OG&E 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 OGE Energy Corp. OGE Energy Corp. 31

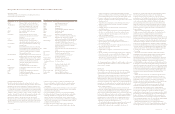

Consolidated Statements of Income

Year ended December 31 (In millions except per share data) 2014 2013 2012

Operating revenues

Electric Utility $ 2,453.1 $ 2,259.7 $ 2,128.7

Natural Gas Midstream Operations (Note 1) — 608.0 1,542.5

Total operating revenues 2,453.1 2,867.7 3,671.2

Cost of Sales

Electric Utility 1,106.6 950.0 831.4

Natural Gas Midstream Operations (Note 1) — 478.9 1,087.3

Total cost of sales 1,106.6 1,428.9 1,918.7

Operating Expenses

Other operation and maintenance 439.6 489.2 601.5

Depreciation and amortization 281.4 297.3 371.4

Gain on insurance proceeds — — (7.5)

Taxes other than income 88.7 98.8 110.2

Total operating expenses 809.7 885.3 1,075.6

Operating Income 536.8 553.5 676.9

Other Income (Expense)

Equity in earnings of unconsolidated affiliates (Note 1) 172.6 101.9 —

Allowance for equity funds used during construction 4.2 6.6 6.2

Other income 17.8 31.8 17.6

Other expense (14.4) (22.2) (16.5)

Net other income 180.2 118.1 7.3

Interest Expense

Interest on long-term debt 144.6 145.6 158.9

Allowance for borrowed funds used during construction (2.4) (3.4) (3.5)

Interest on short-term debt and other interest charges 6.2 5.3 8.7

Interest expense 148.4 147.5 164.1

Income Before Taxes 568.6 524.1 520.1

Income Tax Expense 172.8 130.3 135.1

Net Income 395.8 393.8 385.0

Less: net income attributable to noncontrolling interests — 6.2 30.0

Net Income Attributable to OGE Energy $ 395.8 $ 387.6 $ 355.0

Basic Average Common Shares Outstanding 199.2 198.2 197.1

Diluted Average Common Shares Outstanding 199.9 199.4 198.1

Basic Earnings Per Average Common Share Attributable to

OGE Energy Common Shareholders $ 1.99 $ 1.96 $ 1.80

Diluted Earnings Per Average Common Share Attributable to

OGE Energy Common Shareholders $ 1.98 $ 1.94 $ 1.79

Dividends Declared Per Common Share $0.95000 $0.85125 $0.79750

The accompanying Notes to Consolidated Financial Statements are an integral part hereof.

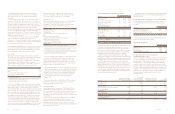

Market risks are, in most cases, risks that are actively traded in a

marketplace and have been well studied in regards to quantification.

Market risks include, but are not limited to, changes in interest rates

and commodity prices. The Company’s exposure to changes in interest

rates relates primarily to short-term variable-rate debt and commercial

paper. The Company is exposed to commodity prices in its operations.

Risk Oversight Committee

Management monitors market risks using a risk committee structure.

The Company’s Risk Oversight Committee, which consists primarily

of corporate officers, is responsible for the overall development,

implementation and enforcement of strategies and policies for all

market risk management activities of the Company. This committee’s

emphasis is a holistic perspective of risk measurement and policies

targeting the Company’s overall financial performance. On a quarterly

basis, the Risk Oversight Committee reports to the Audit Committee

of the Company’s Board of Directors on the Company’s risk profile

affecting anticipated financial results, including any significant

risk issues.

The Company also has a Corporate Risk Management Department.

This group, in conjunction with the aforementioned committees, is

responsible for establishing and enforcing the Company’s risk policies.

Quantitative and Qualitative Disclosures About Market Risk.

Risk Policies

Management utilizes risk policies to control the amount of market risk

exposure. These policies are designed to provide the Audit Committee

of the Company’s Board of Directors and senior executives of the

Company with confidence that the risks taken on by the Company’s

business activities are in accordance with their expectations for

financial returns and that the approved policies and controls related to

market risk management are being followed.

Interest Rate Risk

The Company’s exposure to changes in interest rates primarily relates

to short-term variable-rate debt and commercial paper. The Company

manages its interest rate exposure by monitoring and limiting the

effects of market changes in interest rates. The Company may utilize

interest rate derivatives to alter interest rate exposure in an attempt to

reduce the effects of these changes. Interest rate derivatives are used

solely to modify interest rate exposure and not to modify the overall

leverage of the debt portfolio.

The fair value of the Company’s long-term debt is based on quoted

market prices and estimates of current rates available for similar issues

with similar maturities or by calculating the net present value of the

monthly payments discounted by the Company’s current borrowing

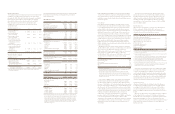

rate. The following table shows the Company’s long-term debt

maturities and the weighted-average interest rates by maturity date.

Year ended December 31 12/31/14

(Dollars in millions) 2015 2016 2017 2018 2019 Thereafter Total Fair Value

Fixed-rate debt (A)

Principal amount $ 0.2 $110.2 $125.1 $250.1 $250.1 $1,794.5 $2,530.2 $2,968.0

Weighted-average interest rate 3.02% 5.15% 6.50% 6.35% 8.25% 5.20% 5.67%

Variable-rate debt (B)

Principal amount $ — $ — $100.0 $ — $ — $ 135.4 $ 235.4 $ 235.3

Weighted-average interest rate —% —% 0.78% —% —% 0.07% 0.38%

(A) Prior to or when these debt obligations mature, the Company may refinance all or a portion of such debt at then-existing market interest rates which may be more or less than the

interest rates on the maturing debt.

(B) A hypothetical change of 100 basis points in the underlying variable interest rate incurred by the Company would change interest expense by $2.4 million annually through 2017 and

$1.4 million thereafter.