2012; and

• the combination of operating cash generated from the operations of

Enogex Holdings through April 30, 2013 and the cash distributions

received from Enable since May 1, 2013 were less than the operating

cash generated from the operations of Enogex Holdings for the year

ended December 31, 2012.

Investing Activities

The decrease of $397.9 million, or 41.6 percent, in net cash used in

investing activities in 2014 as compared to 2013 was primarily due to

lower levels of capital expenditures due to a decrease in transmission

projects at OG&E and the deconsolidation of Enogex Holdings.

The decrease of $235.6 million, or 19.8 percent, in net cash used in

investing activities in 2013 as compared to 2012 is primarily a result

of decreased capital expenditures related to the deconsolidation of

Enogex Holdings on May 1, 2013 partially offset by increased capital

expenditures at OG&E in 2013 related to various transmission projects.

Financing Activities

The increase of $502.6 million in net cash used in financing activities in

2014 as compared to 2013 was primarily due to:

• a decrease in short-term debt;

• the payment to retire $240 million of long-term debt in 2014;

• payments in 2013 on advances from unconsolidated affiliates due to

the deconsolidation of Enogex Holdings; and

• contributions in 2013 from the ArcLight group related to the closing

of the transaction to form Enable.

These increases were partially offset by proceeds received from the

issuance of long-term debt in 2014.

The increase of $195.1 million in net cash provided from financing

activities in 2013 as compared to 2012 was primarily due to:

• a decrease in repayments of lines of credit in 2013 as compared

to 2012;

• payments on advances from unconsolidated affiliates due to the

deconsolidation of Enogex Holdings on May 1, 2013; and

• higher contributions from the ArcLight group related to the closing

of the transaction to form Enable.

These increases in net cash provided from financing activities were

partially offset by a decrease in short-term debt borrowings during

2013 as compared to 2012.

Future Capital Requirements and Financing Activities

The Company’s primary needs for capital are related to acquiring or

constructing new facilities and replacing or expanding existing facilities

at OG&E. Other working capital requirements are expected to be

primarily related to maturing debt, operating lease obligations, fuel

clause under and over recoveries and other general corporate

purposes. The Company generally meets its cash needs through a

combination of cash generated from operations, short-term borrowings

(through a combination of bank borrowings and commercial paper)

and permanent financings.

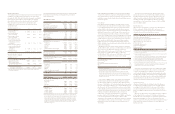

Capital Expenditures

The Company’s consolidated estimates of capital expenditures for

the years 2015 through 2019 are shown in the following table. These

capital expenditures represent the base maintenance capital

expenditures (i.e., capital expenditures to maintain and operate the

Company’s businesses) plus capital expenditures for known and

committed projects. Estimated capital expenditures for Enable are not

included in the table below.

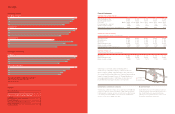

(In millions) 2015 2016 2017 2018 2019

OG&E Base Transmission $ 40 $ 30 $ 30 $ 30 $ 30

OG&E Base Distribution 175 175 175 175 175

OG&E Base Generation 90 75 75 75 75

OG&E Other 50 25 25 25 25

Total Base Transmission, Distribution, Generation and Other 355 305 305 305 305

OG&E Known and Committed Projects:

Transmission Projects:

Regionally Allocated Base Projects (A) 20 20 20 20 20

SPP Integrated Transmission Projects (B) (C) 30 35 25 10 60

Total Transmission Projects 50 55 45 30 80

Other Projects:

Smart Grid Program 10 10 — — —

Environmental - low NOX burners (D) 35 20 10 — —

Environmental - activated carbon injection (D) 20 — — — —

Environmental - natural gas conversion (D) — — — 40 35

Environmental - scrubbers (D) 60 115 75 215 55

Combustion turbines - Environmental Compliance Plan 15 45 175 165 —

Total Other Projects 140 190 260 420 90

Total Known and Committed Projects 190 245 305 450 170

Total $545 $550 $610 $755 $475

(A)

Approximately 30% of revenue requirement allocated to SPP members other than OG&E.

(B)

Approximately 85% of revenue requirement allocated to SPP members other than OG&E.

(C) Estimated Cost Projected

Project Type Project Description (In millions) In-Service Date

Integrated Transmission Project 30 miles of transmission line from OG&E’s Gracemont substation to an $45 Early 2018

AEP companion transmission line to its Elk City substation

Integrated Transmission Project 126 miles of transmission line from OG&E’s Woodward District Extra High Voltage substation $180 Early 2021

to OG&E’s Cimarron substation; construction of the Mathewson substation on this transmission line

(D)

Represent capital costs associated with OG&E’s Environmental Compliance Plan to comply with the EPA’s MATS and Regional Haze rules. More detailed discussion regarding

Regional Haze and OG&E’s Environmental Compliance Plan can be found in Note 15 of Notes to Financial Statements under “Environmental Compliance Plan” in this Annual Report

and under “Environmental Laws and Regulations” within “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report.

Additional capital expenditures beyond those identified in the table above, including additional incremental growth opportunities in electric transmission assets will be evaluated based

upon their impact upon achieving the Company’s financial objectives.

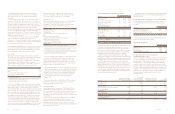

Cash Flows

2014 vs. 2013 2013 vs. 2012

Year ended December 31 (In millions) 2014 2013 2012 $ Change % Change $ Change % Change

Net cash provided from operating activities $ 721.6 $ 623.2 $ 1,046.1 $ 98.4 15.8% $(422.9) (40.4)%

Net cash used in investing activities (559.1) (957.0) (1,192.6) 397.9 41.6% 235.6 19.8%

Net cash provided from (used in) financing activities (163.8) 338.8 143.7 (502.6) * 195.1 *

* Percentage is greater than 100 percent.