OG&E 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 OGE Energy Corp. OGE Energy Corp. 19

OGE Holding’s net income decreased $4.2 million, or 4 percent for

the year ended December 31, 2014 as compared to the same period

of 2013 due to higher pre-tax income and higher tax expense. OGE

Holding’s earnings before taxes increased $38.0 million, or

28.5 percent, for the year ended December 31, 2014 as compared to

the same period of 2013. The increase reflects the accretive effect to

OGE Holdings of Enable, for the entire year of 2014, as compared to

only eight months of 2013, following the formation of Enable on May 1,

2013. Enable’s operating results for 2014 improved as compared to

2013, due to increased gathering and processing margins as a result

of higher processed volumes in the Anadarko and Ark-La-Tex basins

(which offset lower gathering volumes) and higher crude oil gathering

margins. Additionally, Enable’s operating results for 2014 improved as

compared to 2013 due to higher transportation and storage margins as

a result of an increase of unrealized gains on natural gas derivatives

and an increase of system optimization activities. The higher margins

were offset in part, by higher depreciation expenses resulting from

assets being placed in service and higher operating and maintenance

expenses. Finally, as a result of Enable’s initial public offering in

April 2014, and CenterPoint’s exercising of its put right to Enable, for its

24.95 percent interest in SESH, OGE Energy’s ownership in Enable

dropped from 28.5 percent at the beginning of 2014 to 26.3 percent by

the end of 2014, further partially offsetting the increase in earnings

before taxes.

Income Tax Expense. Income tax expense was $69.1 million in 2014

as compared to $26.9 million in 2013, an increase of $42.2 million

primarily due to higher pre-tax income and higher tax expense as

compared to the prior period due to the absence of favorable deferred

tax adjustments related to the formation of Enable.

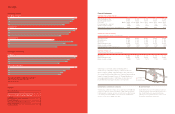

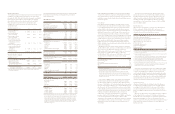

Operating Data

December 31,

2014 2013

Gathered volumes - TBtu/d 3.34 3.05

Transportation volumes - TBtu/d 4.95 4.41

Natural gas processed volumes - TBtu/d 1.56 1.09

NGLs sold - million gallons/d (A)(B) 68.67 44.91

(A) Excludes condensate.

(B) NGLs sold includes volumes of NGLs withdrawn from inventory or purchased for

system balancing purposes.

Year Ended December 31, 2013 as Compared to

Year Ended December 31, 2012

OGE Holdings’ net income for the four months ended April 2013 as

compared to the same period of 2012 decreased $18.7 million

primarily due to a $45.4 million reduction in operating income reflecting

lower NGLs prices, lower keep-whole processing spreads and the

contract conversion of the Texas production volumes of one of Enogex

LLC’s five largest customers from keep-whole to fixed-fee, and to a

lesser extent, slightly higher other operation and maintenance expense

and depreciation and amortization expense. These decreases were

partially offset by increased gathering rates and volumes and inlet

processing volumes associated with ongoing Enogex LLC expansion

projects and the gas gathering assets acquired in August 2012, and a

$9.9 million gain related to the sale of certain gas gathering assets in

the Texas panhandle in January 2013. Also offsetting the decrease

were $11.4 million in lower income taxes primarily related to lower

pre-tax income, and a $6.8 million reduction in earnings attributable

to non-controlling interests due to the lower pre-tax earnings.

Due to the deconsolidation of Enogex LLC on May 1, 2013 as

discussed above, the Company recorded no operating income for

this segment for the eight month period from May 1, 2013 through

December 31, 2013. Earnings in this eight month period reflect the

Company’s equity interest in Enable’s results, which are recorded in

equity in earnings of unconsolidated affiliate, and the related tax effect.

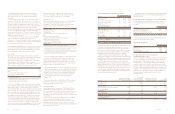

The table set forth below illustrates the impact of the operating results

of Enogex LLC and Enable for the four months ended April 30, 2013,

and the eight months from May 1, 2013 to December 31, 2013,

respectively.

Results for Enable for the eight months ended December 31, 2013,

were consistent with management’s expectations in light of lower

natural gas liquids prices and low seasonal and geographic price

differentials. Enable continued to increase processing volumes through

system expansions. Transportation throughput was impacted by system

integrity projects and slightly lower demand. Gathering throughput was

slightly lower, impacted by well connects, with lower throughput offset

by the impact of minimum commitment features. For the eight-month

period from May 1, 2013 to December 31, 2013 as compared to the

same period in 2012 there was a $44.5 million increase in net income

in large part reflecting the accretive impact of the Enable formation.

Included in that increase was a $24.9 million reduction in deferred state

income taxes, associated with a remeasurement of the accumulated

deferred taxes related to the formation of Enable partially offset by

deferred tax adjustments related to the Company’s deconsolidation

of Enogex Holdings and higher pre-tax income (net of noncontrolling

interest). Enable continued to increase processing volumes through

system expansions. Transportation throughput was impacted by system

integrity projects and slightly lower demand. Gathering throughput was

slightly lower, impacted by well connects, with lower throughput offset

by the impact of minimum commitment features.

For the year ended December 31, 2013, OGE Holdings’ net income

increased $25.8 million as a result of the $44.5 million increase in net

income for eight months ended December 31, offset in part by the

$18.7 million reduction for the four months ended April 30.

Off-Balance Sheet Arrangement

OG&E Railcar Lease Agreement

OG&E has a noncancellable operating lease with purchase options,

covering 1,387 coal rotary gondola railcars to transport coal from

Wyoming to OG&E’s coal-fired generation units. Rental payments are

charged to Fuel Expense and are recovered through OG&E’s tariffs

and fuel adjustment clauses. On December 15, 2010, OG&E renewed

the lease agreement effective February 1, 2011. At the end of the new

lease term, which is February 1, 2016, OG&E has the option to either

purchase the railcars at a stipulated fair market value or renew the

lease. If OG&E chooses not to purchase the railcars or renew the lease

agreement and the actual fair value of the railcars is less than the

stipulated fair market value, OG&E would be responsible for the

difference in those values up to a maximum of $22.8 million. OG&E is

also required to maintain all of the railcars it has under the operating

lease and has entered into an agreement with a non-affiliated company

to furnish this maintenance.

On January 11, 2012, OG&E executed a five-year lease agreement

for 135 railcars to replace railcars that have been taken out of service

or destroyed. OG&E has a unilateral right to terminate this lease upon

a 6-month notice effective April 2016.

On October 14, 2014, OG&E signed a three-year lease effective

beginning December 2014 for 131 railcars to replace railcars that have

been taken out of service or destroyed.

Liquidity and Capital Resources

Working Capital

Working capital is defined as the amount by which current assets

exceed current liabilities. The Company’s working capital requirements

are driven generally by changes in accounts receivable, accounts

payable, commodity prices, credit extended to, and the timing of

collections from, customers, the level and timing of spending for

maintenance and expansion activity, inventory levels and fuel

recoveries.

The balance of Income Taxes Receivable was $16.0 million and

$5.6 million at December 31, 2014 and 2013, respectively, an increase

of $10.4 million, primarily due to a receivable related to Oklahoma wind

credits and overpayments refundable from Louisiana.

The balance of Fuel Inventories was $58.5 million and $74.4 million

at December 31, 2014 and 2013, respectively, a decrease of

$15.9 million, or 21.4 percent, primarily due to lower coal inventory

balances at OG&E’s coal fired plants resulting from higher generation

related to OG&E’s participation in the Integrated Market along with

lower deliveries due to market constraints.

The balance of Deferred Income Tax assets was $191.4 million

and $215.8 million at December 31, 2014 and 2013, respectively, a

decrease of $24.4 million, or 11.3 percent, primarily due to a decrease

in deferred income taxes reflecting the expected utilization of net

operating losses.

The balance of Fuel Clause Under Recoveries was $68.3 million

and $26.2 million at December 31, 2014 and 2013, respectively, an

increase of $42.1 million, primarily due to lower amounts billed to

OG&E retail customers as compared to the actual cost of fuel and

purchased power. The fuel recovery clauses are designed to smooth

the impact of fuel price volatility on customers’ bills. As a result, OG&E

under recovers fuel costs when the actual fuel and purchased power

cost recoveries exceed fuel adjustment clause recoveries and over

recovers fuel costs when the actual fuel and purchased power costs

are below the fuel adjustment clause recoveries. Provisions in the fuel

clauses are intended to allow OG&E to amortize under and over

recovery balances into future cost recoveries.

The balance of Short-Term Debt was $98.0 million and

$439.6 million at December 31, 2014 and 2013, respectively, a

decrease of $341.6 million or 77.7 percent, primarily due to proceeds

received from a $250 million bond issuance in December 2014 along

with distributions from Enable.

The balance of Accounts Payable was $179.1 million and

$251.0 million at December 31, 2014 and 2013, respectively, a

decrease of $71.9 million, or 28.6 percent, primarily due to a decrease

of fuel and purchased power mainly due to participation in the SPP

Integrated Marketplace along with milder weather in 2014. Additionally,

there was a decrease in accounts payable related to the timing of

vendor payments.

The balance of Accrued Compensation was $38.2 million and

$56.9 million at December 31, 2014 and 2013, respectively, a decrease

of $18.7 million, or 32.9 percent, primarily resulting from the payment

of incentive compensation for Enable employees related to 2013 as

well as lower levels of accrued incentive compensation for 2014.

The balance of Long-Term Debt due within one year had no balance

as of December 31, 2014 compared to $100.0 million at December 31,

2013, primarily due to a senior note that was due to mature in

November 2014. The Company made the decision to refinance the

note in August 2014 and it was reclassified as long term debt at

that time.

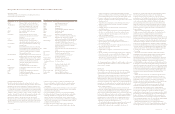

Natural Gas Natural Gas

Midstream Operations OGE Holdings Total Midstream Operations

(Consolidated - Four Months (Equity Method -Eight Months (Year Ended (Consolidated - Year Ended

(In millions) Ended April 30, 2013) Ended December 31, 2013) December 31, 2013) December 31, 2012)

Operating revenues $630.4 $ — $630.4 $1,608.6

Cost of sales 489.0 — 489.0 1,120.1

Operating expenses 108.2 — 108.2 302.9

Operating income 33.2 — 33.2 185.6

Equity in earnings of unconsolidated affiliates — 101.9 101.9 —

Other income (expense) 8.9 — 8.9 (3.5)

Interest expense 10.6 — 10.6 32.6

Earnings before income taxes 31.5 101.9 133.4 149.5

Income tax expense 9.4 17.5 26.9 45.7

Net income 22.1 84.4 106.5 103.8

Less: net income attributable to

noncontrolling interests 6.6 — 6.6 29.7

Net income attributable to OGE Energy $ 15.5 $ 84.4 $ 99.9 $ 74.1