OG&E 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

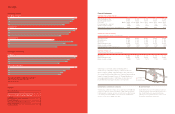

10 OGE Energy Corp. OGE Energy Corp. 11

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

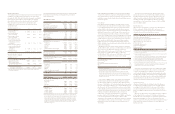

Glossary of Terms

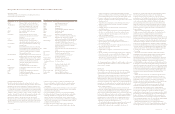

The following is a glossary of frequently used abbreviations that are

found throughout this Annual Report.

Abbreviation Definition

401(k) Plan Qualified defined contribution retirement plan

APSC Arkansas Public Service Commission

ArcLight group Bronco Midstream Holdings, LLC, Bronco

Midstream Holdings II, LLC, collectively

ASC Financial Accounting Standards Board

Accounting Standards Codification

BART Best available retrofit technology

Bcf Billion cubic feet

CenterPoint CenterPoint Energy Resources Corp.,

wholly-owned Subsidiary of CenterPoint

Energy, Inc.

Code Internal Revenue Code of 1986

Company OGE Energy Corp, collectively with its

subsidiaries and Enable Midstream Partners

Dry Scrubbers Dry flue gas desulfurization units with spray

dryer absorber

Enable Enable Midstream Partners, LP, partnership

between OGE Energy, the ArcLight Group and

CenterPoint Energy, Inc. formed to own and

operate the midstream businesses of OGE

Energy and CenterPoint

Enogex Holdings Enogex Holdings LLC, the parent company of

Enogex LLC and a majority-owned subsidiary

of OGE Holdings, LLC (prior to May 1, 2013)

Enogex, LLC Enogex, LLC collectively with its subsidiaries

(effective June 30, 2013, the name was

changed to Enable Oklahoma Intrastate

Transmission, LLC)

EPA U.S. Environmental Protection Agency

Federal Clean Federal Water Pollution Control Act of 1972,

Water Act as amended

FERC Federal Energy Regulatory Commission

FIP Federal implementation plan

GAAP Accounting principles generally accepted in

the United States

Abbreviation Definition

MATS Mercury and Air Toxics Standards

MMBtu Million British thermal unit

MMcf/d Million cubic feet per day

MW Megawatt

MWH Megawatt-hour

NAAQS National Ambient Air Quality Standards

NGLs Natural gas liquids

NOX Nitrogen oxide

OCC Oklahoma Corporation Commission

Off-system sales Sales to other utilities and power marketers

OG&E Oklahoma Gas and Electric Company,

wholly-owned subsidiary of OGE Energy Corp

OGE Holdings OGE Enogex Holdings, LLC, wholly-owned

subsidiary of OGE Energy Corp, parent

company of Enogex Holdings (prior to May 1,

2013) and 26.3 percent owner of Enable

Midstream Partners

OSHA Federal Occupational Safety and Health Act of

1970

Pension Plan Qualified defined benefit retirement plan

QF Qualified cogeneration facilities

QF contracts Contracts with QFs and small power

production producers

Regional Haze The EPA’s regional haze rule

Restoration of Supplemental retirement plan to

Retirement Income the Pension Plan

Plan

SESH Southeast Supply Header, LLC

SIP State implementation plan

SO2 Sulfur dioxide

SPP Southwest Power Pool

Stock Incentive Plan 2013 Stock Incentive Plan

System sales Sales to OG&E’s customers

TBtu/d Trillion British thermal units per day

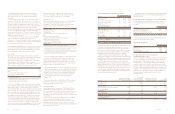

Forward-Looking Statements

Except for the historical statements contained herein, the matters

discussed in this Annual Report, including those matters discussed in

Management’s Discussion and Analysis of Financial Condition and

Results of Operations, are forward-looking statements that are subject

to certain risks, uncertainties and assumptions. Such forward-looking

statements are intended to be identified in this document by the words

“anticipate”, “believe”, “estimate”, “expect”, “intend”, “objective”, “plan”,

“possible”, “potential”, “project” and similar expressions. Actual results

may vary materially from those expressed in forward-looking

statements. In addition to the specific risk factors discussed in

Management’s Discussion and Analysis of Financial Condition and

Results of Operations herein, factors that could cause actual results to

differ materially from the forward-looking statements include, but are

not limited to:

• general economic conditions, including the availability of credit,

access to existing lines of credit, access to the commercial paper

markets, actions of rating agencies and their impact on capital

expenditures;

• the ability of the Company and its subsidiaries to access the capital

markets and obtain financing on favorable terms as well as inflation

rates and monetary fluctuations;

• prices and availability of electricity, coal, natural gas and NGLs;

• the timing and extent of changes in commodity prices, particularly

natural gas and NGLs, the competitive effects of the available

pipeline capacity in the regions Enable serves, and the effects of

geographic and seasonal commodity price differentials, including the

effects of these circumstances on re-contracting available capacity

on Enable’s interstate pipelines;

• the timing and extent of changes in the supply of natural gas,

particularly supplies available for gathering by Enable’s gathering

and processing business and transporting by Enable’s interstate

pipelines, including the impact of natural gas and NGLs prices on the

level of drilling and production activities in the regions Enable serves;

• business conditions in the energy and natural gas midstream

industries, including the demand for natural gas, NGLs, crude oil and

midstream services;

• competitive factors including the extent and timing of the entry of

additional competition in the markets served by the Company;

• unusual weather;

• availability and prices of raw materials for current and future

construction projects;

• Federal or state legislation and regulatory decisions and initiatives

that affect cost and investment recovery, have an impact on rate

structures or affect the speed and degree to which competition

enters the Company’s markets;

• environmental laws and regulations that may impact the Company’s

operations;

• changes in accounting standards, rules or guidelines;

• the discontinuance of accounting principles for certain types of

rate-regulated activities;

• the cost of protecting assets against, or damage due to, terrorism or

cyber attacks and other catastrophic events;

• advances in technology;

• creditworthiness of suppliers, customers and other contractual

parties;

• difficulty in making accurate assumptions and projections regarding

future revenues and costs associated with the Company’s equity

investment in Enable that the Company does not control; and

• other risk factors listed in the reports filed by the Company with the

Securities and Exchange Commission.

The Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Introduction

The Company is an energy and energy services provider offering

physical delivery and related services for both electricity and natural

gas primarily in the south central United States. The Company

conducts these activities through two business segments: (i) electric

utility and (ii) natural gas midstream operations. The accounts of

OGE Energy and its wholly owned and majority owned subsidiaries

are included in the consolidated financial statements. All intercompany

transactions and balances are eliminated in consolidation. OGE Energy

generally uses the equity method of accounting for investments where

its ownership interest is between 20% and 50% and has the ability to

exercise significant influence.

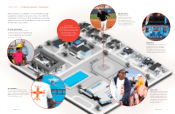

The electric utility segment generates, transmits, distributes and

sells electric energy in Oklahoma and western Arkansas. Its operations

are conducted through OG&E and are subject to regulation by the

OCC, the APSC and the FERC. OG&E was incorporated in 1902 under

the laws of the Oklahoma Territory, and is a wholly owned subsidiary of

the Company. OG&E is the largest electric utility in Oklahoma and its

franchised service territory includes the Fort Smith, Arkansas area.

OG&E sold its retail natural gas business in 1928 and is no longer

engaged in the natural gas distribution business.

The natural gas midstream operations segment currently represents

the Company’s investment in Enable through its wholly owned

subsidiary OGE Holdings. Enable is engaged in the business of

gathering, processing, transporting and storing natural gas. Enable’s

natural gas gathering and processing assets are strategically

located in four states and serve natural gas production from shale

developments in the Anadarko, Arkoma and Ark-La-Tex basins. Enable

also owns an emerging crude oil gathering business in the Bakken

shale formation, principally located in the Williston basin. Enable’s

natural gas transportation and storage assets extend from western

Oklahoma and the Texas Panhandle to Alabama and from Louisiana

to Illinois. For periods prior to the formation of Enable, the natural gas

midstream operations segment reflected the consolidated results of

Enogex Holdings.

Enable was formed effective May 1, 2013 by OGE Energy, the

ArcLight group and CenterPoint Energy, Inc. to own and operate the

midstream businesses of OGE Energy and CenterPoint. In the

formation transaction, OGE Energy and ArcLight contributed

Enogex LLC to Enable and the Company deconsolidated its previously

held investment in Enogex Holdings and acquired an equity interest in

Enable. The Company’s contribution of Enogex LLC to Enable met the

requirements of being in substance real estate and was recorded at

historical cost. The general partner of Enable is equally controlled by

CenterPoint and OGE Energy, who each have 50 percent management

ownership. Based on the 50/50 management ownership, with neither

company having control, effective May 1, 2013, OGE Energy began

accounting for its interest in Enable using the equity method

of accounting.

On April 16, 2014, Enable completed an initial public offering of

25,000,000 common units resulting in Enable becoming a publicly

traded Master Limited Partnership. The offering represented

approximately 6.0 percent of the limited partner interests and raised

approximately $464 million in net proceeds for Enable. In connection

with the offering, underwriters exercised their option to purchase

3,750,000 additional common units which were fulfilled with units held

by ArcLight. As a result of the offering, OGE Holding’s ownership was

reduced from 28.5 percent to 26.7 percent. In connection with Enable’s

initial public offering, approximately 61.4 percent of OGE Holdings and

CenterPoint’s common units were converted into subordinated units.

As a result, following the initial public offering, OGE Holdings owned

42,832,291 common units and 68,150,514 subordinated units

of Enable.

On May 13, 2014, CenterPoint exercised its put right with respect

to a 24.95 percent interest in SESH and pursuant to that right, on

May 30, 2014, Enable issued 6,322,457 common units representing

limited partner interests in Enable in exchange for CenterPoint’s

24.95 percent interest in SESH. At December 31, 2014, OGE Energy

held 26.3 percent of the limited partner interests in Enable.

On January 26, 2015, Enable announced a quarterly dividend

distribution of $0.30875 per unit on its outstanding common and

subordinated units, representing an increase of approximately

2.1 percent over the prior quarter distribution. Enable’s gross margins

are affected by commodity price movements. Based on forward

commodity prices, Enable expects to see a change in producer activity

that will affect its future distribution growth rate. If cash distributions to

Enable’s unitholders exceed $0.330625 per unit in any quarter, the

general partner will receive increasing percentages, up to 50 percent,

of the cash Enable distributes in excess of that amount. OGE Holdings

is entitled to 60 percent of those “incentive distributions.”

OG&E began participating in the SPP Integrated Marketplace

effective March 1, 2014. The SPP Integrated Marketplace replaced the

SPP Energy Imbalance Services market. As part of the Integrated